Now I need to make financial statements. I am fairly certain that the above answers are correct, but it would help me out if you could check them for me.

I made the income statement (again please check for me)

I need help in making the statements of changes in equity, and statement of financial position, as follows:

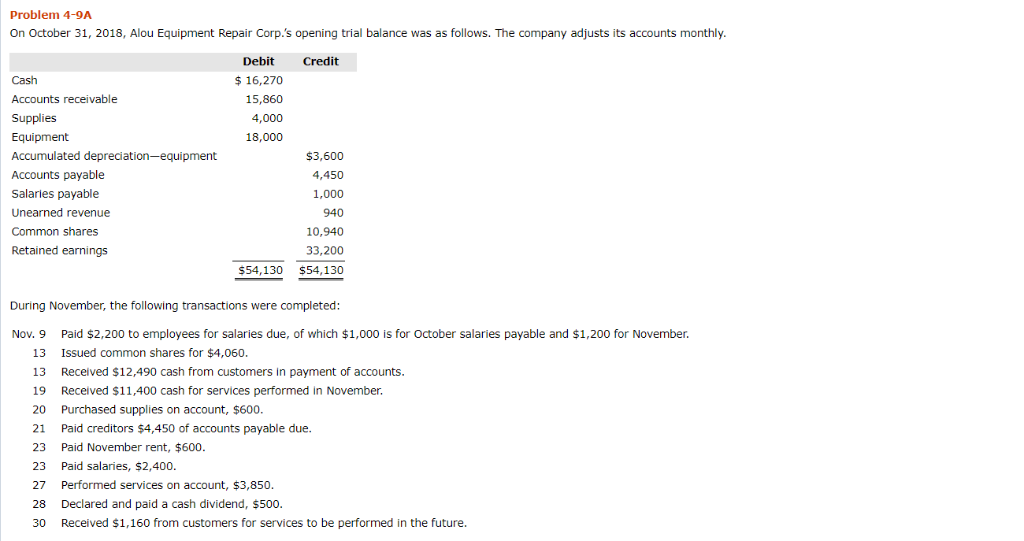

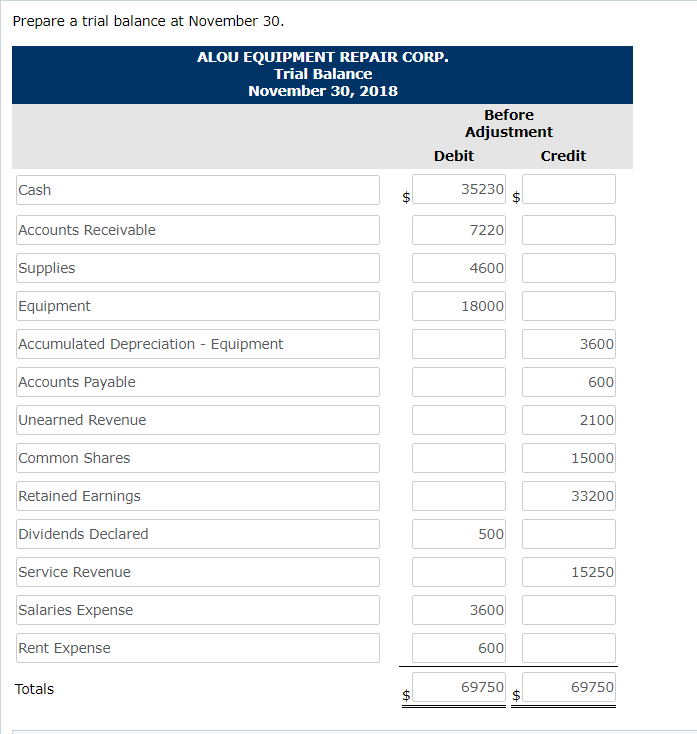

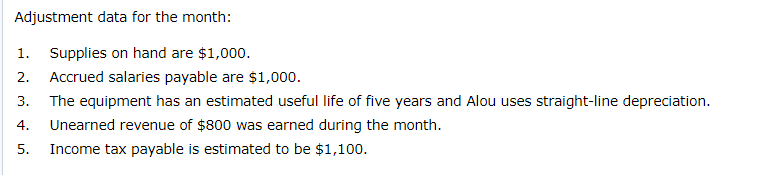

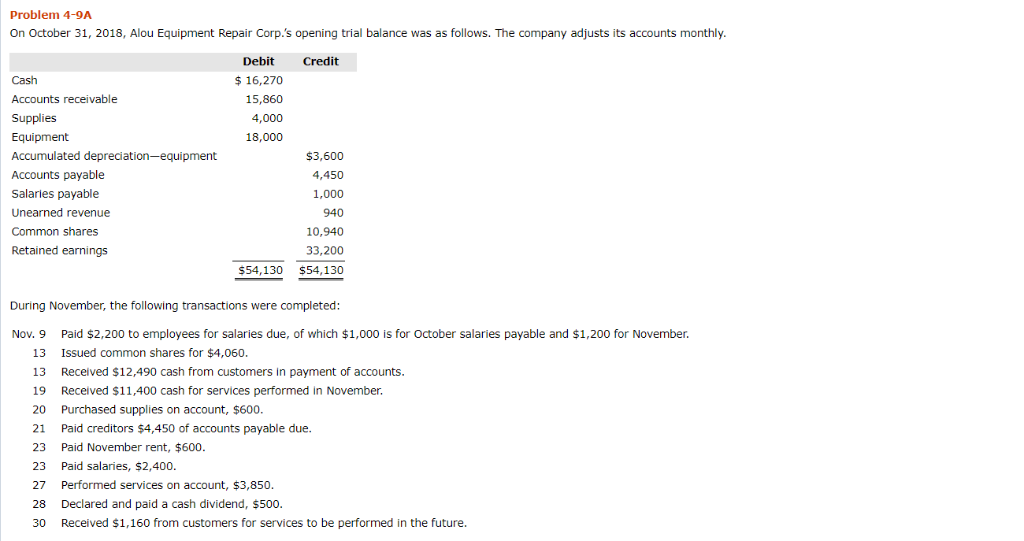

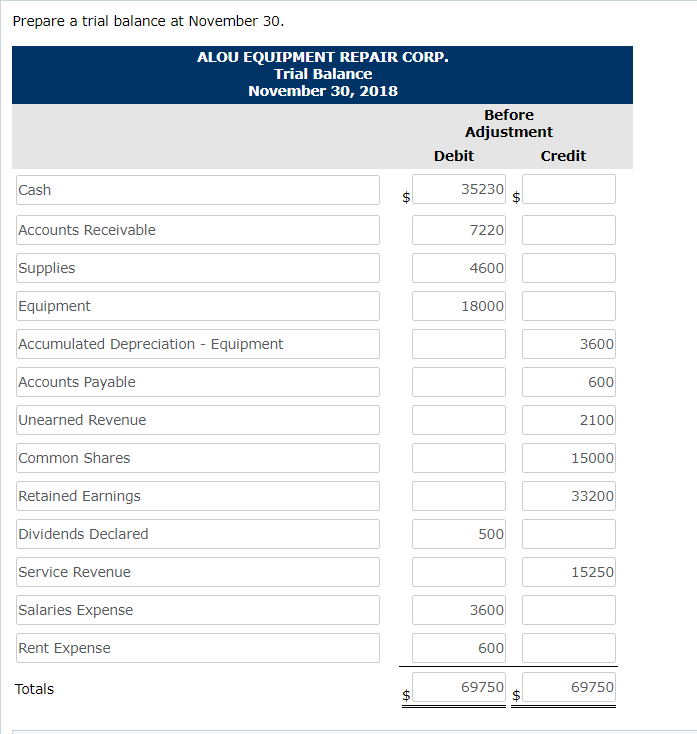

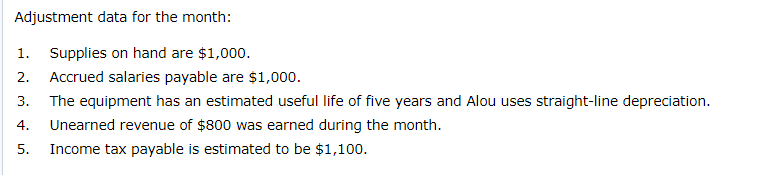

Problem 4-9A On October 31, 2018, Alou Equipment Repair Corp.'s opening trial balance was as follows. The company adjusts its accounts monthly Debit Credit Cash 16,270 Accounts receivable 15,860 Supplies 4,000 Equipment 18,000 Accumulated depreciation-equipment $3,600 Accounts payable 4,450 Salaries payable 1,000 Unearned revenue 940 Common shares 10,940 Retained earnings 33,200 S54,130 $54,130 During November, the following transactions were completed Nov. 9 Paid $2,200 to employees for salaries due, of which $1,000 is for October salaries payable and $1,200 for November. Issued common shares for $4,060 13 13 Received $12,490 cash from customers in payment of accounts. 19 Received $11,400 cash for services performed in November. 20 Purchased supplies on account, $600. 21 Paid creditors $4,450 of accounts payable due 23 Paid November rent, $600 23 Paid salaries, $2,400. 27 Performed services on account, $3,850 Declared and paid a cash dividend, $500 28 Received $1,160 from customers for services to be performed in the future. 30 Prepare a trial balance at November 30 ALOU EQUIPMENT REPAIR CORP. Trial Balance November 30, 2018 Before Adjustment Debit Credit Cash 35230 Accounts Receivable 7220 Supplies 4600 Equipment 18000 Accumulated Depreciation - Equipment 3600 Accounts Payable 600 Unearned Revenue 2100 Common Shares 15000 33200 Retained Earnings Dividends Declared 500 Service Revenue 15250 Salaries Expense 3600 Rent Expense 600 Totals 69750 69750 Adjustment data for the month: 1. Supplies on hand are $1,000. 2. Accrued salaries payable are $1,000 The equipment has an estimated useful life of five years and Alou uses straight-line depreciation. 3. Unearned revenue of $800 was earned during the month. 4. 5. Income tax payable is estimated to be $1,100. Adjusted Trial Balance November 30, 2018 After Adjustment Debit Credit Cash 35230 Accounts Receivable 7220 Supplies 1000 Equipment 18000 Accumulated Depreciation - Equipment 3900 Accounts Payable 600 Salaries Payable 1000 Income Tax Payable 1100 Unearned Revenue 1300 Common Shares 15000 Retained Earnings 33200 500 Dividends Declared Service Revenue 16050 600 Rent Expense Income Tax Expense 1100 Supplies Expense 3600 Depreciation Expense 300 Salaries Expense 4600 Totals 72150 72150 Prepare an income statement for the month ALOU EQUIPMENT REPAIR CORP. Income Statement Month Ended November 30, 2018 Revenues 16050 Service Revenue Expenses Salaries Expense 4600 Rent Expense 600 Supplies Expense 3600 300 Depreciation Expense 9100 Total expenses Income before income tax 6950 1100 Income Tax Expense 5850 Net income SHOW LIST OF ACCOUNTS LINK TO TEXT LIN LINK TO TEXTL TO TEXT Prepare a statement of changes in equity for the month. ALOU EQUIPMENT REPAIR CORP Statement of Changes in Equity Month Ended November 30, 2018 Common Shares Retained Earnings Total Equity Balance, November 1 7 Issued common shares Net income Dividends Declared Balance, November 30 Statement of Financial Position November 30, 2018 Assets Liabilities and Shareholders' Equity