Answered step by step

Verified Expert Solution

Question

1 Approved Answer

numeric (4) Problem - Growth Opportunities (PVGO) Turkcell is growing at a rate of 6% each year and is projected to keep growing at the

numeric (4)

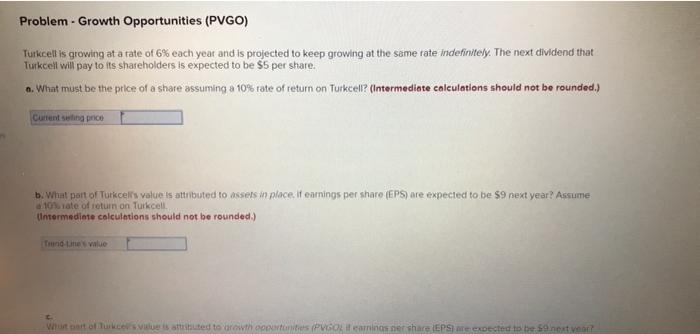

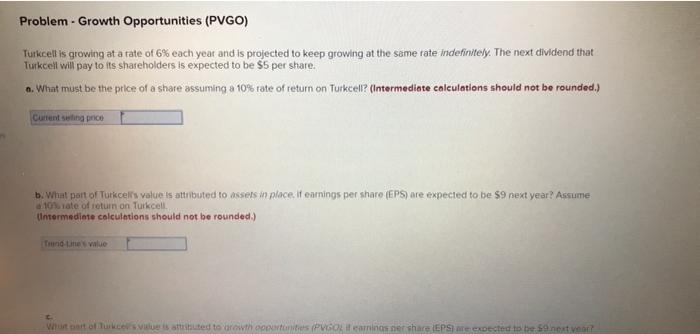

Problem - Growth Opportunities (PVGO) Turkcell is growing at a rate of 6% each year and is projected to keep growing at the same rate indefinitely. The next dividend that Turkcell will pay to its shareholders is expected to be $5 per share. What must be the price of a share assuming a 10% rate of return on Turkcell? (Intermediate calculations should not be rounded.) Current seting price b. What part of Turkcell value is attributed to assets in place it earnings per sharo (EPS) are expected to be $9 pext year? Assume 0.10% rate of return on Turkcell Untermedinte calculations should not be rounded) Thund evalue Wurt of we've is attributed to growth outons ( Potaminas ner share EPS e expected to be 59 next voor b. What part of Turkcell's value is attributed to assets in place. If earnings per share (LPS) are expected to be sent year! a 10% rate of return on Turkcell (Intermediate calculations should not be rounded.) Trend Line's value C. What part of Turkcell's value is attributed to growth opportunities (PVGO), If earnings per share (EPS) are expected to be $9 next year? (Intermediate calculations should not be rounded.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started