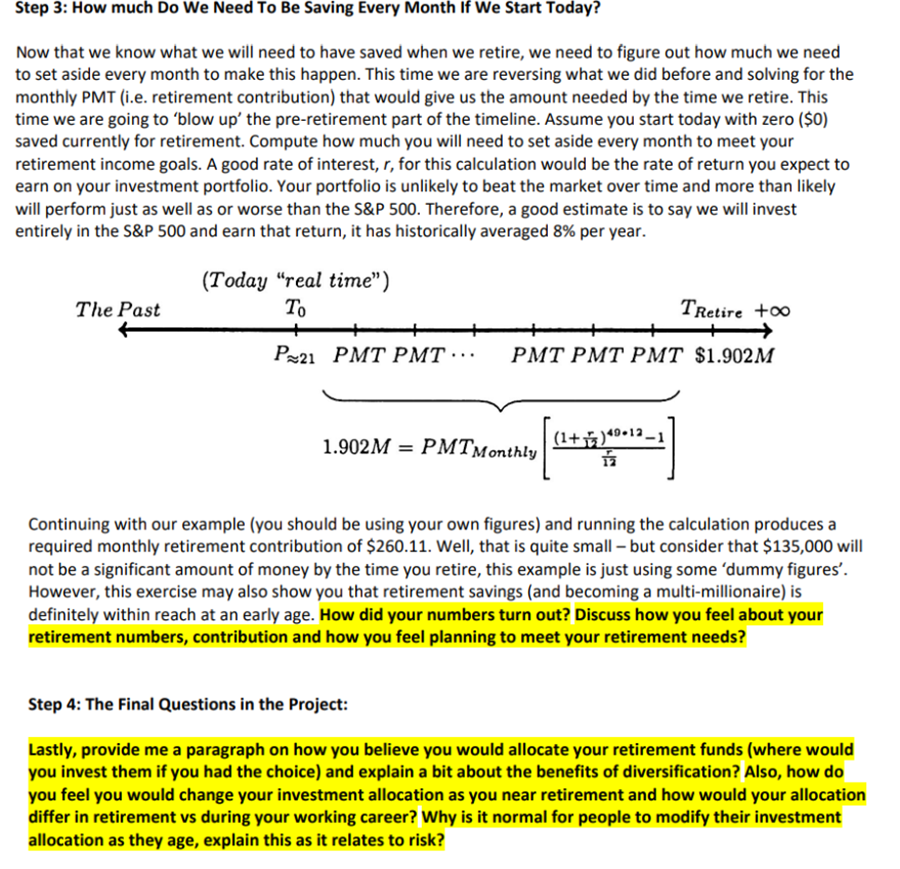

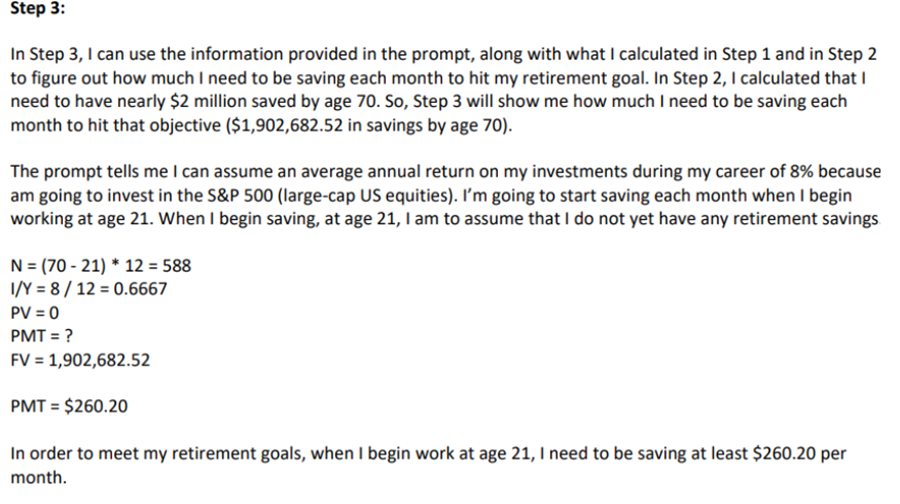

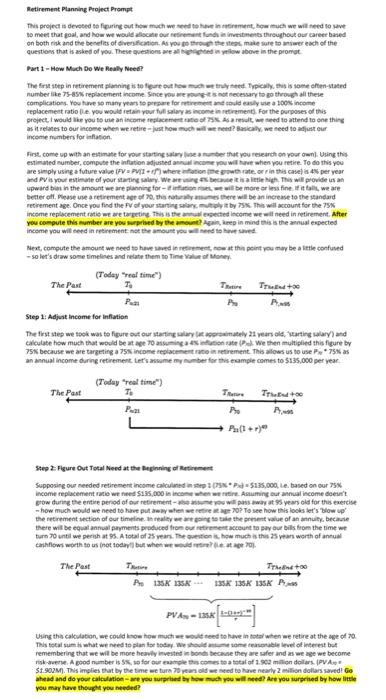

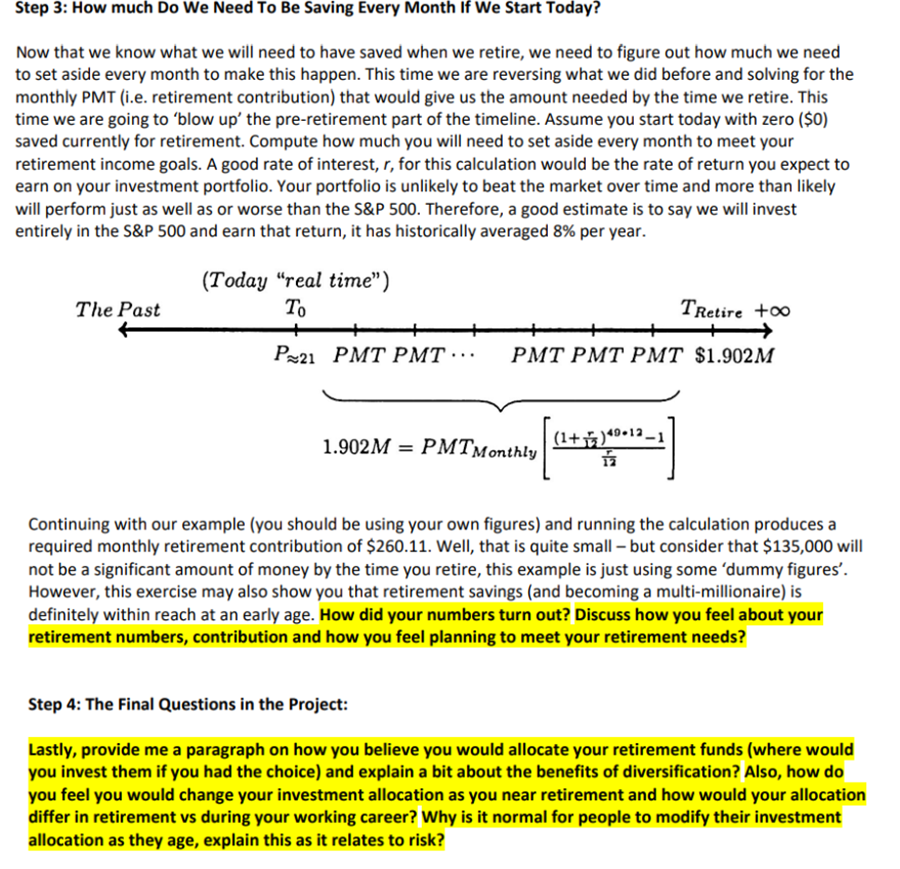

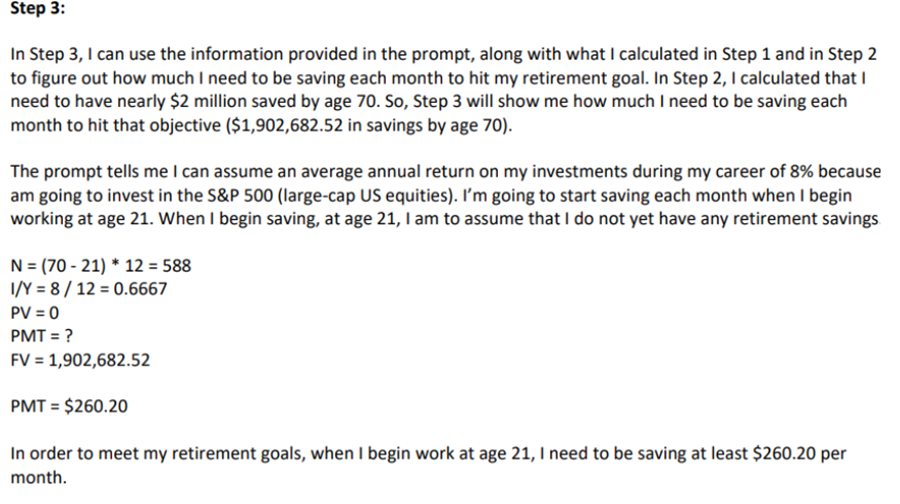

Now that we know what we will need to have saved when we retire, we need to figure out how much we need to set aside every month to make this happen. This time we are reversing what we did before and solving for the monthly PMT (i.e. retirement contribution) that would give us the amount needed by the time we retire. This time we are going to 'blow up' the pre-retirement part of the timeline. Assume you start today with zero ($0) saved currently for retirement. Compute how much you will need to set aside every month to meet your retirement income goals. A good rate of interest, r, for this calculation would be the rate of return you expect to earn on your investment portfolio. Your portfolio is unlikely to beat the market over time and more than likely will perform just as well as or worse than the S\&P 500. Therefore, a good estimate is to say we will invest entirely in the S\&P 500 and earn that return, it has historically averaged 8% per year. Continuing with our example (you should be using your own figures) and running the calculation produces a required monthly retirement contribution of $260.11. Well, that is quite small - but consider that $135,000 will not be a significant amount of money by the time you retire, this example is just using some 'dummy figures'. However, this exercise may also show you that retirement savings (and becoming a multi-millionaire) is definitely within reach at an early age. How did your numbers turn out? Discuss how you feel about your retirement numbers, contribution and how you feel planning to meet your retirement needs? Step 4: The Final Questions in the Project: Lastly, provide me a paragraph on how you believe you would allocate your retirement funds (where would you invest them if you had the choice) and explain a bit about the benefits of diversification? Also, how do you feel you would change your investment allocation as you near retirement and how would your allocation differ in retirement vs during your working career? Why is it normal for people to modify their investment allocation as they age, explain this as it relates to risk? In Step 3, I can use the information provided in the prompt, along with what I calculated in Step 1 and in Step 2 to figure out how much I need to be saving each month to hit my retirement goal. In Step 2, I calculated that I need to have nearly $2 million saved by age 70 . So, Step 3 will show me how much I need to be saving each month to hit that objective ($1,902,682.52 in savings by age 70). The prompt tells me I can assume an average annual return on my investments during my career of 8% because am going to invest in the S\&P 500 (large-cap US equities). I'm going to start saving each month when I begin working at age 21 . When I begin saving, at age 21, I am to assume that I do not yet have any retirement savings. N=(7021)12=588I/Y=8/12=0.6667PV=0PMT=?FV=1,902,682.52PMT=$260.20 In order to meet my retirement goals, when I begin work at age 21, I need to be saving at least $260.20 per month. Aetirement Plannine Project Prompt so meet that goal, and how we would alocate our retinement fondi in inentments throughout our career baned Dart 1 - Hew Mach Do We Reully Neee? replacement ratio fie, you would irtain pour fud salar as income in netirement, For the parposes of this income numbers for inflation. Step 1: Adjat income for inflation an annual income during retinement. tets ascume ner nmber for this ecample comes to 5135,000 per year. Step 2: Figure Out Total Need at the Beginning of Antirement turn 70 until we perigh at 95 . A total of 25 vean. The ourition is. how much is thin 25 vean worth of annual pou mary have theuple you needed