Answered step by step

Verified Expert Solution

Question

1 Approved Answer

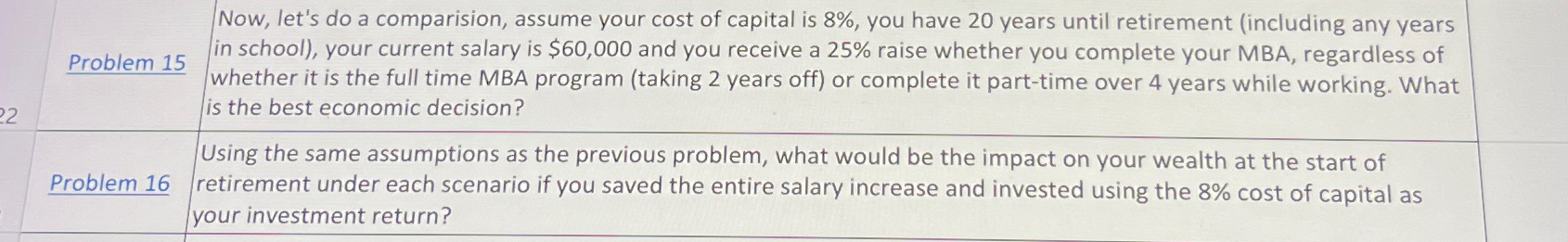

Now, let's do a comparision, assume your cost of capital is 8 % , you have 2 0 years until retirement ( including any years

Now, let's do a comparision, assume your cost of capital is you have years until retirement including any years

Problem in school your current salary is $ and you receive a raise whether you complete your MBA, regardless of whether it is the full time MBA program taking years off or complete it parttime over years while working. What is the best economic decision?

Using the same assumptions as the previous problem, what would be the impact on your wealth at the start of

Problem retirement under each scenario if you saved the entire salary increase and invested using the cost of capital as your investment return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started