Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Now that you have assembled Sunset's raw data into useable income statements and balance sheets, and have evaluated the cash flow situation Sunset is

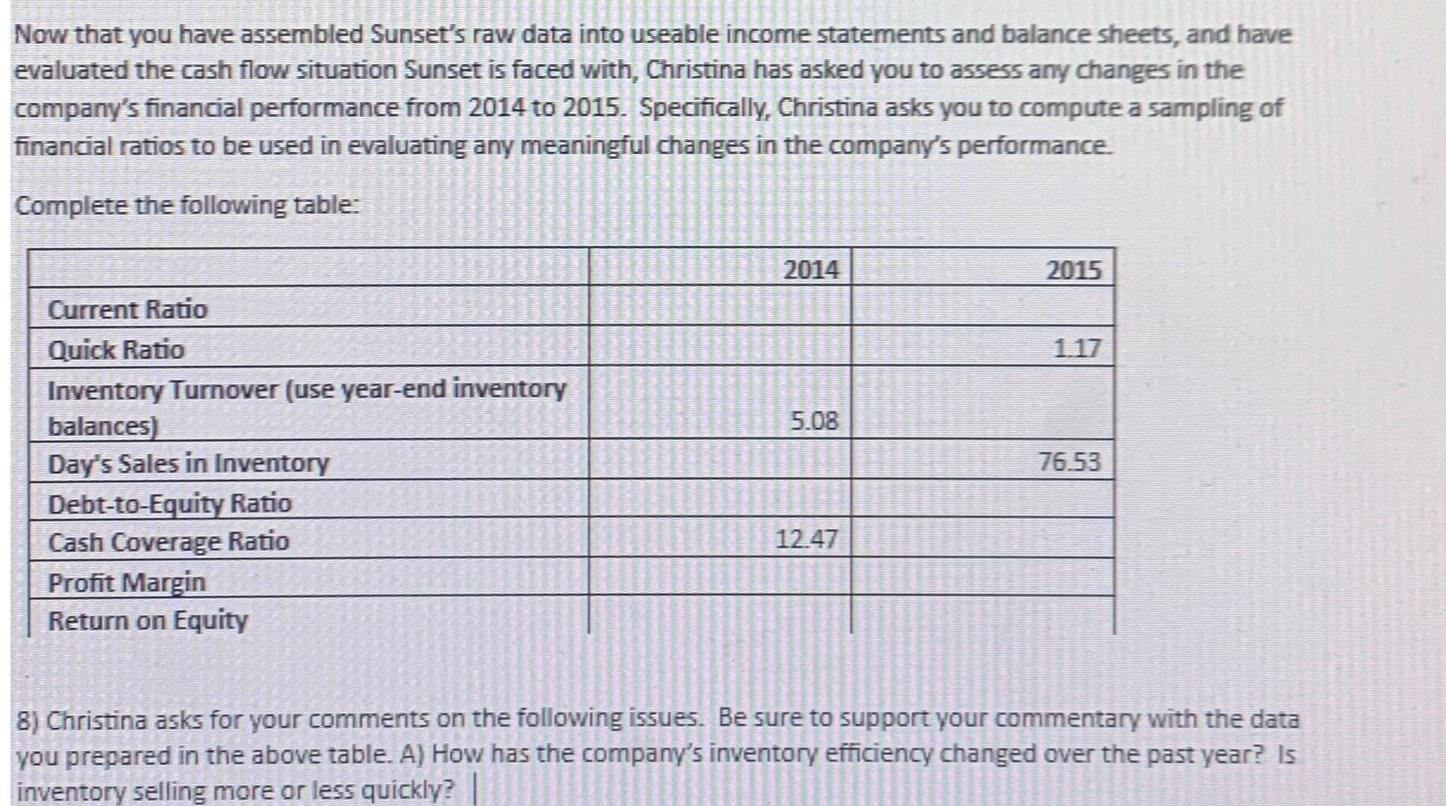

Now that you have assembled Sunset's raw data into useable income statements and balance sheets, and have evaluated the cash flow situation Sunset is faced with, Christina has asked you to assess any changes in the company's financial performance from 2014 to 2015. Specifically, Christina asks you to compute a sampling of financial ratios to be used in evaluating any meaningful changes in the company's performance. Complete the following table: Current Ratio Quick Ratio Inventory Turnover (use year-end inventory balances) Day's Sales in Inventory Debt-to-Equity Ratio Cash Coverage Ratio Profit Margin Return on Equity 2014 5.08 12.47 2015 1.17 76.53 8) Christina asks for your comments on the following issues. Be sure to support your commentary with the data you prepared in the above table. A) How has the company's inventory efficiency changed over the past year? Is inventory selling more or less quickly?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To assess the change in Sunsets inventory ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started