Answered step by step

Verified Expert Solution

Question

1 Approved Answer

number ii (2) only Question 1: (a) A mining company is planning a new project that will run from 2021 to 2031. The project will

number ii (2) only

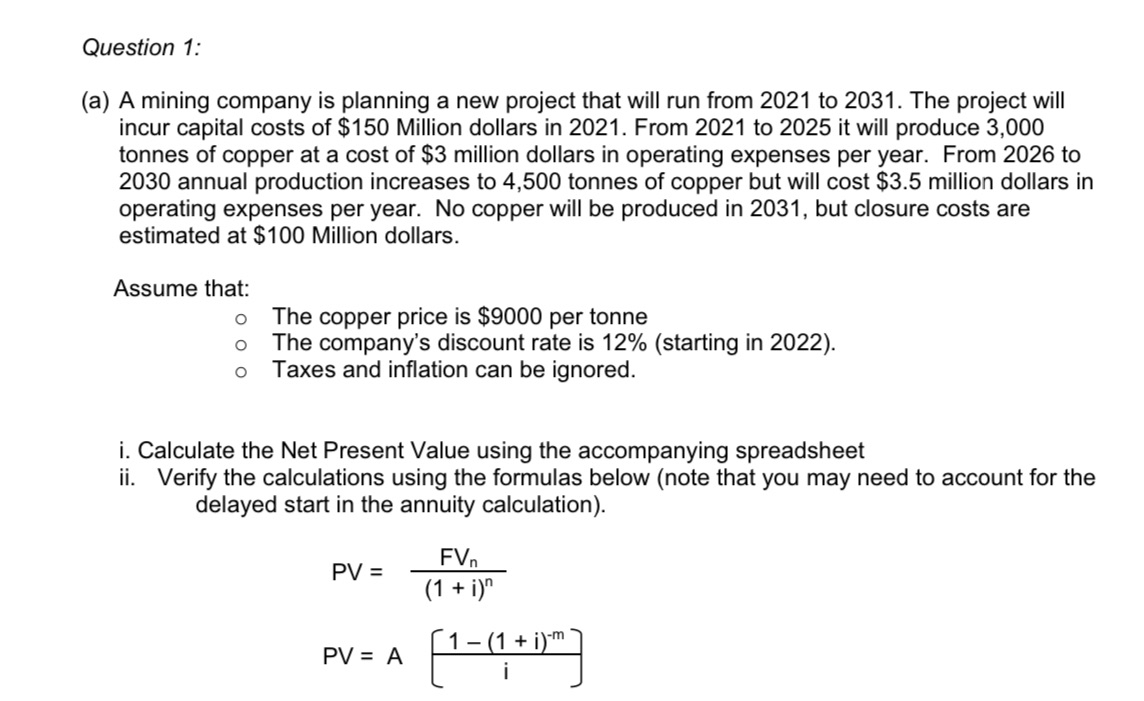

Question 1: (a) A mining company is planning a new project that will run from 2021 to 2031. The project will incur capital costs of $150 Million dollars in 2021. From 2021 to 2025 it will produce 3,000 tonnes of copper at a cost of $3 million dollars in operating expenses per year. From 2026 to 2030 annual production increases to 4,500 tonnes of copper but will cost $3.5 million dollars in operating expenses per year. No copper will be produced in 2031, but closure costs are estimated at $100 Million dollars. Assume that: The copper price is $9000 per tonne The company's discount rate is 12% (starting in 2022). Taxes and inflation can be ignored. i. Calculate the Net Present Value using the accompanying spreadsheet ii. Verify the calculations using the formulas below (note that you may need to account for the delayed start in the annuity calculation). PV = FVn (1 + i)n PV = A - [ 1 (1 + i)m '

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV of the project we need to discount the cash flows to their present value and subtract the initial investment He...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started