Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NSS, a Canadian public company, entered into the following transactions late in 20X8: Transaction #1: On October 15, NSS purchased inventory from a Mexican

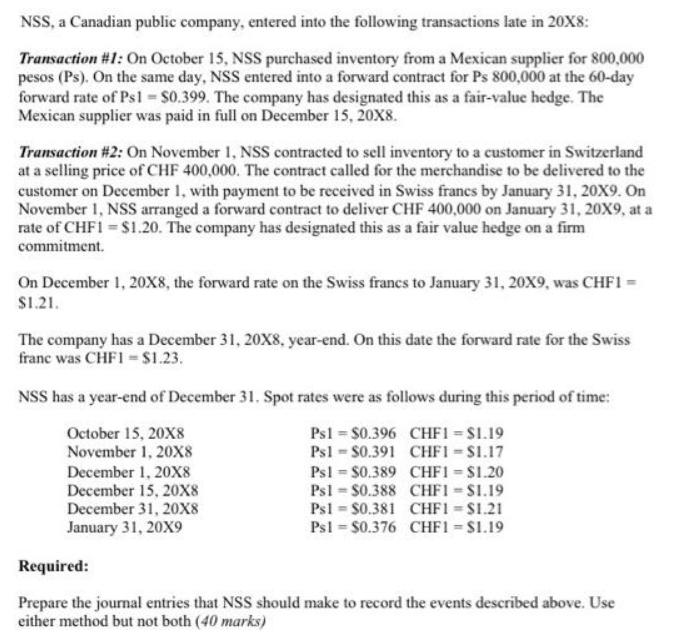

NSS, a Canadian public company, entered into the following transactions late in 20X8: Transaction #1: On October 15, NSS purchased inventory from a Mexican supplier for 800,000 pesos (Ps). On the same day, NSS entered into a forward contract for Ps 800,000 at the 60-day forward rate of Psl = $0.399. The company has designated this as a fair-value hedge. The Mexican supplier was paid in full on December 15, 20X8. Transaction #2: On November 1, NSS contracted to sell inventory to a customer in Switzerland at a selling price of CHF 400,000. The contract called for the merchandise to be delivered to the customer on December 1, with payment to be received in Swiss francs by January 31, 20X9. On November 1, NSS arranged a forward contract to deliver CHF 400,000 on January 31, 20X9, at a rate of CHF1 $1.20. The company has designated this as a fair value hedge on a firm commitment. On December 1, 20x8, the forward rate on the Swiss francs to January 31, 20X9, was CHF1 = $1.21. The company has a December 31, 20X8, year-end. On this date the forward rate for the Swiss franc was CHF1 $1.23. NSS has a year-end of December 31. Spot rates were as follows during this period of time: Ps1 = $0.396 CHF1 = SI.19 Psl - $0.391 CHF1 - S1.17 Psl = $0.389 CHF1 = $1.20 Psl = $0.388 CHFI S1.19 Psl = $0.381 CHF1 = $1.21 Psl = $0.376 CHF1 = S1.19 October 15, 20X8 November 1, 20X8 December 1, 20X8 December 15, 20x8 December 31, 20X8 January 31, 20X9 Required: Prepare the journal entries that NSS should make to record the events described above. Use either method but not both (40 marks)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Forward Contract These contract are created between two parties for buying and selling ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started