Answered step by step

Verified Expert Solution

Question

1 Approved Answer

number 3 Help HW4-1.pdf (1 page) 1. Perpetuities. In exchange for $1000 today, Boston College promises to pay you (and your ancestors) $25 per year

number 3

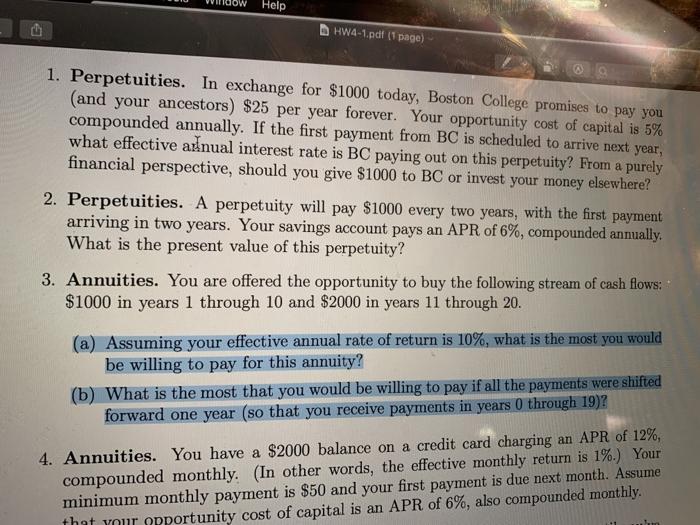

Help HW4-1.pdf (1 page) 1. Perpetuities. In exchange for $1000 today, Boston College promises to pay you (and your ancestors) $25 per year forever. Your opportunity cost of capital is 5% compounded annually. If the first payment from BC is scheduled to arrive next year, what effective anual interest rate is BC paying out on this perpetuity? From a purely financial perspective, should you give $1000 to BC or invest your money elsewhere? 2. Perpetuities. A perpetuity will pay $1000 every two years, with the first payment arriving in two years. Your savings account pays an APR of 6%, compounded annually. What is the present value of this perpetuity? 3. Annuities. You are offered the opportunity to buy the following stream of cash flows: $1000 in years 1 through 10 and $2000 in years 11 through 20. (a) Assuming your effective annual rate of return is 10%, what is the most you would be willing to pay for this annuity? (b) What is the most that you would be willing to pay if all the payments were shifted forward one year (so that you receive payments in years 0 through 19)? 4. Annuities. You have a $2000 balance on a credit card charging an APR of 12%, compounded monthly. (In other words, the effective monthly return is 1%.) Your minimum monthly payment is $50 and your first payment is due next month. Assume that your opportunity cost of capital is an APR of 6%, also compounded monthly Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started