Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Novak Industries, Inc. issued $ 19,200,000 of 8% debentures on May 1, 2020 and received cash totaling $ 17,035,446. The bonds pay interest semiannually

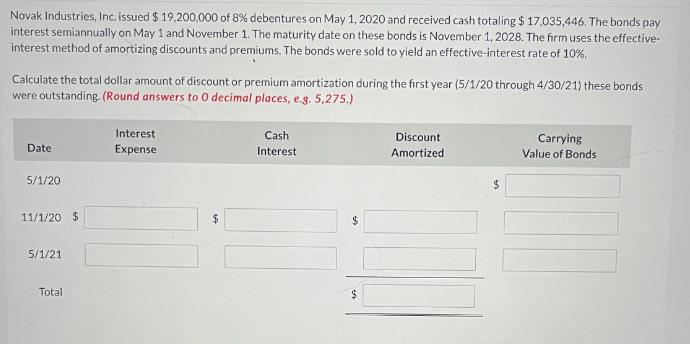

Novak Industries, Inc. issued $ 19,200,000 of 8% debentures on May 1, 2020 and received cash totaling $ 17,035,446. The bonds pay interest semiannually on May 1 and November 1. The maturity date on these bonds is November 1, 2028. The firm uses the effective- interest method of amortizing discounts and premiums. The bonds were sold to yield an effective-interest rate of 10%. Calculate the total dollar amount of discount or premium amortization during the first year (5/1/20 through 4/30/21) these bonds were outstanding. (Round answers to 0 decimal places, e.g. 5,275.) Date 5/1/20 11/1/20 $ 5/1/21 Total Interest Expense Cash Interest LA Discount Amortized Carrying Value of Bonds

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The calculation for each date is as follows Date 5120 Carrying Value of Bonds 19200000 in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started