Answered step by step

Verified Expert Solution

Question

1 Approved Answer

November 1 1 12 21 26 28 32 223 2228 Issued SXXX,XXX of common shares in the new company for cash. Purchased land and

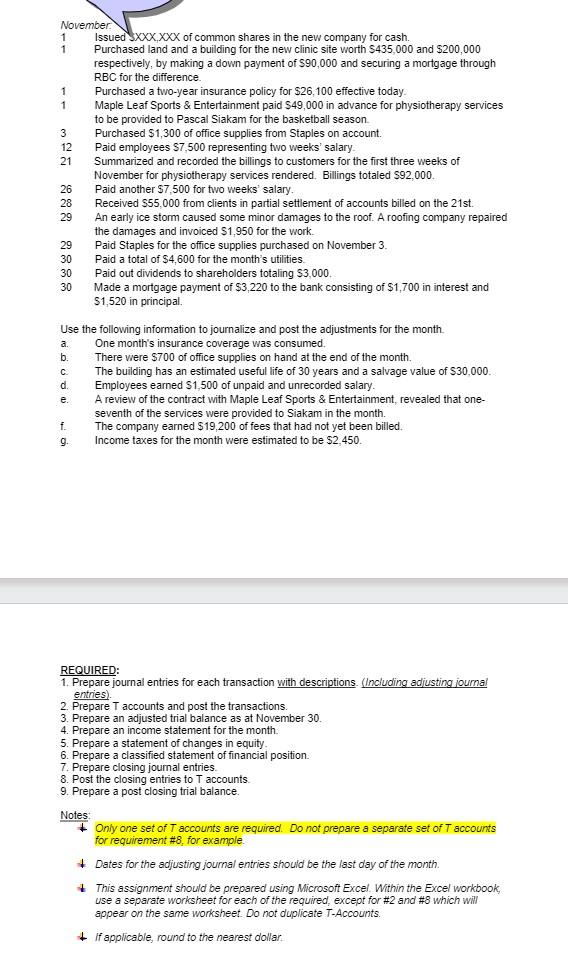

November 1 1 12 21 26 28 32 223 2228 Issued SXXX,XXX of common shares in the new company for cash. Purchased land and a building for the new clinic site worth $435,000 and $200,000 respectively, by making a down payment of $90,000 and securing a mortgage through RBC for the difference. Purchased a two-year insurance policy for $26,100 effective today. Maple Leaf Sports & Entertainment paid $49,000 in advance for physiotherapy services to be provided to Pascal Siakam for the basketball season. Purchased $1,300 of office supplies from Staples on account. Paid employees $7,500 representing two weeks' salary. Summarized and recorded the billings to customers for the first three weeks of November for physiotherapy services rendered. Billings totaled $92,000. Paid another $7,500 for two weeks' salary. Received $55,000 from clients in partial settlement of accounts billed on the 21st. 29 An early ice storm caused some minor damages to the roof. A roofing company repaired the damages and invoiced $1,950 for the work. Paid Staples for the office supplies purchased on November 3. 29 30 Paid a total of $4,600 for the month's utilities. 30 Paid out dividends to shareholders totaling $3,000. 30 Made a mortgage payment of $3,220 to the bank consisting of $1,700 in interest and $1,520 in principal. Use the following information to journalize and post the adjustments for the month. One month's insurance coverage was consumed. a. b. There were $700 of office supplies on hand at the end of the month. C. d. e. f. 9. The building has an estimated useful life of 30 years and a salvage value of $30,000. Employees earned $1,500 of unpaid and unrecorded salary. A review of the contract with Maple Leaf Sports & Entertainment, revealed that one- seventh of the services were provided to Siakam in the month. The company earned $19,200 of fees that had not yet been billed. Income taxes for the month were estimated to be $2,450. REQUIRED: 1. Prepare journal entries for each transaction with descriptions. (Including adjusting journal entries). 2. Prepare T accounts and post the transactions. 3. Prepare an adjusted trial balance as at November 30. 4. Prepare an income statement for the month. 5. Prepare a statement of changes in equity. 6. Prepare a classified statement of financial position. 7. Prepare closing journal entries. 8. Post the closing entries to T accounts. 9. Prepare a post closing trial balance. Notes: Only one set of T accounts are required. Do not prepare a separate set of T accounts for requirement #8, for example. + Dates for the adjusting journal entries should be the last day of the month. This assignment should be prepared using Microsoft Excel. Within the Excel workbook, use a separate worksheet for each of the required, except for #2 and #8 which will appear on the same worksheet. Do not duplicate T-Accounts. +If applicable, round to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started