Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Now that you know a bit more about mortgages, we can look at how to apply this information. Knowing how to calculator mortgage payments,

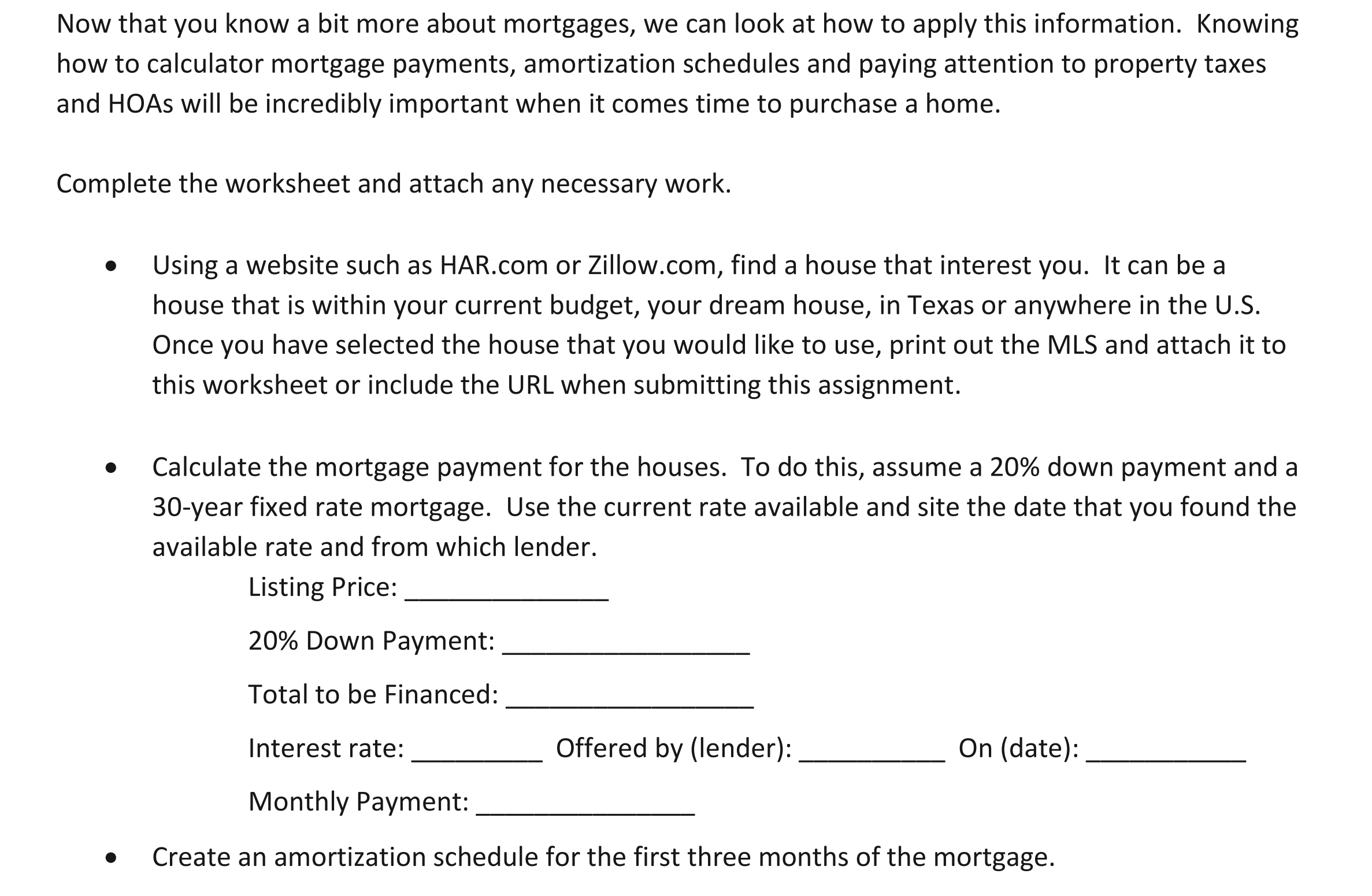

Now that you know a bit more about mortgages, we can look at how to apply this information. Knowing how to calculator mortgage payments, amortization schedules and paying attention to property taxes and HOAs will be incredibly important when it comes time to purchase a home. Complete the worksheet and attach any necessary work. Using a website such as HAR.com or Zillow.com, find a house that interest you. It can be a house that is within your current budget, your dream house, in Texas or anywhere in the U.S. Once you have selected the house that you would like to use, print out the MLS and attach it to this worksheet or include the URL when submitting this assignment. Calculate the mortgage payment for the houses. To do this, assume a 20% down payment and a 30-year fixed rate mortgage. Use the current rate available and site the date that you found the available rate and from which lender. Listing Price: 20% Down Payment: Total to be Financed: Interest rate: Offered by (lender): On (date): Monthly Payment: Create an amortization schedule for the first three months of the mortgage. Create an amortization schedule for the first three months of the mortgage. End of Month Portion towards Portion towards Balance of principle interest principle 1 2 3 Find the net monthly expenditure for the house, including any property taxes and HOAs provided on the MLS. Annual Property Taxes: Monthly Property Taxes: Annual HOAs: Monthly HOAs: Total Monthly Expenditure: HO LOA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started