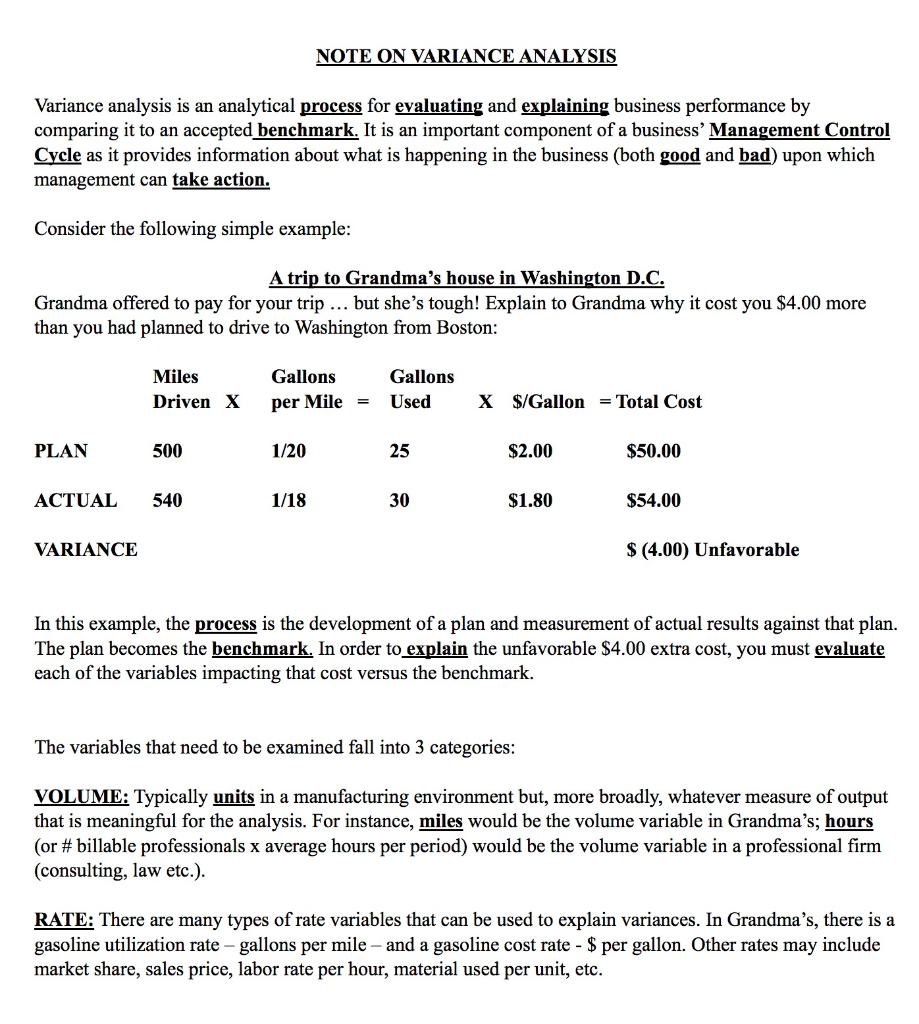

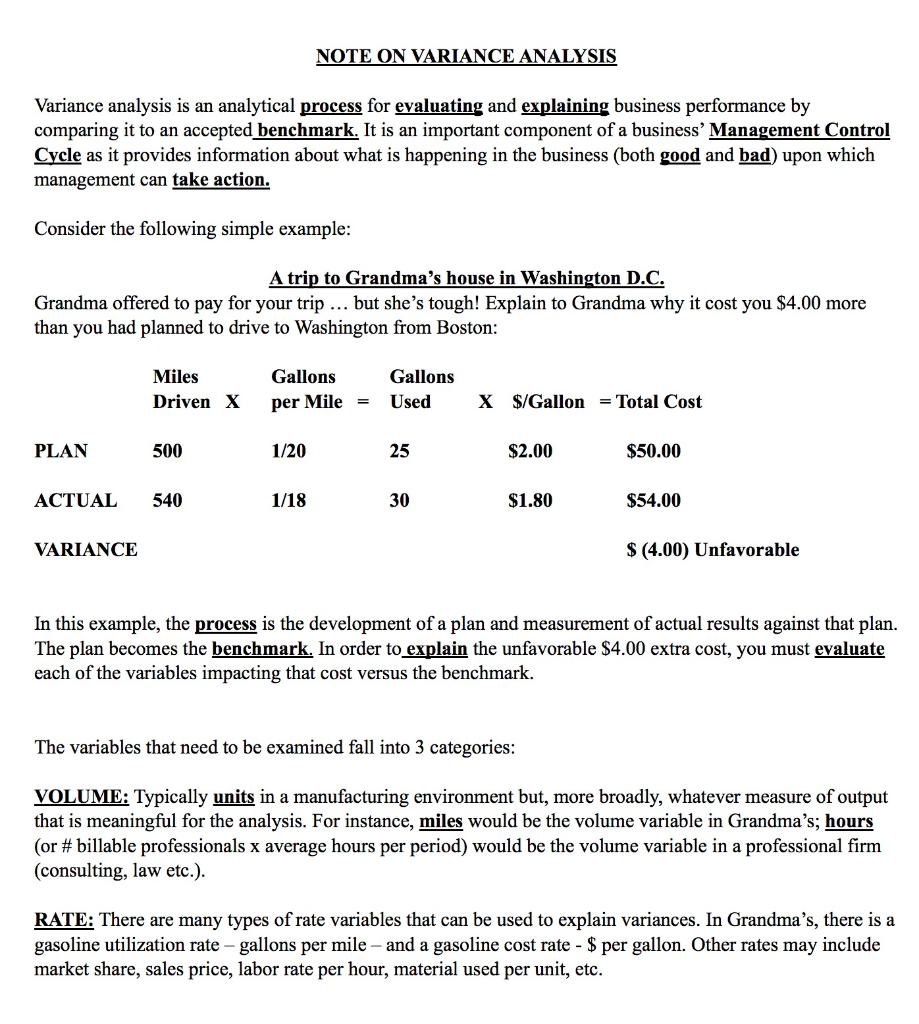

Now use the results of the variance analysis to tell Grandma what happened and WHAT ACTIONS you would take next time to avoid the cost overrun: What Happened Corrective Action Plan BRACKETS ARE BAD Favorable variances- spending less than plan, bringing in more revenue/profit than plan - are POSITIVE values. Unfavorable variances- spending more than plan, bringing in less revenue/profit than plan - are NEGATIVE values. They are best displayed inside brackets (XXX.XX) In order to make the variance calculations come out with the correct +/- signs, you need to use the following conventions: Revenue/profit related items use Actual - Budget your variances with a "U" for Unfavorable and an "F" for Favorable NOTE ON VARIANCE ANALYSIS Variance analysis is an analytical process for evaluating and explaining business performance by comparing it to an accepted benchmark. It is an important component of a business Management Control Cycle as it provides information about what is happening in the business (both good and bad) upon which management can take action. Consider the following simple example: A trip to Grandma's house in Washington D.C. Grandma offered to pay for your trip ... but she's tough! Explain to Grandma why it cost you $4.00 more than you had planned to drive to Washington from Boston: Miles Driven X Gallons Gallons per Mile = Used X $/Gallon = Total Cost PLAN 500 1/20 25 $2.00 $50.00 ACTUAL 540 1/18 30 $1.80 $54.00 VARIANCE $ (4.00) Unfavorable In this example, the process is the development of a plan and measurement of actual results against that plan. The plan becomes the benchmark. In order to explain the unfavorable $4.00 extra cost, you must evaluate each of the variables impacting that cost versus the benchmark. The variables that need to be examined fall into 3 categories: VOLUME: Typically units in a manufacturing environment but, more broadly, whatever measure of output that is meaningful for the analysis. For instance, miles would be the volume variable in Grandma's; hours (or #billable professionals x average hours per period) would be the volume variable in a professional firm (consulting, law etc.). RATE: There are many types of rate variables that can be used to explain variances. In Grandma's, there is a gasoline utilization rate - gallons per mile - and a gasoline cost rate - $ per gallon. Other rates may include market share, sales price, labor rate per hour, material used per unit, etc. Now use the results of the variance analysis to tell Grandma what happened and WHAT ACTIONS you would take next time to avoid the cost overrun: What Happened Corrective Action Plan BRACKETS ARE BAD Favorable variances- spending less than plan, bringing in more revenue/profit than plan - are POSITIVE values. Unfavorable variances- spending more than plan, bringing in less revenue/profit than plan - are NEGATIVE values. They are best displayed inside brackets (XXX.XX) In order to make the variance calculations come out with the correct +/- signs, you need to use the following conventions: Revenue/profit related items use Actual - Budget your variances with a "U" for Unfavorable and an "F" for Favorable NOTE ON VARIANCE ANALYSIS Variance analysis is an analytical process for evaluating and explaining business performance by comparing it to an accepted benchmark. It is an important component of a business Management Control Cycle as it provides information about what is happening in the business (both good and bad) upon which management can take action. Consider the following simple example: A trip to Grandma's house in Washington D.C. Grandma offered to pay for your trip ... but she's tough! Explain to Grandma why it cost you $4.00 more than you had planned to drive to Washington from Boston: Miles Driven X Gallons Gallons per Mile = Used X $/Gallon = Total Cost PLAN 500 1/20 25 $2.00 $50.00 ACTUAL 540 1/18 30 $1.80 $54.00 VARIANCE $ (4.00) Unfavorable In this example, the process is the development of a plan and measurement of actual results against that plan. The plan becomes the benchmark. In order to explain the unfavorable $4.00 extra cost, you must evaluate each of the variables impacting that cost versus the benchmark. The variables that need to be examined fall into 3 categories: VOLUME: Typically units in a manufacturing environment but, more broadly, whatever measure of output that is meaningful for the analysis. For instance, miles would be the volume variable in Grandma's; hours (or #billable professionals x average hours per period) would be the volume variable in a professional firm (consulting, law etc.). RATE: There are many types of rate variables that can be used to explain variances. In Grandma's, there is a gasoline utilization rate - gallons per mile - and a gasoline cost rate - $ per gallon. Other rates may include market share, sales price, labor rate per hour, material used per unit, etc