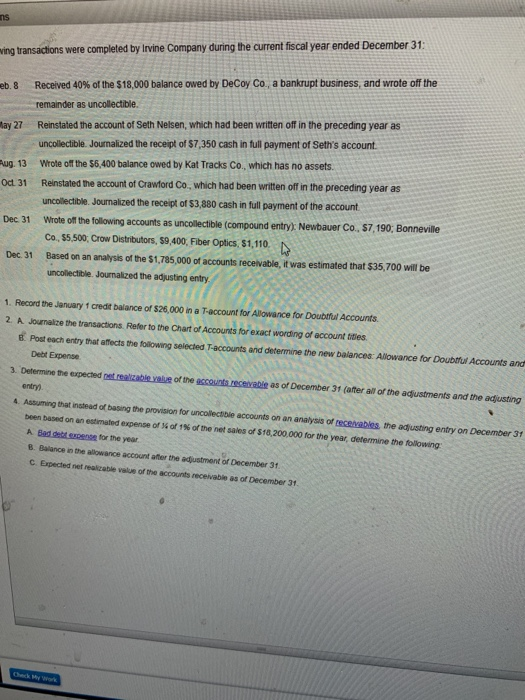

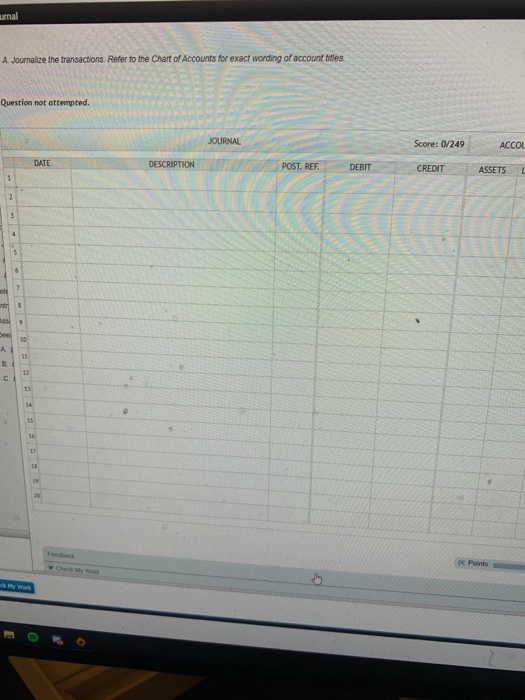

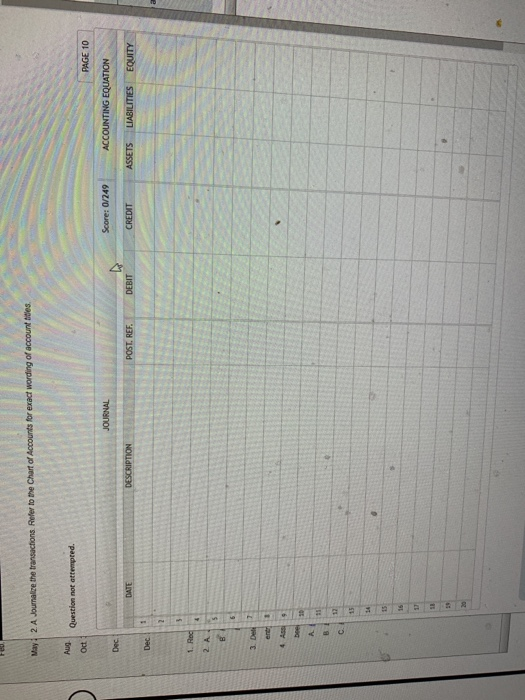

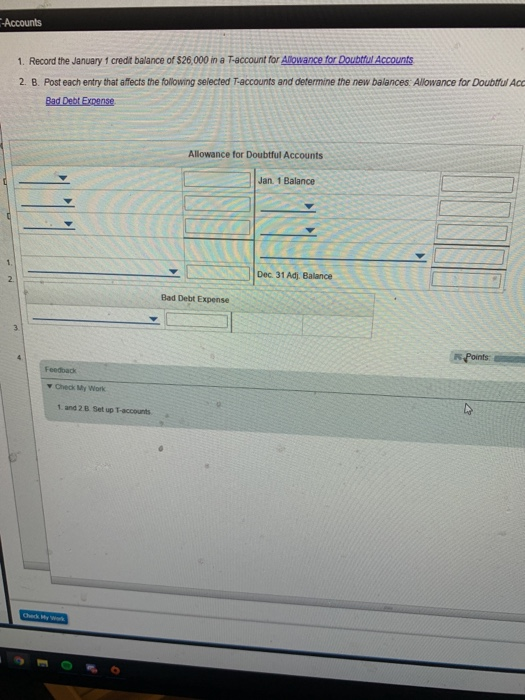

ns ving transactions were completed by Irvine Company during the current fiscal year ended December 31: eb. 8 Received 40% of the 518,000 balance owed by DeCoy Co., a bankrupt business, and wrote off the remainder as uncollectible. Lay 27 Reinstated the account of Seth Nelsen, which had been written off in the preceding year as uncollectible. Journalized the receipt of $7,350 cash in full payment of Seth's account ug. 13 Wrote of the $6,400 balance owed by Kat Tracks Co, which has no assets. Oct 31 Reinstated the account of Crawford Co., which had been written off in the preceding year as uncollectible. Journalized the receipt of $3,880 cash in full payment of the account Dec 31 Wrote of the following accounts as uncollectible (compound entry): Newbauer Co., S7, 190, Bonneville Co., 55,500. Crow Distributors, 59,400, Fiber Optics $1,110 D. Dec 31 Based on an analysis of the $1,785,000 of accounts receivable, it was estimated that $35,700 will be uncollectible. Journalized the adjusting entry 1. Record the January 1 credit balance of $26,000 in a T-account for Allowance for Doubtful Accounts 2 A Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles Posteach entry that affects the following selected T-accounts and determine the new balances: Allowance for Doubtful Accounts and Debt Expense 3. Determine the expected ne realizable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry 4 Asuming that instead of being the provision for uncollectible accounts on an analysis of receivables the adjusting entry on December 31 been based on an estimated expense of 6 of 15 of the net sales of $18,200,000 for the year, determine the following A Badge for the year 8 Balance in the allowance account after the adjustment of December 31 C. Expected netreble value of the accounts receivable as of December 31 umal A Journalize the transactions Refer to the Chart of Accounts for exact wording of account titles Question not attempted. JOURNAL Score: 0/249 ACCOU DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS 1 2 5 7 A B c 14 16 LT Points May 2 A Journalize the transactions Refer to the Chart of Accounts for exact wording of account titles Aug Question not attempted. Oct PAGE 10 JOURNAL Score: 0/249 ACCOUNTING EQUATION Dec DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Dec & 1. Red B 3. Der ent 4 Ass bee 15 12 11 20 -Accounts 1. Record the January 1 credit balance of $26,000 in a T-account for Allowance for Doubtful Accounts 2. B. Post each entry that affects the following selected T-accounts and determine the new balances: Allowance for Doubtful Aco Bad Debt Expense Allowance for Doubtful Accounts Jan 1 Balance Dec 31 Adj. Balance Bad Debt Expense Points Feedback Check My Work 1 and 2 set up T-accounts Final Questions Final Questions 1 Dumne the expected to the access of December 31(eral of the adjustments and the adjusting entry Chey 3. Remeber that was the mouthped to be collected or realized Tace 4 ming thread of being the power to colectie conto an any of the agusting entry on December 31 had been based on an estimated expense of Nor is of the persons of 18,200,000 for the year, determine the A the years of December 315 uncle