Answered step by step

Verified Expert Solution

Question

1 Approved Answer

number 1,7,9,10, and 12 7,9,10,12 I want to know if I did it right, thanks!! IH W Mary www While she has w may be

number 1,7,9,10, and 12

7,9,10,12

I want to know if I did it right, thanks!!

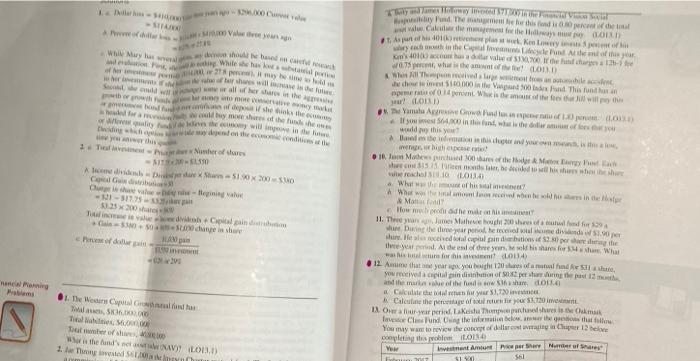

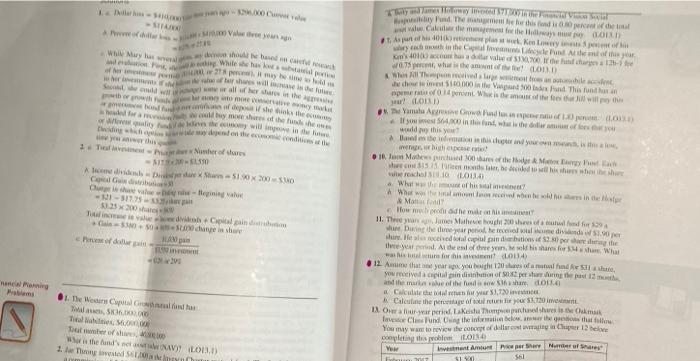

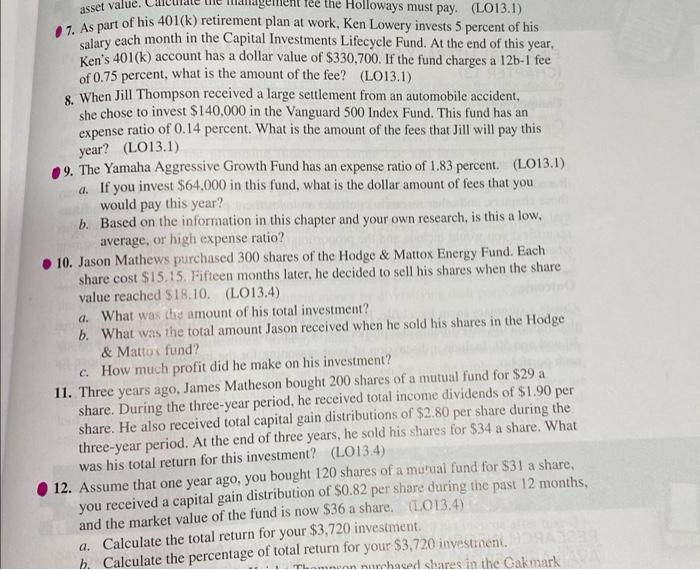

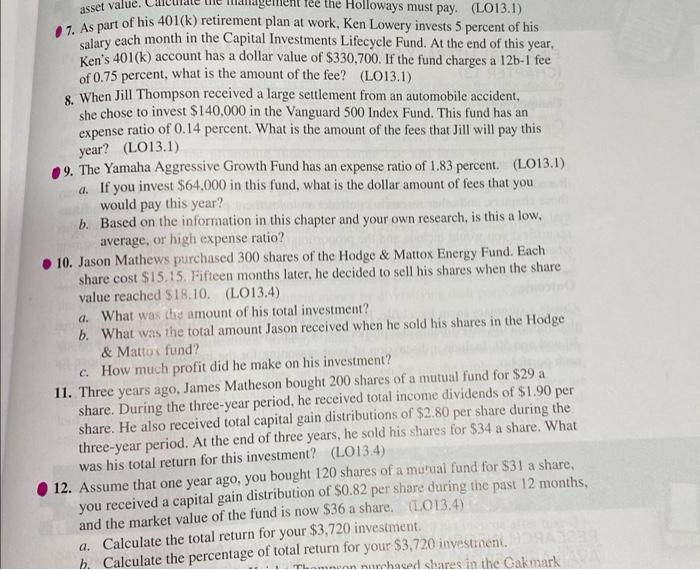

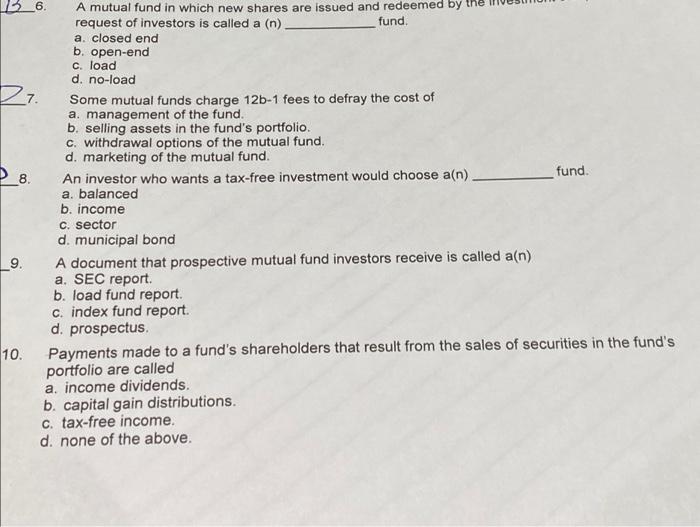

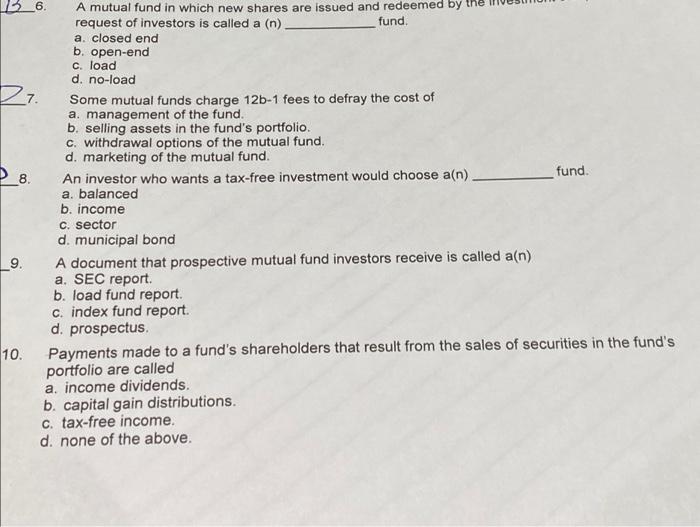

IH W Mary www While she has w may be in ber hehe ww we mv w she is the www.me shohesh e a mi em willinge in the the dead on the TM y nowy dhe me te this and the Calle me feel Autonewal Kesowych wwych the death of 2010. aasta 0.75 pm what the LORD Thrive who in 100 DOO is the indend. This normation. With the (LOID Yamaha Awd (LO formes 564 in what is the one would this yeu Nashers SITO Alice divided 510 x 300 C G Cheng -01-3117 35x20 Toda Coding is l Mathew 00 AM con 51515 doll his show we reacher (2014) What of his time What was recent in the Man How more dhe me 11. The name Muchach 2009 During the prime did. alaralaalalaal piraattaa p be ya Ardent of the years for What une fois it LOLA 12 Anume ant your ago you hoch samlade lite you moved in this pering the past 12 month and the market shared Cultura, Calculate the protagoly 1.720 in 1. Os afour year per Lakes Thumppanfushes Oak laveste lundite inmate where the follow You may want to review de corpo della costru Cher 12 ekme completing this problem Yew Invent Anunt par une of the Sh 1. the Western Cape WS oshi Who is the day (L013.) 1 lid States 5140 asset value. Tee the Holloways must pay. (L013.1) 7. As part of his 401(k) retirement plan at work, Ken Lowery invests 5 percent of his salary each month in the Capital Investments Lifecycle Fund. At the end of this year, Ken's 401(k) account has a dollar value of $330,700. If the fund charges a 126-1 fee of 0.75 percent, what is the amount of the fee? (L013.1) 8. When Jill Thompson received a large settlement from an automobile accident, she chose to invest $140,000 in the Vanguard 500 Index Fund. This fund has an expense ratio of 0.14 percent. What is the amount of the fees that Jill will pay this year? (L013.1) 9. The Yamaha Aggressive Growth Fund has an expense ratio of 1.83 percent. (L013.1) a. If you invest $64,000 in this fund, what is the dollar amount of fees that you would pay this year? b. Based on the information in this chapter and your own research, is this a low, average, or high expense ratio? 10. Jason Mathews purchased 300 shares of the Hodge & Mattox Energy Fund. Each share cost $15.15. Fifteen months later, he decided to sell his shares when the share value reached $18.10. (LO13.4) a. What was the amount of his total investment? b. What was the total amount Jason received when he sold his shares in the Hodge & Mattox fund? c. How much profit did he make on his investment? 11. Three years ago, James Matheson bought 200 shares of a mutual fund for $29 a share. During the three-year period, he received total income dividends of $1.90 per share. He also received total capital gain distributions of $2.80 per share during the three-year period. At the end of three years, he sold his shares for $34 a share. What was his total return for this investment? (L013.4) 12. Assume that one year ago, you bought 120 shares of a mutual fund for $31 a share, you received a capital gain distribution of $0.82 per share during the past 12 months, and the market value of the fund is now $36 a share. (LO13.4) a. Calculate the total return for your $3.720 investment. b. Calculate the percentage of total return for your $3,720 investieni. mamnunn nurhaced shares in the Cakmark 13_6. A mutual fund in which new shares are issued and redeemed by the request of investors is called a (n) fund. a. closed end b. open-end c. load d. no-load 27. Some mutual funds charge 12b-1 fees to defray the cost of a. management of the fund. b. selling assets in the fund's portfolio. c. withdrawal options of the mutual fund. d. marketing of the mutual fund. 8. An investor who wants a tax-free investment would choose a(n) fund. a. balanced b. income c. sector d. municipal bond 9. A document that prospective mutual fund investors receive is called a(n) a. SEC report. b. load fund report c. index fund report. d. prospectus. 10. Payments made to a fund's shareholders that result from the sales of securities in the fund's portfolio are called a. income dividends. b. capital gain distributions. c. tax-free income. d. none of the above. IH W Mary www While she has w may be in ber hehe ww we mv w she is the www.me shohesh e a mi em willinge in the the dead on the TM y nowy dhe me te this and the Calle me feel Autonewal Kesowych wwych the death of 2010. aasta 0.75 pm what the LORD Thrive who in 100 DOO is the indend. This normation. With the (LOID Yamaha Awd (LO formes 564 in what is the one would this yeu Nashers SITO Alice divided 510 x 300 C G Cheng -01-3117 35x20 Toda Coding is l Mathew 00 AM con 51515 doll his show we reacher (2014) What of his time What was recent in the Man How more dhe me 11. The name Muchach 2009 During the prime did. alaralaalalaal piraattaa p be ya Ardent of the years for What une fois it LOLA 12 Anume ant your ago you hoch samlade lite you moved in this pering the past 12 month and the market shared Cultura, Calculate the protagoly 1.720 in 1. Os afour year per Lakes Thumppanfushes Oak laveste lundite inmate where the follow You may want to review de corpo della costru Cher 12 ekme completing this problem Yew Invent Anunt par une of the Sh 1. the Western Cape WS oshi Who is the day (L013.) 1 lid States 5140 asset value. Tee the Holloways must pay. (L013.1) 7. As part of his 401(k) retirement plan at work, Ken Lowery invests 5 percent of his salary each month in the Capital Investments Lifecycle Fund. At the end of this year, Ken's 401(k) account has a dollar value of $330,700. If the fund charges a 126-1 fee of 0.75 percent, what is the amount of the fee? (L013.1) 8. When Jill Thompson received a large settlement from an automobile accident, she chose to invest $140,000 in the Vanguard 500 Index Fund. This fund has an expense ratio of 0.14 percent. What is the amount of the fees that Jill will pay this year? (L013.1) 9. The Yamaha Aggressive Growth Fund has an expense ratio of 1.83 percent. (L013.1) a. If you invest $64,000 in this fund, what is the dollar amount of fees that you would pay this year? b. Based on the information in this chapter and your own research, is this a low, average, or high expense ratio? 10. Jason Mathews purchased 300 shares of the Hodge & Mattox Energy Fund. Each share cost $15.15. Fifteen months later, he decided to sell his shares when the share value reached $18.10. (LO13.4) a. What was the amount of his total investment? b. What was the total amount Jason received when he sold his shares in the Hodge & Mattox fund? c. How much profit did he make on his investment? 11. Three years ago, James Matheson bought 200 shares of a mutual fund for $29 a share. During the three-year period, he received total income dividends of $1.90 per share. He also received total capital gain distributions of $2.80 per share during the three-year period. At the end of three years, he sold his shares for $34 a share. What was his total return for this investment? (L013.4) 12. Assume that one year ago, you bought 120 shares of a mutual fund for $31 a share, you received a capital gain distribution of $0.82 per share during the past 12 months, and the market value of the fund is now $36 a share. (LO13.4) a. Calculate the total return for your $3.720 investment. b. Calculate the percentage of total return for your $3,720 investieni. mamnunn nurhaced shares in the Cakmark 13_6. A mutual fund in which new shares are issued and redeemed by the request of investors is called a (n) fund. a. closed end b. open-end c. load d. no-load 27. Some mutual funds charge 12b-1 fees to defray the cost of a. management of the fund. b. selling assets in the fund's portfolio. c. withdrawal options of the mutual fund. d. marketing of the mutual fund. 8. An investor who wants a tax-free investment would choose a(n) fund. a. balanced b. income c. sector d. municipal bond 9. A document that prospective mutual fund investors receive is called a(n) a. SEC report. b. load fund report c. index fund report. d. prospectus. 10. Payments made to a fund's shareholders that result from the sales of securities in the fund's portfolio are called a. income dividends. b. capital gain distributions. c. tax-free income. d. none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started