Answered step by step

Verified Expert Solution

Question

1 Approved Answer

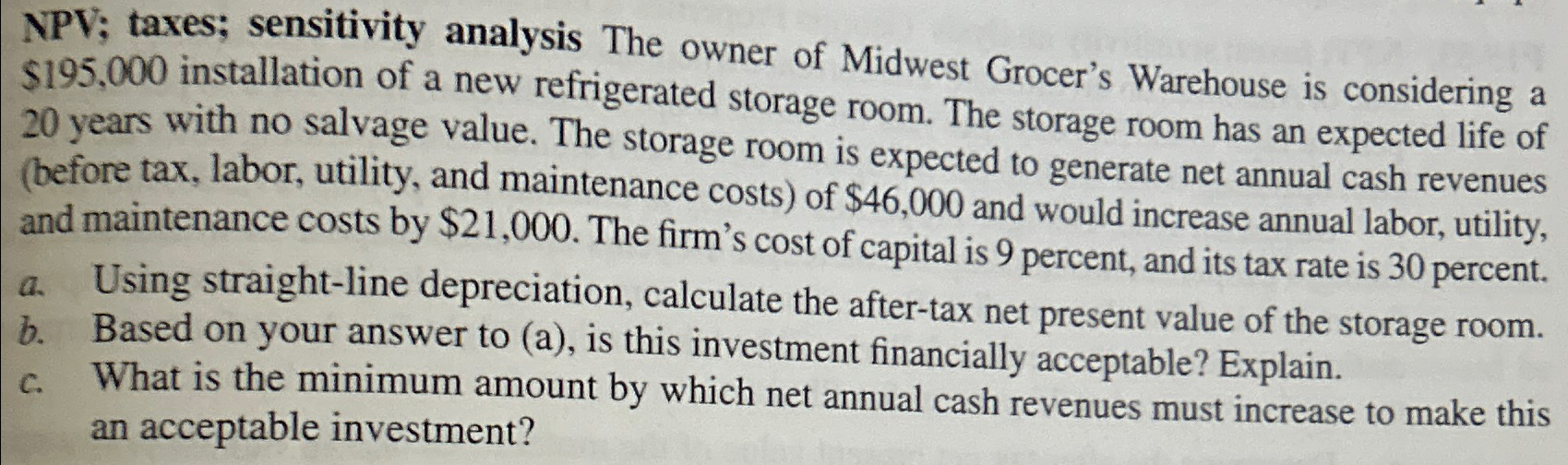

NPV; taxes; sensitivity analysis The owner of Midwest Grocer's Warehouse is considering a $ 1 9 5 , 0 0 0 installation of a new

NPV; taxes; sensitivity analysis The owner of Midwest Grocer's Warehouse is considering a $ installation of a new refrigerated storage room. The storage room has an expected life of years with no salvage value. The storage room is expected to generate net annual cash revenues before tax, labor, utility, and maintenance costs of $ and would increase annual labor, utility, and maintenance costs by $ The firm's cost of capital is percent, and its tax rate is percent.

a Using straightline depreciation, calculate the aftertax net present value of the storage room.

b Based on your answer to a is this investment financially acceptable? Explain.

c What is the minimum amount by which net annual cash revenues must increase to make this an acceptable investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started