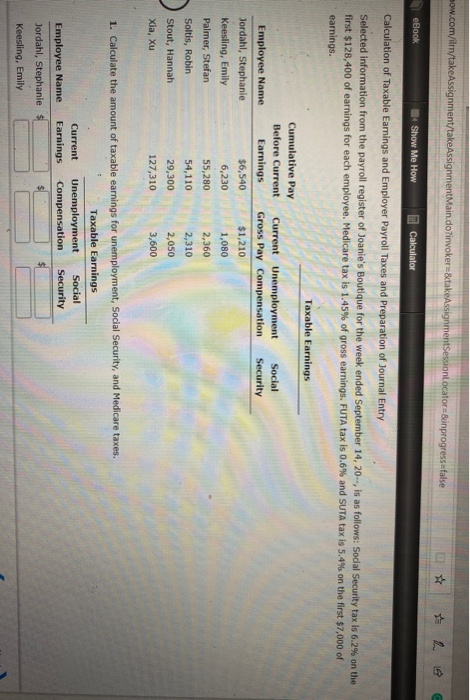

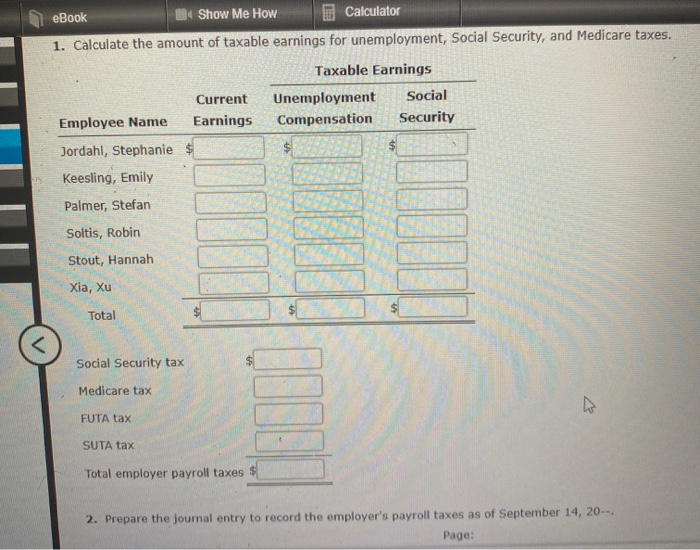

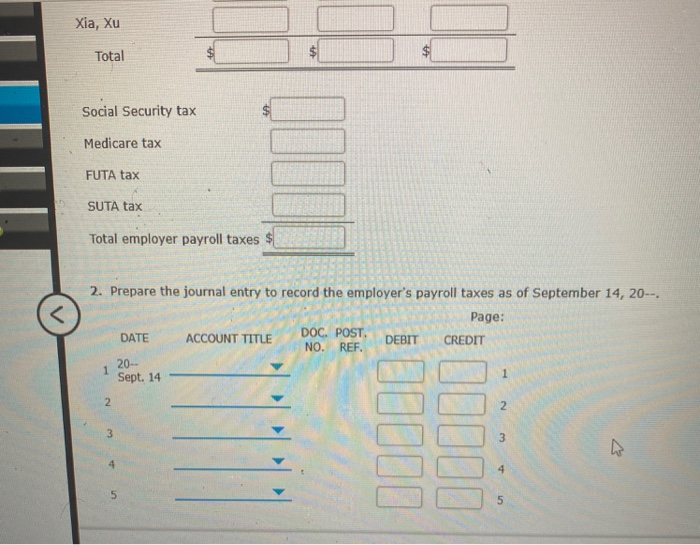

now.com/in/takeAssignment/takeAssignmentMain.do?invokeru&takeAssignmentSessionLocators Binprogress false * * eBook Show Me How Calculator Calculation of Taxable Earnings and Employer Payroll Taxes and Preparation of Journal Entry Selected information from the payroll register of Joanie's Boutique for the week ended September 14, 20--, is as follows: Social Security tax is 6.2% on the first $128,400 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.6% and SUTA tax is 5,4% on the first $7,000 of earnings. Employee Name Jordahl, Stephanie Keesling, Emily Palmer, Stefan Soltis, Robin Stout, Hannah Xia, Xu Taxable Earnings Cumulative Pay Before Current Current Unemployment Social Earnings Gross Pay Compensation Security $6,540 $1,210 6,2301 ,080 55,280 2,360 54,110 2,310 29,300 2,050 127,310 3,600 1. Calculate the amount of taxable earnings for unemployment, Social Security, and Medicare taxes. Taxable Earnings Current Unemployment Social Employee Name Earnings Compensation Security Jordahl, Stephanie $ Keesling, Emily eBook Show Me How Calculator 1. Calculate the amount of taxable earnings for unemployment, Social Security, and Medicare taxes. Taxable Earnings Current Unemployment Social Employee Name Earnings Compensation Security Jordahl, Stephanie $ Keesling, Emily Palmer, Stefan Soltis, Robin Stout, Hannah Xia, Xu Total $ Social Security tax Medicare tax FUTA tax SUTA tax Total employer payroll taxes $ 2. Prepare the journal entry to record the employer's payroll taxes as of September 14, 20- Page: Xia, Xu Total Social Security tax Medicare tax FUTA tax SUTA tax Total employer payroll taxes $ 2. Prepare the journal entry to record the employer's payroll taxes as of September 14, 20- Page: DATE ACCOUNT TITLE DOC. POST. NO. REF. DEBIT CREDIT 20- Sept. 14 now.com/in/takeAssignment/takeAssignmentMain.do?invokeru&takeAssignmentSessionLocators Binprogress false * * eBook Show Me How Calculator Calculation of Taxable Earnings and Employer Payroll Taxes and Preparation of Journal Entry Selected information from the payroll register of Joanie's Boutique for the week ended September 14, 20--, is as follows: Social Security tax is 6.2% on the first $128,400 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.6% and SUTA tax is 5,4% on the first $7,000 of earnings. Employee Name Jordahl, Stephanie Keesling, Emily Palmer, Stefan Soltis, Robin Stout, Hannah Xia, Xu Taxable Earnings Cumulative Pay Before Current Current Unemployment Social Earnings Gross Pay Compensation Security $6,540 $1,210 6,2301 ,080 55,280 2,360 54,110 2,310 29,300 2,050 127,310 3,600 1. Calculate the amount of taxable earnings for unemployment, Social Security, and Medicare taxes. Taxable Earnings Current Unemployment Social Employee Name Earnings Compensation Security Jordahl, Stephanie $ Keesling, Emily eBook Show Me How Calculator 1. Calculate the amount of taxable earnings for unemployment, Social Security, and Medicare taxes. Taxable Earnings Current Unemployment Social Employee Name Earnings Compensation Security Jordahl, Stephanie $ Keesling, Emily Palmer, Stefan Soltis, Robin Stout, Hannah Xia, Xu Total $ Social Security tax Medicare tax FUTA tax SUTA tax Total employer payroll taxes $ 2. Prepare the journal entry to record the employer's payroll taxes as of September 14, 20- Page: Xia, Xu Total Social Security tax Medicare tax FUTA tax SUTA tax Total employer payroll taxes $ 2. Prepare the journal entry to record the employer's payroll taxes as of September 14, 20- Page: DATE ACCOUNT TITLE DOC. POST. NO. REF. DEBIT CREDIT 20- Sept. 14