Question

Now find the Schedule of Cash Receipts and the Schedule of Cash Disbursements for 2017. Baldies Hair Salons projected sales for 2017 is $375,000 but

Now find the Schedule of Cash Receipts and the Schedule of Cash Disbursements for 2017.

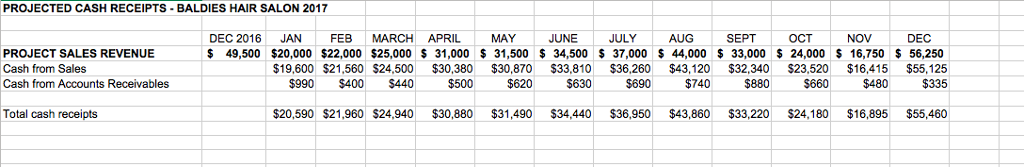

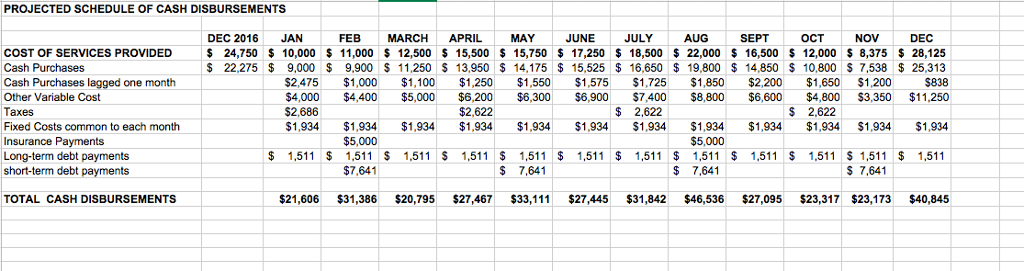

Baldies Hair Salons projected sales for 2017 is $375,000 but there is a good deal of variation in sales month to month with the peak of the business occurring during the summer months as people prepare for weddings and in December as people prepare for holiday parties. The Schedule of Cash Receipts gives the monthly cash receipts. Cash sales are 98% of sales from that month and 2% of sales from the previous month. (Some large groups are given 2 months to pay for their services and the Accounts Receivables come to about 2% of total sales revenue.) All other variable costs are 40% of that months sales. Purchases are 50% of the Cost of Services Provided with ten percent of the cost of those purchases are deferred to the next month. In January, the final tax payment of 2016 is made, while in April, May, and October the first three of four payments of 2017 projected tax liability are paid. Fixed cost are paid equally per month, except for insurance. Insurance is paid in two equal payments, one in February and one in August. Long-term debt payments are paid monthly. The loan payment is $1,511 per month. In 2017, Baldies is paying off the short-term debt acquired in 2016. Short-term debt payments are made quarterly. The short-term debt pays 3.0% interest. Thus, the quarterly payments are $7,641.

g. On a new sheet in your Excel file, create a Cash Budget for 2017 using the Schedule of Cash Receipts and the Schedule of Cash Disbursements. Whenever the end of the month balance is less than the required minimum cash balance of $12,500 add in the amount of financing needed so that the next months beginning cash balance is $12,500. {Note: Do not be worried that the end of December 2017 Cash Balance you found on the Pro Forma Balance Sheet does not exactly match what you find in the Cash Budget. It will not match exactly because of the way I treated debt repayments, and that cash sales and cash disbursements slightly differ from total sales and total costs.}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started