Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KINGDOM Ltd imports self-assembly furniture for resale to retailers and direct to the public. During the year ended 31 December 2003 the company's bookkeeper

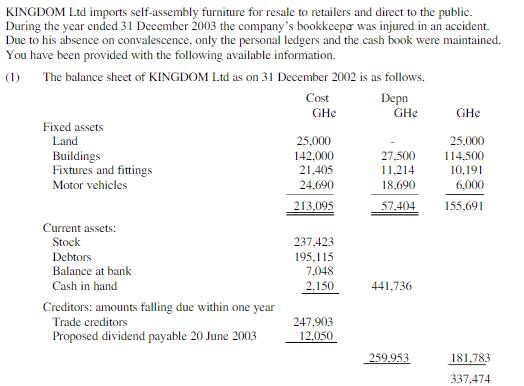

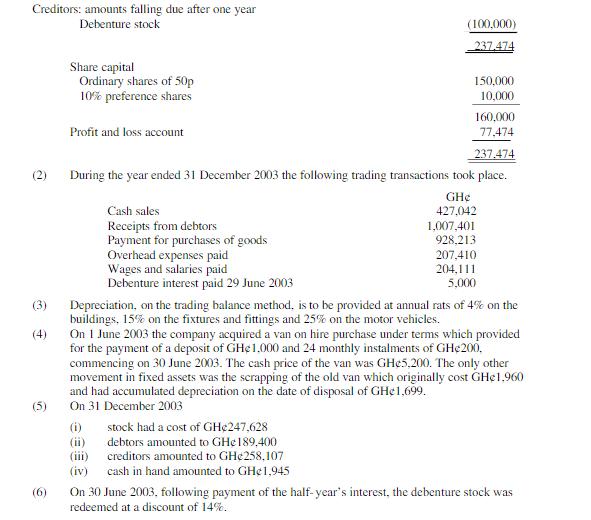

KINGDOM Ltd imports self-assembly furniture for resale to retailers and direct to the public. During the year ended 31 December 2003 the company's bookkeeper was injured in an accident. Due to his absence on convalescence, only the personal ledgers and the cash book were maintained. You have been provided with the following available information. (1) The balance sheet of KINGDOM Ltd as on 31 December 2002 is as follows. Fixed assets Land Buildings Fixtures and fittings Motor vehicles Current assets: Stock Debtors Balance at bank Cash in hand Creditors: amounts falling due within one year Trade creditors Proposed dividend payable 20 June 2003 Cost GH 25,000 142,000 21.405 24,690 213,095 237,423 195,115 7.048 2,150 247,903 12,050 Depn GH 27,500 11.214 18,690 57,404 441,736 259.953 GH 25,000 114.500 10,191 6,000 155,691 181.783 337.474 Creditors: amounts falling due after one year Debenture stock (2) (3) (4) (6) Share capital Ordinary shares of 50p 10% preference shares Profit and loss account 160,000 77,474 237.474 During the year ended 31 December 2003 the following trading transactions took place. GH 427,042 1,007,401 928,213 Cash sales Receipts from debtors Payment for purchases of goods Overhead expenses paid Wages and salaries paid Debenture interest paid 29 June 2003 (100,000) 237.474 150,000 10,000 stock had a cost of GH247,628 debtors amounted to GHe 189,400 creditors amounted to GH258,107 Depreciation, on the trading balance method. is to be provided at annual rats of 4% on the buildings, 15% on the fixtures and fittings and 25% on the motor vehicles. (iii) (iv) cash in hand amounted to GH1,945 207,410 204,111 5,000 On 1 June 2003 the company acquired a van on hire purchase under terms which provided for the payment of a deposit of GH1.000 and 24 monthly instalments of GH200. commencing on 30 June 2003. The cash price of the van was GH5,200. The only other movement in fixed assets was the scrapping of the old van which originally cost GHe1,960 and had accumulated depreciation on the date of disposal of GH1,699. On 31 December 2003 (i) On 30 June 2003, following payment of the half-year's interest, the debenture stock was redeemed at a discount of 14%. The dividend on the preference shares was paid during the year, and a final dividend of 12p per ordinary share is to be provided. Requirements (a) (b) Prepare cash and bank accounts for the year ended 31 December 2003. Prepare the trading and profit and loss account for internal use for the year ended 31 December 2003 giving as much information as possible to management.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a KINGDOM LID Cash and Bank Accounts For the year ended 31 December 2003 2002 2003 Balanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started