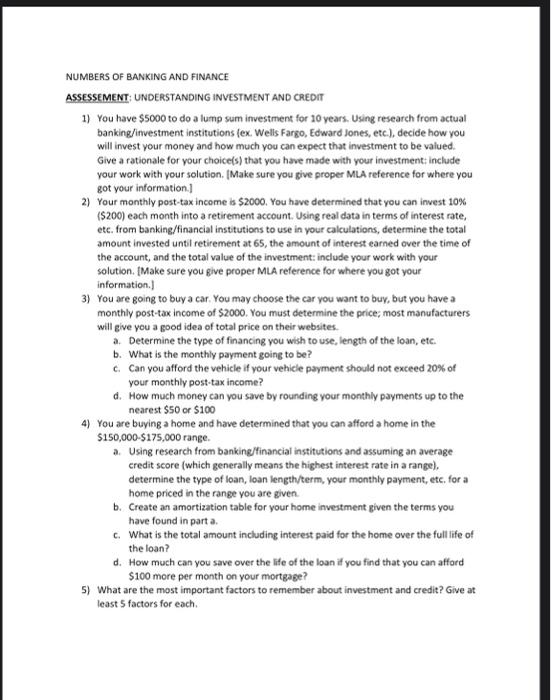

NUMBERS OF BANKING AND FINANCE ASSESSEMENT UNDERSTANDING INVESTMENT AND CREDIT 1) You have $5000 to do a lump sum investment for 10 years. Using research from actual banking/investment institutions (ex. Wells Fargo, Edward Jones, etc.), decide how you will invest your money and how much you can expect that investment to be valued. Give a rationale for your choice(s) that you have made with your investment: include your work with your solution. Make sure you give proper MLA reference for where you got your information 2) Your monthly post-tax income is $2000. You have determined that you can invest 10% ($200) each month into a retirement account. Using real data in terms of interest rate, etc. from banking/financial institutions to use in your calculations, determine the total amount invested until retirement at 65, the amount of interest earned over the time of the account, and the total value of the investment: include your work with your solution. Make sure you give proper MLA reference for where you got your information) 3) You are going to buy a car. You may choose the car you want to buy, but you have a monthly post-tax income of $2000. You must determine the price, most manufacturers will give you a good idea of total price on their websites a. Determine the type of financing you wish to use, length of the loan, etc. b. What is the monthly payment going to be? c. Can you afford the vehicle if your vehicle payment should not exceed 20% of your monthly post-tax income? d. How much money can you save by rounding your monthly payments up to the nearest $50 or $100 4) You are buying a home and have determined that you can afford a home in the $150,000-$175,000 range a. Using research from banking/financial institutions and assuming an average credit score (which generally means the highest interest rate in a range). determine the type of loan, loan length/term, your monthly payment, etc. for a home priced in the range you are given. b. Create an amortization table for your home investment given the terms you have found in part a. c. What is the total amount including interest paid for the home over the full life of the loan? d. How much can you save over the life of the loan if you find that you can afford $100 more per month on your mortgage? 5) What are the most important factors to remember about investment and credit? Give at least 5 factors for each NUMBERS OF BANKING AND FINANCE ASSESSEMENT UNDERSTANDING INVESTMENT AND CREDIT 1) You have $5000 to do a lump sum investment for 10 years. Using research from actual banking/investment institutions (ex. Wells Fargo, Edward Jones, etc.), decide how you will invest your money and how much you can expect that investment to be valued. Give a rationale for your choice(s) that you have made with your investment: include your work with your solution. Make sure you give proper MLA reference for where you got your information 2) Your monthly post-tax income is $2000. You have determined that you can invest 10% ($200) each month into a retirement account. Using real data in terms of interest rate, etc. from banking/financial institutions to use in your calculations, determine the total amount invested until retirement at 65, the amount of interest earned over the time of the account, and the total value of the investment: include your work with your solution. Make sure you give proper MLA reference for where you got your information) 3) You are going to buy a car. You may choose the car you want to buy, but you have a monthly post-tax income of $2000. You must determine the price, most manufacturers will give you a good idea of total price on their websites a. Determine the type of financing you wish to use, length of the loan, etc. b. What is the monthly payment going to be? c. Can you afford the vehicle if your vehicle payment should not exceed 20% of your monthly post-tax income? d. How much money can you save by rounding your monthly payments up to the nearest $50 or $100 4) You are buying a home and have determined that you can afford a home in the $150,000-$175,000 range a. Using research from banking/financial institutions and assuming an average credit score (which generally means the highest interest rate in a range). determine the type of loan, loan length/term, your monthly payment, etc. for a home priced in the range you are given. b. Create an amortization table for your home investment given the terms you have found in part a. c. What is the total amount including interest paid for the home over the full life of the loan? d. How much can you save over the life of the loan if you find that you can afford $100 more per month on your mortgage? 5) What are the most important factors to remember about investment and credit? Give at least 5 factors for each