Answered step by step

Verified Expert Solution

Question

1 Approved Answer

November 30 Compute the Net Pay for each employee. Employee pay will be disbursed on December 4, 2019. Update the Employees' Earnings Record with the

November 30

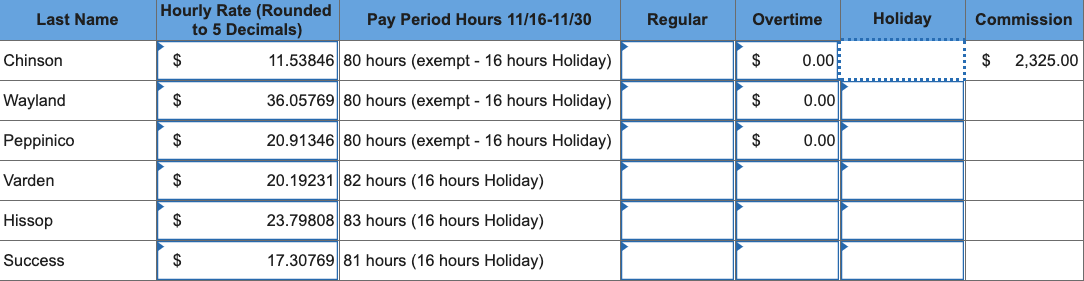

Compute the Net Pay for each employee. Employee pay will be disbursed on December 4, 2019. Update the Employees' Earnings Record with the November 30 pay and the new YTD amount.

The company is closed and pays for the Friday following Thanksgiving. The employees will receive holiday pay for Thanksgiving and the Friday following. All the hours over 80 are eligible for overtime for nonexempt employees as they were worked during the non-holiday week.

- Complete the Employee Gross Pay tab.

- Complete the Payroll Register for November 30.

- You must update the Employee Earnings Record Forms for each employee with the ending YTD amounts from November 15 (the prior pay period) in the "Prior Period YTD" rows. Amounts from the current period are auto-populated from the Payroll Register on the row for November 30.

- Complete the General Journal entries for the November 30 payroll.

- Update the General Ledger with the ending ledger balances from the November 15 pay period ledger accounts first, and then post the journal entries from the current period to the General Ledger.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started