Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NPV Birmingham Bolt, Inc., has been approached by one of its customers about producing 800,000 special-purpose parts for a new home product. The customer

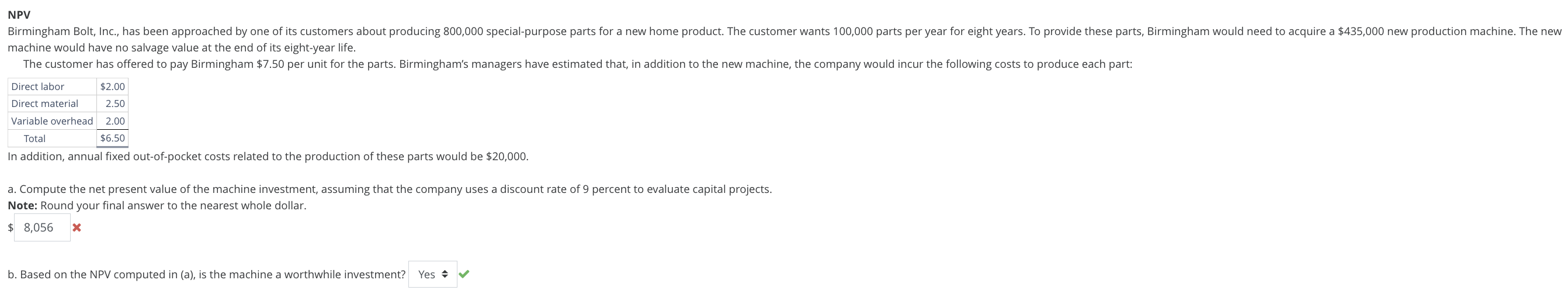

NPV Birmingham Bolt, Inc., has been approached by one of its customers about producing 800,000 special-purpose parts for a new home product. The customer wants 100,000 parts per year for eight years. To provide these parts, Birmingham would need to acquire a $435,000 new production machine. The new machine would have no salvage value at the end of its eight-year life. The customer has offered to pay Birmingham $7.50 per unit for the parts. Birmingham's managers have estimated that, in addition to the new machine, the company would incur the following costs to produce each part: Direct labor $2.00 Direct material 2.50 Variable overhead 2.00 Total $6.50 In addition, annual fixed out-of-pocket costs related to the production of these parts would be $20,000. a. Compute the net present value of the machine investment, assuming that the company uses a discount rate of 9 percent to evaluate capital projects. Note: Round your final answer to the nearest whole dollar. $ 8,056 b. Based on the NPV computed in (a), is the machine a worthwhile investment? Yes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the net present value NPV of the machine investment well use the formula NPV Initial Inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started