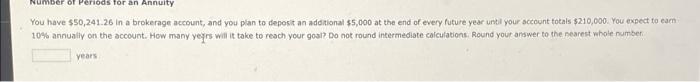

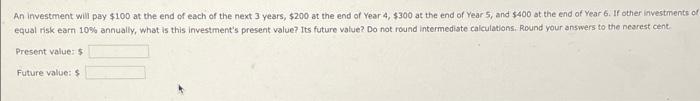

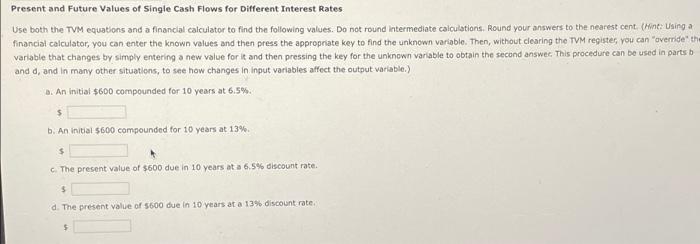

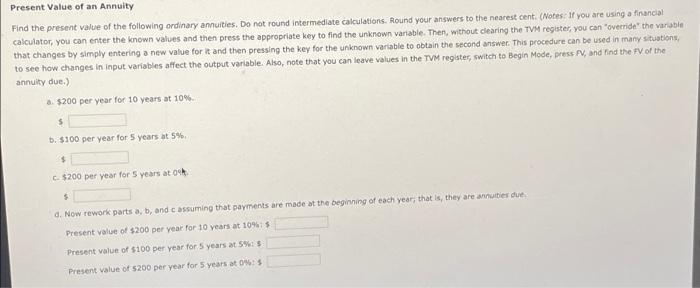

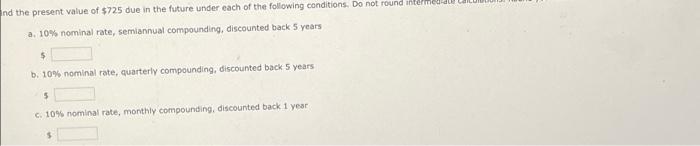

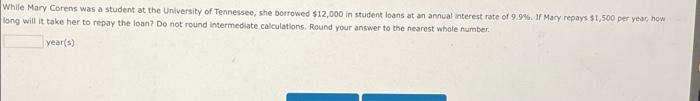

Number of Periods for an Annuity You have $50,241.26 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $210,000. You expect to earn 10% annually on the account. How many years will it take to reach your goal? Do not round intermediate calculations. Round your answer to the nearest whole number years. An investment will pay $100 at the end of each of the next 3 years, $200 at the end of Year 4, $300 at the end of Year 5, and $400 at the end of Year 6. If other investments of equal risk earn 10% annually, what is this investment's present value? Its future value? Do not round intermediate calculations. Round your answers to the nearest cent Present value: $1 Future value: $ Present and Future Values of Single Cash Flows for Different Interest Rates Use both the TVM equations and a financial calculator to find the following values. Do not round intermediate calculations. Round your answers to the nearest cent. (Hint: Using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in parts b and d, and in many other situations, to see how changes in input variables affect the output variable.) a. An initial $600 compounded for 10 years at 6.5%. b. An initial $600 compounded for 10 years at 13%. $ c. The present value of $600 due in 10 years at a 6.5% discount rate. $ d. The present value of $600 due in 10 years at a 13% discount rate.) $ Present Value of an Annuity Find the present value of the following ordinary annuities. Do not round intermediate calculations. Round your answers to the nearest cent. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press PV, and find the FV of the annuity due.) a. $200 per year for 10 years at 10%. $ b. $100 per year for 5 years at 5%. $ c. $200 per year for 5 years at 09. $ d. Now rework parts a, b, and c assuming that payments are made at the beginning of each year, that is, they are annuities due Present value of $200 per year for 10 years at 10%:$ Present value of $100 per year for 5 years at 5%: $ Present value of $200 per year for 5 years at 0%: 5 nd the present value of $725 due in the future under each of the following conditions. Do not round intermedi a. 10% nominal rate, semiannual compounding, discounted back 5 years $ b. 10% nominal rate, quarterly compounding, discounted back 5 years 5 c. 10% nominal rate, monthly compounding, discounted back 1 year While Mary Corens was a student at the University of Tennessee, she borrowed $12,000 in student loans at an annual interest rate of 9.9%. If Mary repays $1,500 per year, how long will it take her to repay the loan? Do not round intermediate calculations. Round your answer to the nearest whole number. year(s)