Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Now assume that there is more uncertainty about the future after-tax cash flows. More specifically, assume that the annual after-tax cash flows are $53,500

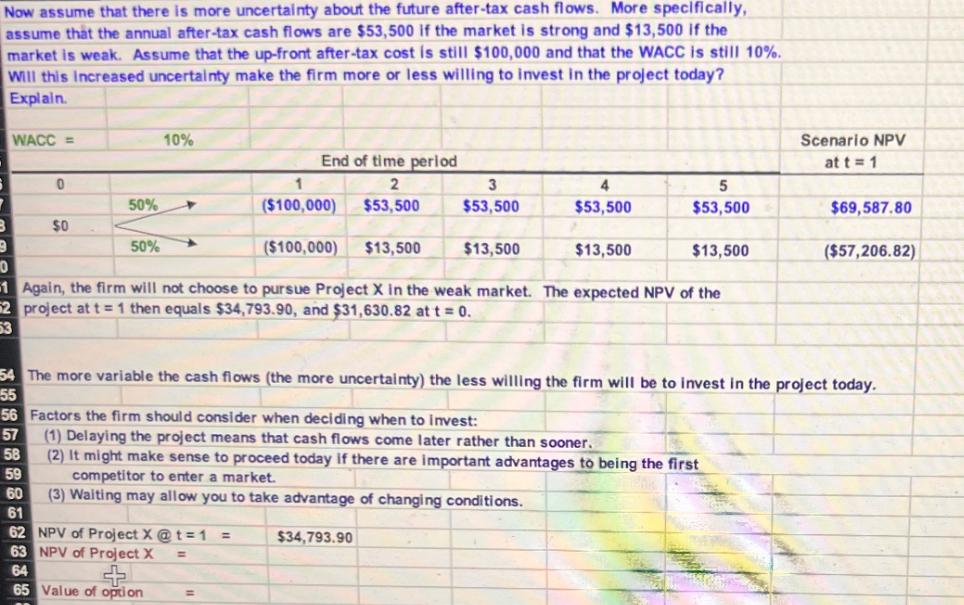

Now assume that there is more uncertainty about the future after-tax cash flows. More specifically, assume that the annual after-tax cash flows are $53,500 if the market is strong and $13,500 if the market is weak. Assume that the up-front after-tax cost is still $100,000 and that the WACC is still 10%. Will this Increased uncertainty make the firm more or less willing to invest in the project today? Explain. WACC= 10% End of time period Scenario NPV at t=1 0 1 2 3 4 5 50% ($100,000) $53,500 $53,500 $53,500 $53,500 $69,587.80 B $0 9 50% ($100,000) $13,500 $13,500 $13,500 $13,500 ($57,206.82) 0 1 Again, the firm will not choose to pursue Project X in the weak market. The expected NPV of the 2 project at t=1 then equals $34,793.90, and $31,630.82 at t=0. 53 57 58 59 54 The more variable the cash flows (the more uncertainty) the less willing the firm will be to invest in the project today. 55 56 Factors the firm should consider when deciding when to invest: (1) Delaying the project means that cash flows come later rather than sooner. 60 61 (2) It might make sense to proceed today if there are important advantages to being the first competitor to enter a market. (3) Waiting may allow you to take advantage of changing conditions. 62 NPV of Project X @t=1 = 63 NPV of Project X + 64 65 Value of option = $34,793.90

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started