Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Now suppose that the above orders arrive on the market over time, in the order of arrival that is listed. That is: at t

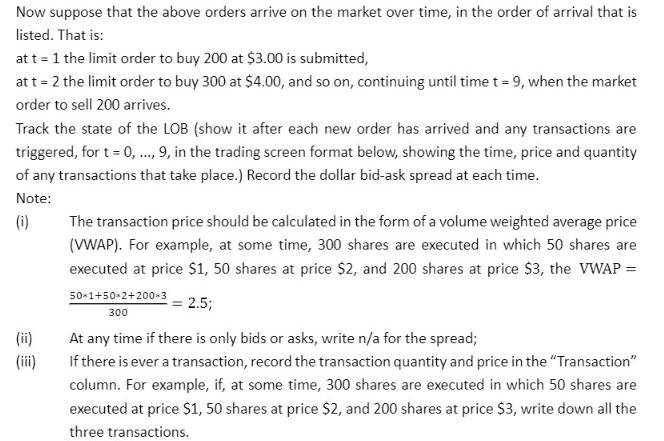

Now suppose that the above orders arrive on the market over time, in the order of arrival that is listed. That is: at t = 1 the limit order to buy 200 at $3.00 is submitted, at t = 2 the limit order to buy 300 at $4.00, and so on, continuing until time t = 9, when the market order to sell 200 arrives. Track the state of the LOB (show it after each new order has arrived and any transactions are triggered, for t = 0, ..., 9, in the trading screen format below, showing the time, price and quantity of any transactions that take place.) Record the dollar bid-ask spread at each time. Note: (i) (ii) (iii) The transaction price should be calculated in the form of a volume weighted average price (VWAP). For example, at some time, 300 shares are executed in which 50 shares are executed at price $1, 50 shares at price $2, and 200 shares at price $3, the VWAP = = 2.5; At any time if there is only bids or asks, write n/a for the spread; If there is ever a transaction, record the transaction quantity and price in the "Transaction" column. For example, if, at some time, 300 shares are executed in which 50 shares are executed at price $1, 50 shares at price $2, and 200 shares at price $3, write down all the three transactions. 50+1+50-2+200-3 300

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Limit Order Book LOB Tracking Time Bid Ask Transaction BidAsk Spread 0 na na na na 1 200 300 na ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started