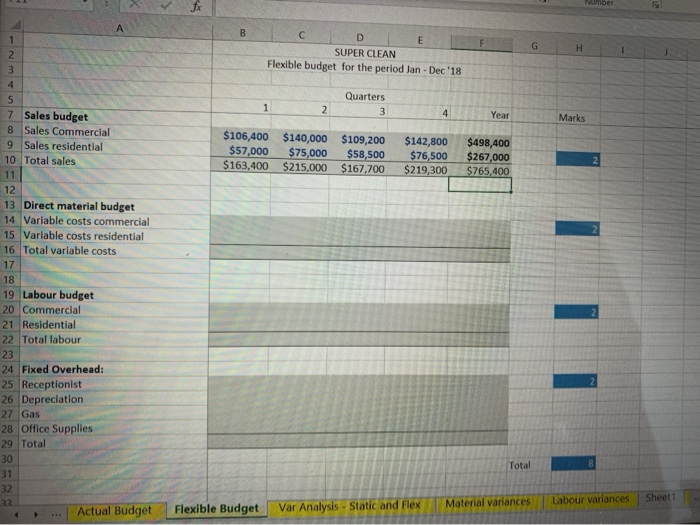

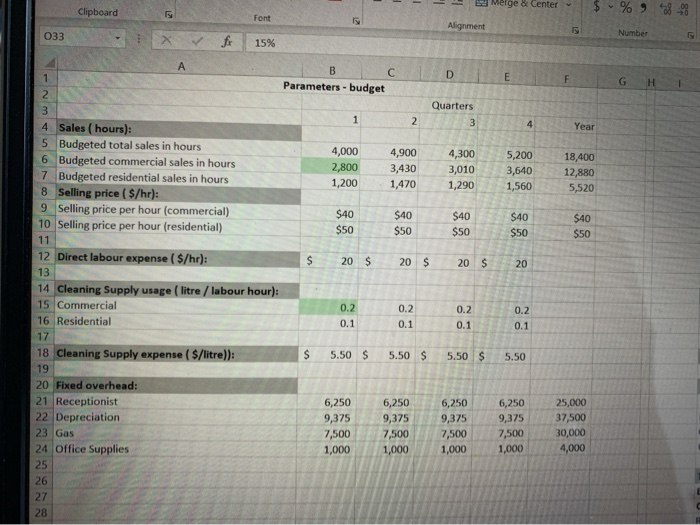

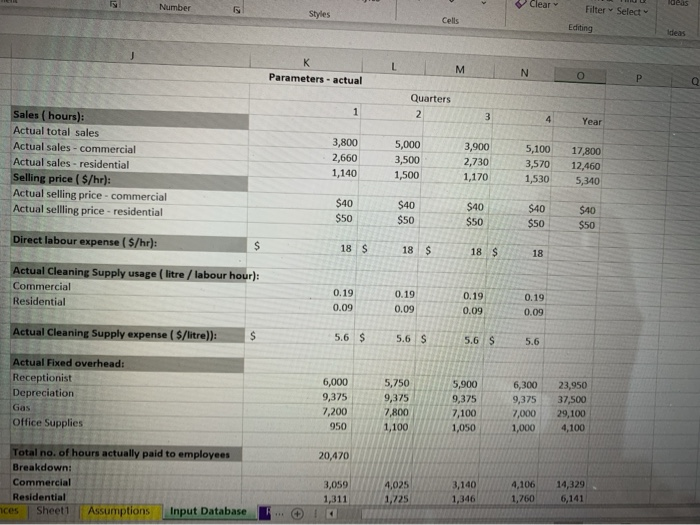

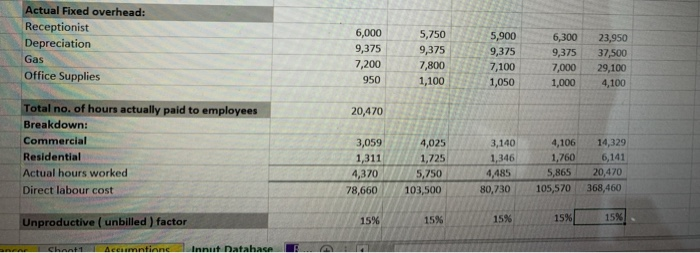

Number B 1 G D E SUPER CLEAN Flexible budget for the period Jan - Dec '18 H 1 Quarters 3 2 4. Year Marks $106,400 $140,000 $109,200 $57,000 $75,000 $58,500 $ 163,400 $215,000 $167,700 $142,800 $76,500 $219,300 $498,400 $267,000 $765,400 2 3 4 5 7 Sales budget 8 Sales Commercial 9 Sales residential 10 Total sales 11 12 13 Direct material budget 14 Variable costs commercial 15 Variable costs residential 16 Total variable costs 17 18 19 Labour budget 20 Commercial 21 Residential 22 Total labour 23 24 Fixed Overhead: 25 Receptionist 26 Depreciation 27 Gas 28 Office Supplies 29 Total 30 31 32 22 Actual Budget Total 8 Sheet1 Material variances Labour variances Flexible Budget Var Analysis - Static and Flex Merge & Center Clipboard $ % 978-98 Font Alignment 033 Number 15% E F G H 4 Year 5,200 3,640 1,560 18,400 12,880 5,520 $40 $50 $40 $50 $ 20 B D Parameters - budget 2 Quarters 3 1 2 3 4 Sales ( hours): 5 Budgeted total sales in hours 4,000 4,900 4,300 6 Budgeted commercial sales in hours 2,800 3,430 3,010 7 Budgeted residential sales in hours 1,200 1,470 1,290 8 Selling price ( $/hr): 9 Selling price per hour (commercial) $40 $40 $40 10 Selling price per hour (residential) $50 $50 $50 11 12 Direct labour expense (S/hr): 20 $ 20 $ 20 S 13 14 Cleaning Supply usage ( litre / labour hour): 15 Commercial 0.2 0.2 0.2 16 Residential 0.1 0.1 0.1 17 18 Cleaning Supply expense (S/litre)); $ 5.50 $ 5.50 $ 5.50 $ 19 20 Fixed overhead: 21 Receptionist 6,250 6,250 6,250 22 Depreciation 9,375 9,375 9,375 23 Gas 7,500 7,500 7,500 24 Office Supplies 1,000 1,000 1,000 25 26 27 28 0.2 0.1 5.50 6,250 9,375 7,500 1,000 25,000 37,500 30,000 4,000 Number Clear deas Filter Select Styles Cells Editing K Parameters - actual L M N O P. a Quarters 2 1 3 4 Year Sales ( hours): Actual total sales Actual sales - commercial Actual sales - residential Selling price ($/hr): Actual selling price-commercial Actual selling price - residential 3,800 2,660 1,140 5,000 3,500 1,500 3,900 2,730 1,170 5,100 3,570 1,530 17,800 12,460 5,340 $40 $50 $40 $50 $40 $50 $40 $50 $40 $50 Direct labour expense ( S/hr): $ 18 S 18 $ 18 $ 18 Actual Cleaning Supply usage ( litre / labour hour): Commercial Residential 0.19 0.09 0.19 0.09 0.19 0.09 0.19 0.09 Actual Cleaning Supply expense ($/litre)): $ 5.6 $ 5.6 S 5.6 S 5.6 Actual Fixed overhead: Receptionist Depreciation Gas Office Supplies 6,000 9,375 7,200 950 5,750 9,375 7,800 1,100 5,900 9,375 7,100 1,050 6,300 9,375 7,000 1,000 23,950 37,500 29,100 4,100 20,470 Total no. of hours actually paid to employees Breakdown: Commercial Residential ces Sheet1 Assumptions Input Database 3,059 1,311 4,025 1,725 3,140 1,346 4,106 1,760 14,329 6,141 Actual Fixed overhead: Receptionist Depreciation Gas Office Supplies 6,000 9,375 7,200 950 5,750 9,375 7,800 1,100 5,900 9,375 7,100 1,050 6,300 9,375 7,000 1,000 23,950 37,500 29,100 4,100 20,470 Total no. of hours actually paid to employees Breakdown: Commercial Residential Actual hours worked Direct labour cost 3,059 1,311 4,370 78,660 4,025 1,725 5,750 103,500 3,140 1,346 4,485 80,730 4,106 1,760 5,865 105,570 14,329 6,141 20,470 368,460 15% Unproductive ( unbilled) factor 15% 15% 15% 15% Chant1 Accounting Innut Database Number B 1 G D E SUPER CLEAN Flexible budget for the period Jan - Dec '18 H 1 Quarters 3 2 4. Year Marks $106,400 $140,000 $109,200 $57,000 $75,000 $58,500 $ 163,400 $215,000 $167,700 $142,800 $76,500 $219,300 $498,400 $267,000 $765,400 2 3 4 5 7 Sales budget 8 Sales Commercial 9 Sales residential 10 Total sales 11 12 13 Direct material budget 14 Variable costs commercial 15 Variable costs residential 16 Total variable costs 17 18 19 Labour budget 20 Commercial 21 Residential 22 Total labour 23 24 Fixed Overhead: 25 Receptionist 26 Depreciation 27 Gas 28 Office Supplies 29 Total 30 31 32 22 Actual Budget Total 8 Sheet1 Material variances Labour variances Flexible Budget Var Analysis - Static and Flex Merge & Center Clipboard $ % 978-98 Font Alignment 033 Number 15% E F G H 4 Year 5,200 3,640 1,560 18,400 12,880 5,520 $40 $50 $40 $50 $ 20 B D Parameters - budget 2 Quarters 3 1 2 3 4 Sales ( hours): 5 Budgeted total sales in hours 4,000 4,900 4,300 6 Budgeted commercial sales in hours 2,800 3,430 3,010 7 Budgeted residential sales in hours 1,200 1,470 1,290 8 Selling price ( $/hr): 9 Selling price per hour (commercial) $40 $40 $40 10 Selling price per hour (residential) $50 $50 $50 11 12 Direct labour expense (S/hr): 20 $ 20 $ 20 S 13 14 Cleaning Supply usage ( litre / labour hour): 15 Commercial 0.2 0.2 0.2 16 Residential 0.1 0.1 0.1 17 18 Cleaning Supply expense (S/litre)); $ 5.50 $ 5.50 $ 5.50 $ 19 20 Fixed overhead: 21 Receptionist 6,250 6,250 6,250 22 Depreciation 9,375 9,375 9,375 23 Gas 7,500 7,500 7,500 24 Office Supplies 1,000 1,000 1,000 25 26 27 28 0.2 0.1 5.50 6,250 9,375 7,500 1,000 25,000 37,500 30,000 4,000 Number Clear deas Filter Select Styles Cells Editing K Parameters - actual L M N O P. a Quarters 2 1 3 4 Year Sales ( hours): Actual total sales Actual sales - commercial Actual sales - residential Selling price ($/hr): Actual selling price-commercial Actual selling price - residential 3,800 2,660 1,140 5,000 3,500 1,500 3,900 2,730 1,170 5,100 3,570 1,530 17,800 12,460 5,340 $40 $50 $40 $50 $40 $50 $40 $50 $40 $50 Direct labour expense ( S/hr): $ 18 S 18 $ 18 $ 18 Actual Cleaning Supply usage ( litre / labour hour): Commercial Residential 0.19 0.09 0.19 0.09 0.19 0.09 0.19 0.09 Actual Cleaning Supply expense ($/litre)): $ 5.6 $ 5.6 S 5.6 S 5.6 Actual Fixed overhead: Receptionist Depreciation Gas Office Supplies 6,000 9,375 7,200 950 5,750 9,375 7,800 1,100 5,900 9,375 7,100 1,050 6,300 9,375 7,000 1,000 23,950 37,500 29,100 4,100 20,470 Total no. of hours actually paid to employees Breakdown: Commercial Residential ces Sheet1 Assumptions Input Database 3,059 1,311 4,025 1,725 3,140 1,346 4,106 1,760 14,329 6,141 Actual Fixed overhead: Receptionist Depreciation Gas Office Supplies 6,000 9,375 7,200 950 5,750 9,375 7,800 1,100 5,900 9,375 7,100 1,050 6,300 9,375 7,000 1,000 23,950 37,500 29,100 4,100 20,470 Total no. of hours actually paid to employees Breakdown: Commercial Residential Actual hours worked Direct labour cost 3,059 1,311 4,370 78,660 4,025 1,725 5,750 103,500 3,140 1,346 4,485 80,730 4,106 1,760 5,865 105,570 14,329 6,141 20,470 368,460 15% Unproductive ( unbilled) factor 15% 15% 15% 15% Chant1 Accounting Innut Database