Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Now Trendy Sdn Bhd, providing product consultant services, is a taxable person under the Service Tax Act 2018. Now Trendy recently carried out an

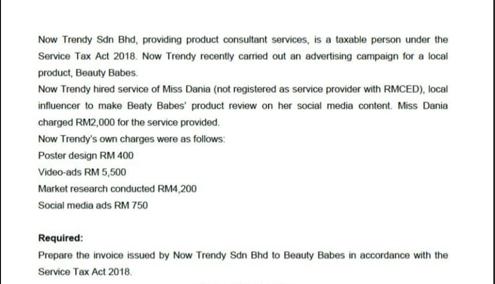

Now Trendy Sdn Bhd, providing product consultant services, is a taxable person under the Service Tax Act 2018. Now Trendy recently carried out an advertising campaign for a local product, Beauty Babes. Now Trendy hired service of Miss Dania (not registered as service provider with RMCED), local influencer to make Beaty Babes' product review on her social media content. Miss Dania charged RM2,000 for the service provided. Now Trendy's own charges were as follows: Poster design RM 400 Video-ads RM 5,500 Market research conducted RM4,200 Social media ads RM 750 Required: Prepare the invoice issued by Now Trendy Sdn Bhd to Beauty Babes in accordance with the Service Tax Act 2018.

Step by Step Solution

★★★★★

3.59 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The image provided shows a scenario where Now Trendy Sdn Bhd a product consultant service taxable un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started