Answered step by step

Verified Expert Solution

Question

1 Approved Answer

number 3 answer Worksheet. Put-Call parity Consider the case of European IBM call and put options that have exercise price of $115 and expire in

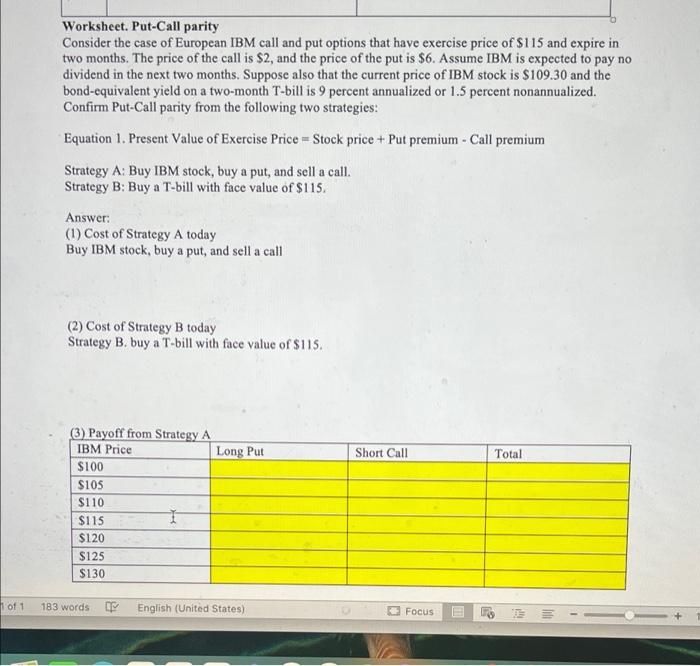

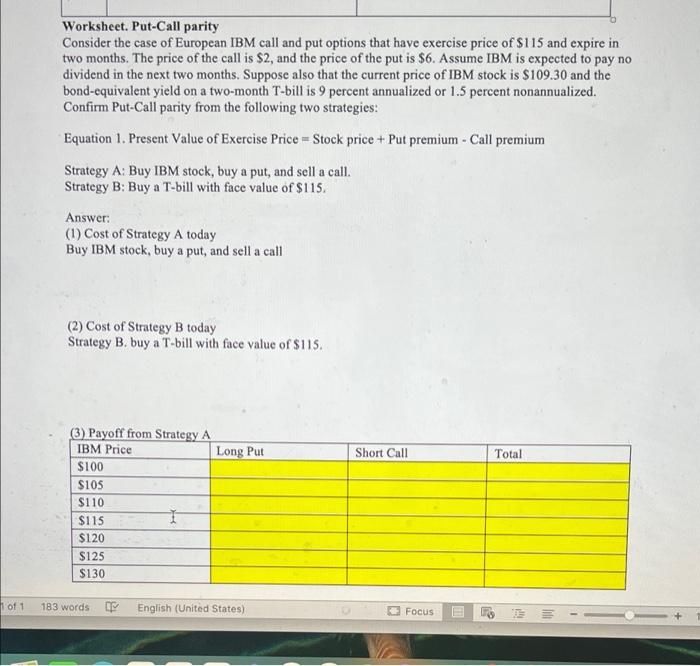

number 3 answer  Worksheet. Put-Call parity Consider the case of European IBM call and put options that have exercise price of $115 and expire in two months. The price of the call is $2, and the price of the put is $6. Assume IBM is expected to pay no dividend in the next two months. Suppose also that the current price of IBM stock is $109.30 and the bond-equivalent yield on a two-month T-bill is 9 percent annualized or 1.5 percent nonannualized. Confirm Put-Call parity from the following two strategies: Equation 1. Present Value of Exercise Price = Stock price + Put premium - Call premium Strategy A: Buy IBM stock, buy a put, and sell a call. Strategy B: Buy a T-bill with face value of $115. Answer: (1) Cost of Strategy A today Buy IBM stock, buy a put, and sell a call (2) Cost of Strategy B today Strategy B. buy a T-bill with face value of $115. Long Put Short Call Total (3) Payoff from Strategy A IBM Price $100 $105 $110 $115 I $120 $125 $130 1 of 1 183 words E English (United States) Focus

Worksheet. Put-Call parity Consider the case of European IBM call and put options that have exercise price of $115 and expire in two months. The price of the call is $2, and the price of the put is $6. Assume IBM is expected to pay no dividend in the next two months. Suppose also that the current price of IBM stock is $109.30 and the bond-equivalent yield on a two-month T-bill is 9 percent annualized or 1.5 percent nonannualized. Confirm Put-Call parity from the following two strategies: Equation 1. Present Value of Exercise Price = Stock price + Put premium - Call premium Strategy A: Buy IBM stock, buy a put, and sell a call. Strategy B: Buy a T-bill with face value of $115. Answer: (1) Cost of Strategy A today Buy IBM stock, buy a put, and sell a call (2) Cost of Strategy B today Strategy B. buy a T-bill with face value of $115. Long Put Short Call Total (3) Payoff from Strategy A IBM Price $100 $105 $110 $115 I $120 $125 $130 1 of 1 183 words E English (United States) Focus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started