Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Numbers and headings may not be correct! Went off multiple Chegg questions that were different than each other so please don't copy theirs. Thanks! Newman

Numbers and headings may not be correct! Went off multiple Chegg questions that were different than each other so please don't copy theirs. Thanks!

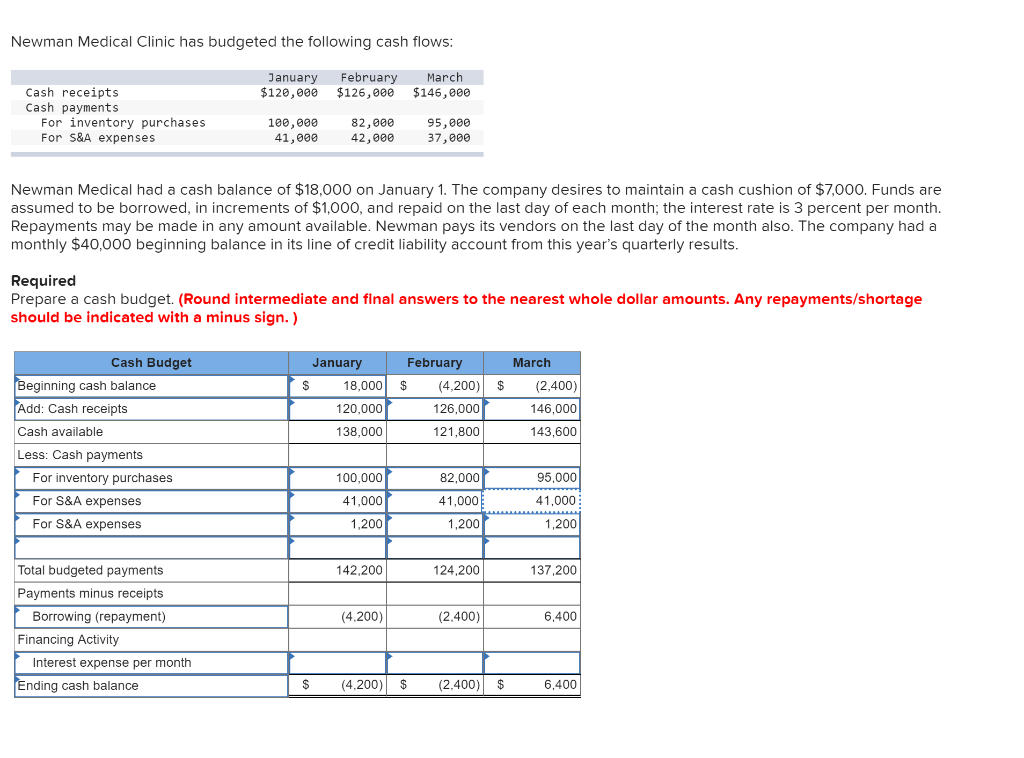

Newman Medical Clinic has budgeted the following cash flows January February March Cash receipts Cash payments $120,000 $126,000 $146,000 For inventory purchases For S&A expenses 100,000 41,000 82,000 42,000 95,000 37,000 Newman Medical had a cash balance of $18,000 on January 1. The company desires to maintain a cash cushion of $7,000. Funds are assumed to be borrowed, in increments of $1,000, and repaid on the last day of each month; the interest rate is 3 percent per month Repayments may be made in any amount available. Newman pays its vendors on the last day of the month also. The company had a monthly $40,000 beginning balance in its line of credit liability account from this year's quarterly results Required Prepare a cash budget. (Round intermediate and final answers to the nearest whole dollar amounts. Any repayments/shortage should be indicated with a minus sign.) Cash Budget January February March eginning cash balance Add: Cash receipts Cash available Less: Cash payments S 18,000 (4,200)(2,400) 146,000 143,600 120,000 126,000 138,000 121,800 For inventory purchases For S&A expenses For S&A expenses 100,000 41,000 1,200 82,000 41,000 1,200 95,000 41,000 1,200 Total budgeted payments Payments minus receipts 142,200 124,200 137,200 (4.200) Borrowing (repayment) Financing Activity (2.400) 6,400 Interest expense per month nding cash balance S (4,200) (2.400)$ 6,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started