Answered step by step

Verified Expert Solution

Question

1 Approved Answer

now its complete i posted the data posted again Results from Super Corporation's most recent year of operations are presented in the following table. (Click

now its complete

i posted the data

posted again

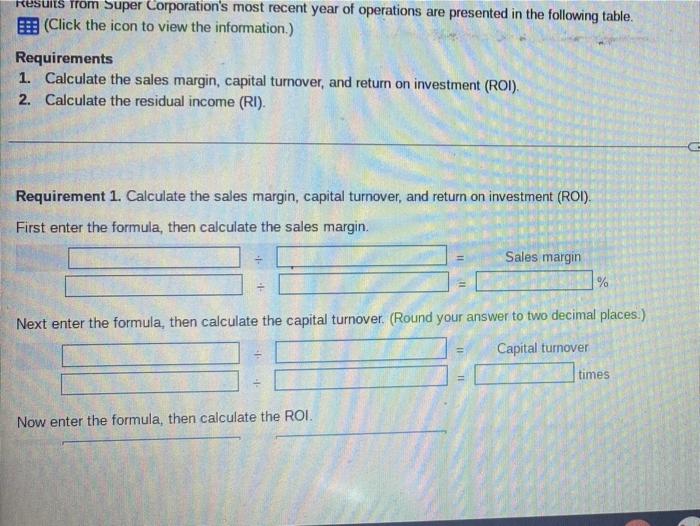

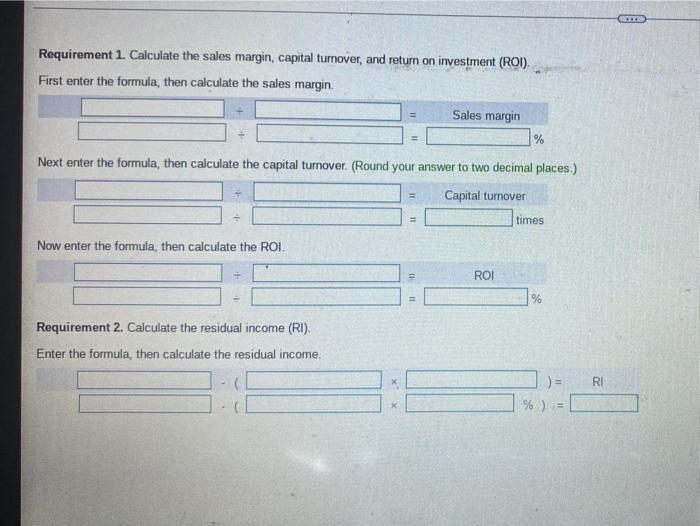

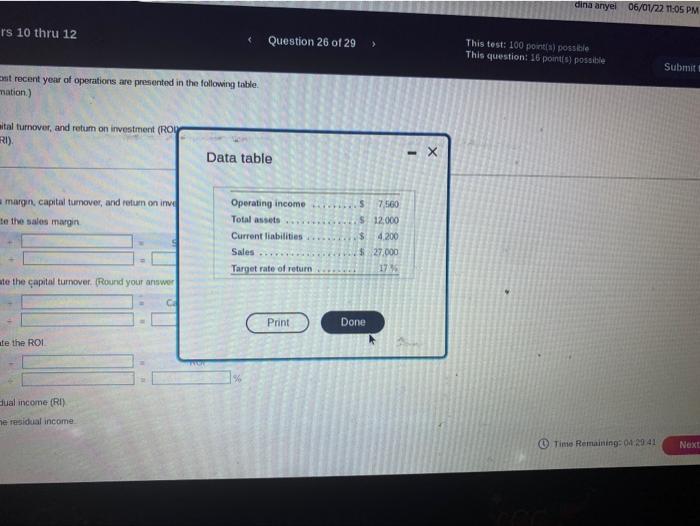

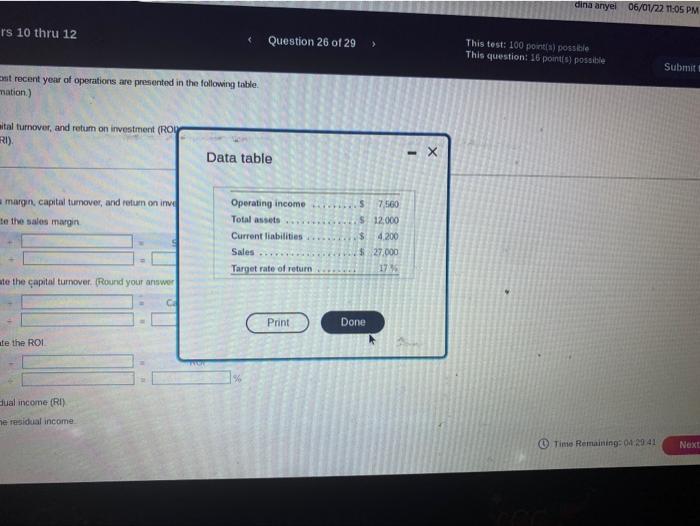

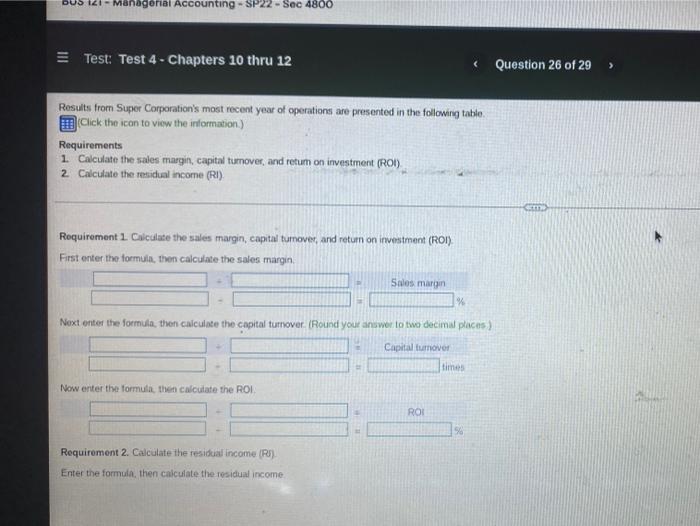

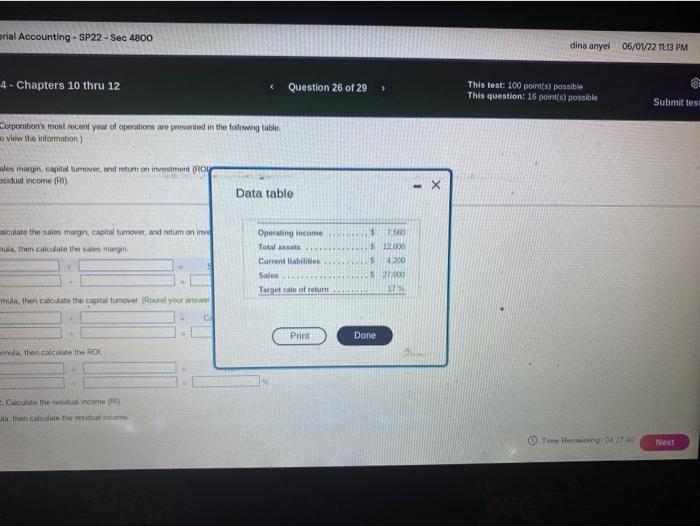

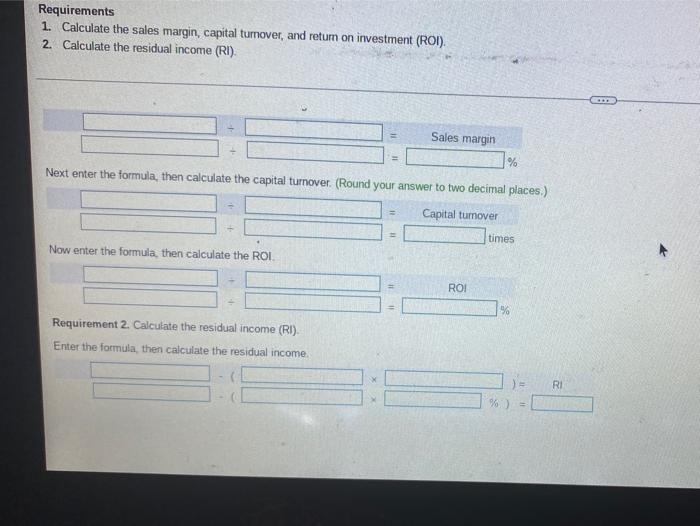

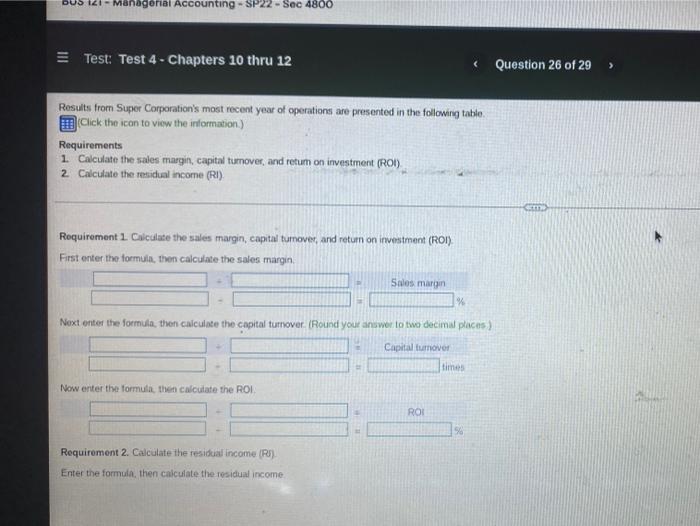

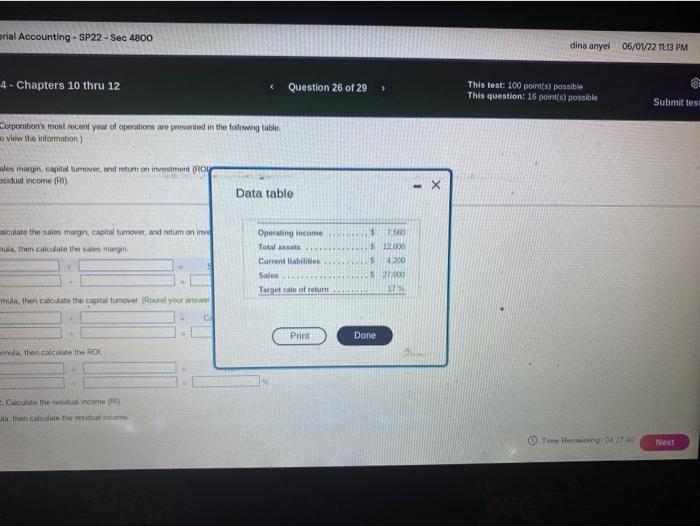

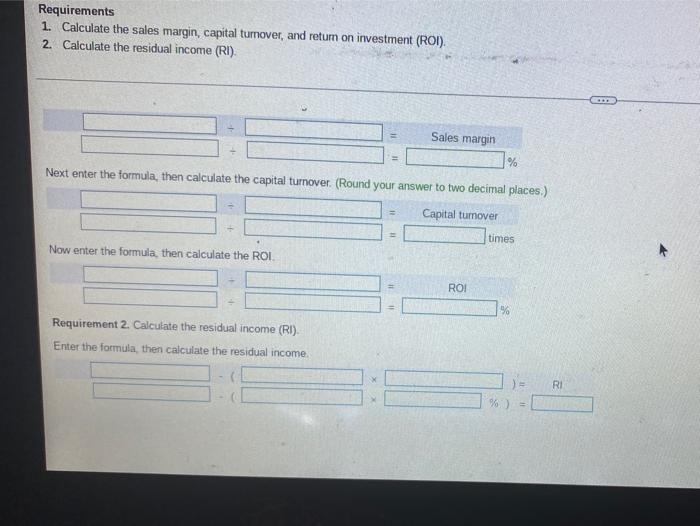

Results from Super Corporation's most recent year of operations are presented in the following table. (Click the icon to view the information.) Requirements 1. Calculate the sales margin, capital turnover, and return on investment (ROI). 2. Calculate the residual income (RI). Requirement 1. Calculate the sales margin, capital turnover, and return on investment (ROI). First enter the formula, then calculate the sales margin. Sales margin % Next enter the formula, then calculate the capital turnover. (Round your answer to two decimal places.) Capital turnover # times = Now enter the formula, then calculate the ROI. Requirement 1. Calculate the sales margin, capital turnover, and return on investment (ROI). First enter the formula, then calculate the sales margin. Sales margin % Next enter the formula, then calculate the capital turnover. (Round your answer to two decimal places.) Capital turnover Now enter the formula, then calculate the ROI. + ROI Requirement 2. Calculate the residual income (RI). Enter the formula, then calculate the residual income. 10 11 times % )= RI %) = rs 10 thru 12 most recent year of operations are presented in the following table mation.) mital turnover, and retum on investment (ROU RI). Data table a margin, capital turnover, and retum on inve te the sales margin ate the capital turnover. (Round your answer te the ROI Jual income (RI) he residual income. Question 26 of 29 > Operating income Total assets Current liabilities Sales Target rate of return Print $ 7,560 $ 12,000 $ 4.200 $ 27,000 17% Done I X dina anyei 06/01/22 11:05 PM Submit t Next: This test: 100 point(s) possible This question: 16 point(s) possible Time Remaining: 04:29 41 Dus 121-Managerial Accounting - SP22-Sec 4800 Test: Test 4 - Chapters 10 thru 12 Results from Super Corporation's most recent year of operations are presented in the following table. (Click the icon to view the information.) Requirements 1. Calculate the sales margin, capital turnover, and retum on investment (ROI) 2. Calculate the residual income (RI) Requirement 1. Calculate the sales margin, capital turnover, and return on investment (ROI) First enter the formula, then calculate the sales margin. Sales margin % # Next enter the formula, then calculate the capital turnover. (Round your answer to two decimal places) Capital turnover Now enter the formula, then calculate the ROI ROI Requirement 2. Calculate the residual income (R) Enter the formula, then calculate the residual income. times % Question 26 of 29 > arial Accounting-SP22-Sec 4800 4- Chapters 10 thru 12 Corporation's most recent year of operations are presented in the following table View the information) ales margin, capital turnover, and retum on investment (RO sidual income (R) Data table alculate the sales margin, capital tumover, and retium on inve mula, then calculate the sales margin mula, then calculate the capital tumover (Round your answer mula, then calculate the ROL Calculate the residual income (R) a then calculate the residual income Question 26 of 29 Operating income Total assets Current liabilities Sales Target rate of return Print 1 7,500 $22.000 S 4.200 $ 27,000 27/16 Done dina anyel 06/01/22 11:13 PM This test: 100 point(s) possible This question: 16 point(s) possible Tim Remaining: 04 27 40 9 Submit test Next Requirements 1. Calculate the sales margin, capital turnover, and return on investment (ROI). 2. Calculate the residual income (RI). Sales margin % Next enter the formula, then calculate the capital turnover. (Round your answer to two decimal places.) = Capital turnover Now enter the formula, then calculate the ROI. ROI Requirement 2. Calculate the residual income (RI). Enter the formula, then calculate the residual income. (L #1 times 1% ) = %) = RI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started