Answered step by step

Verified Expert Solution

Question

1 Approved Answer

nro Thus, weighted average cost of capital is the weighted average after tax costs of the individual components of firm's capital structure. That the after

nro

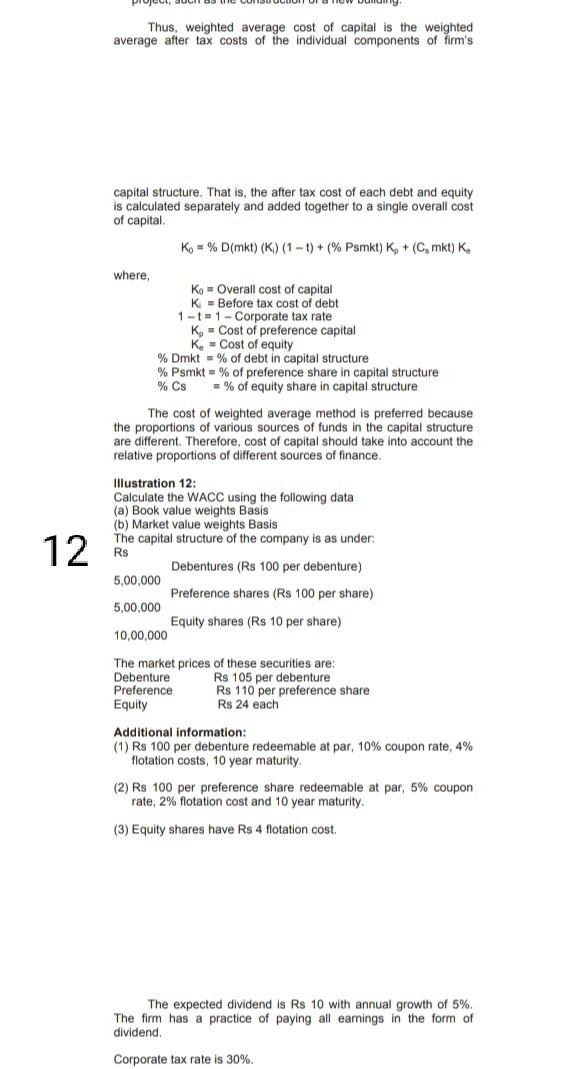

Thus, weighted average cost of capital is the weighted average after tax costs of the individual components of firm's capital structure. That the after tax cost of each debt and equity is calculated separately and added together to a single overall cost of capital Ko = % D(mkt) (K) (1 - 1) + (% Psmkt) K, + (C, mkt) K. where, Ko - Overall cost of capital K = Before tax cost of debt 1 - - 1 - Corporate tax rate K, - Cost of preference capital K. - Cost of equity % Dmkt =% of debt in capital structure % Psmkt - % of preference share in capital structure % Cs =% of equity share in capital structure The cost of weighted average method is preferred because the proportions of various sources of funds in the capital structure are different. Therefore, cost of capital should take into account the relative proportions of different sources of finance. 12 Illustration 12: Calculate the WACC using the following data (a) Book value weights Basis (b) Market value weights Basis The capital structure of the company is as under Rs Debentures (Rs 100 per debenture) 5,00,000 Preference shares (Rs 100 per share) 5,00,000 Equity shares (Rs 10 per share) 10,00,000 The market prices of these securities are: Debenture Rs 105 per debenture Preference Rs 110 per preference share Equity Rs 24 each Additional information: (1) Rs 100 per debenture redeemable at par, 10% coupon rate, 4% flotation costs, 10 year maturity (2) Rs 100 per preference share redeemable at par, 5% coupon rate, 2% flotation cost and 10 year maturity. (3) Equity shares have Rs 4 flotation cost, The expected dividend is Rs 10 with annual growth of 5%. The firm has a practice of paying all earnings in the form of dividend. Corporate tax rate is 30%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started