Question

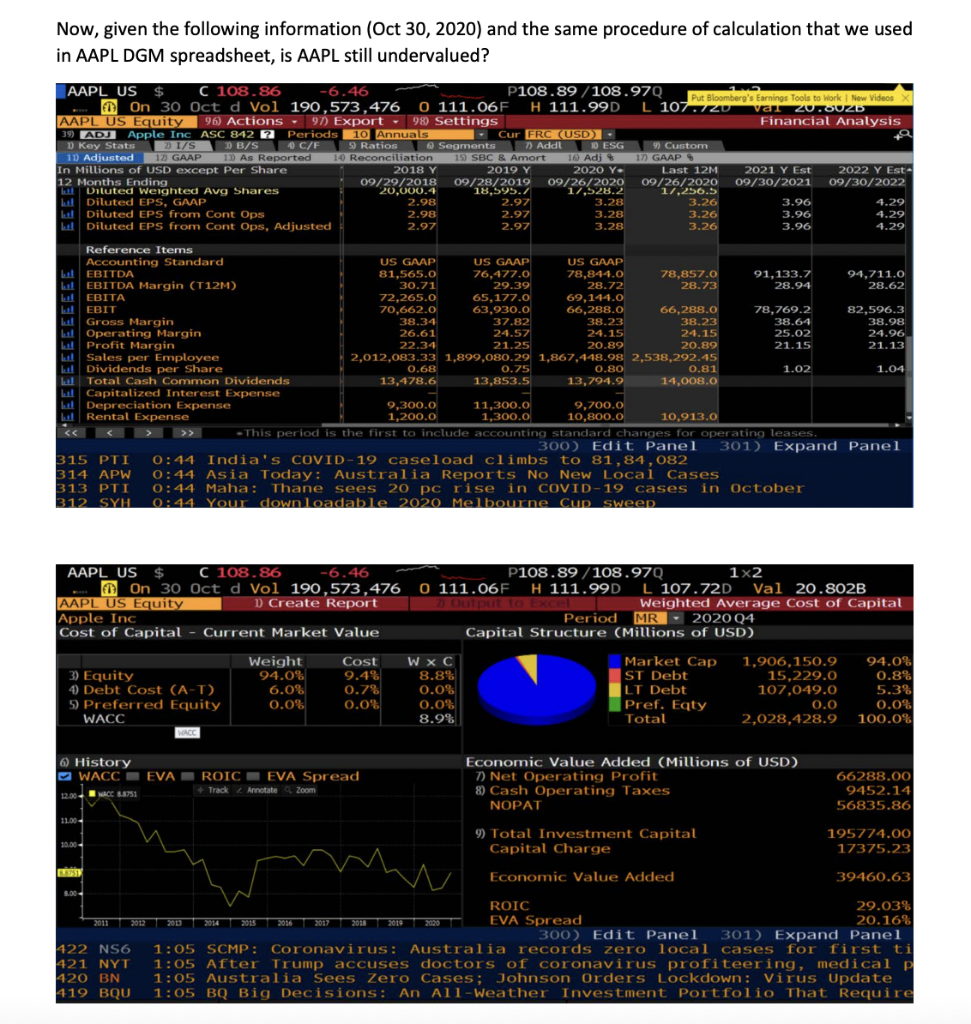

Now, given the following information (Oct 30, 2020) and the same procedure of calculation that we used in AAPL DGM spreadsheet, is AAPL still undervalued?

Now, given the following information (Oct 30, 2020) and the same procedure of calculation that we used in AAPL DGM spreadsheet, is AAPL still undervalued?

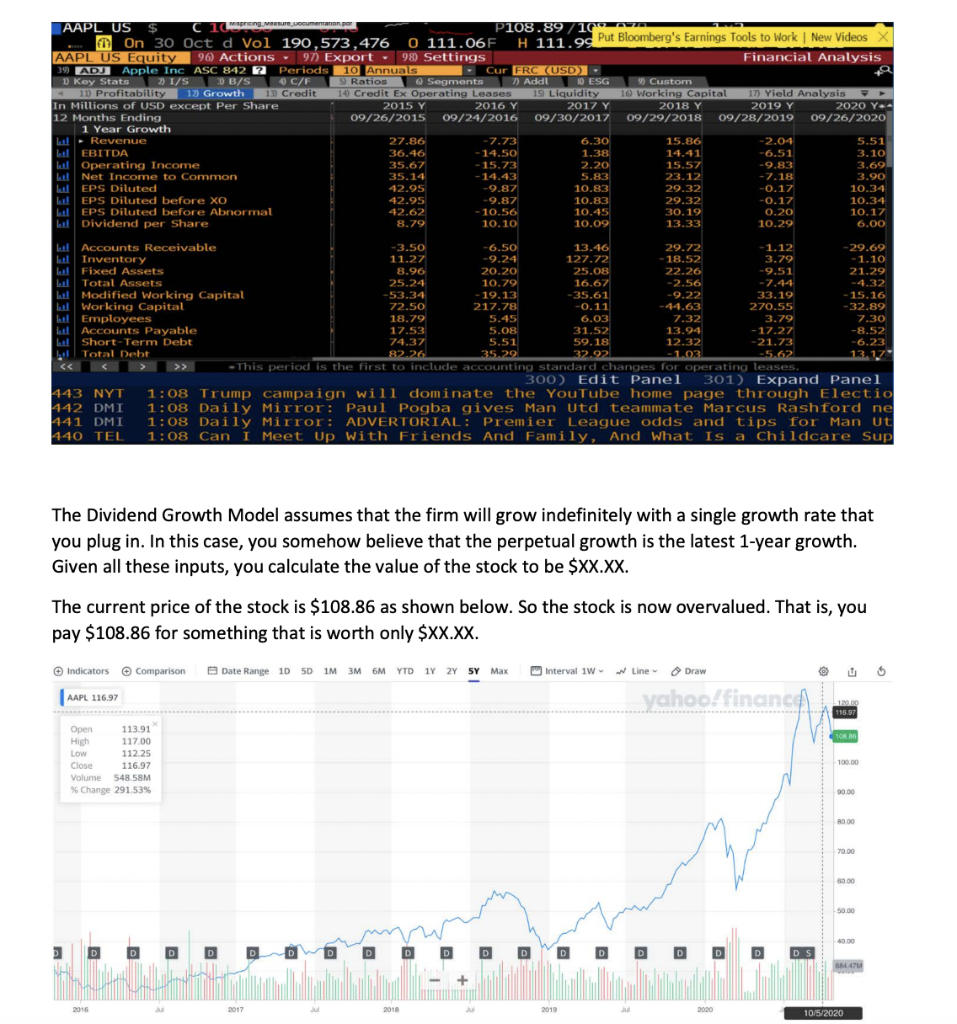

The Dividend Growth Model assumes that the firm will grow indefinitely with a single growth rate that you plug in. In this case, you somehow believe that the perpetual growth is the latest 1-year growth. Given all these inputs, you calculate the value of the stock to be $XX.XX. The current price of the stock is $108.86 as shown below. So the stock is now overvalued. That is, you pay $108.86 for something that is worth only $XX.XX.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started