Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Numerical Problem Sets (100% in total for all problem sets; the credit allocation is specified next to each problem set (e.g., 10% for problem

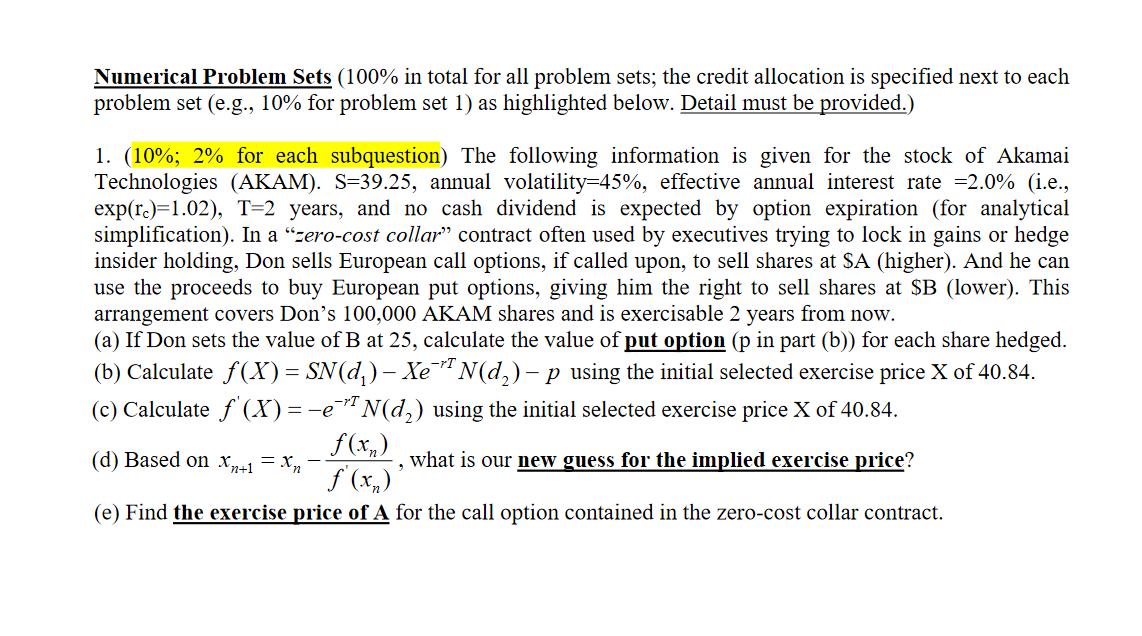

Numerical Problem Sets (100% in total for all problem sets; the credit allocation is specified next to each problem set (e.g., 10% for problem set 1) as highlighted below. Detail must be provided.) 1. (10%; 2% for each subquestion) The following information is given for the stock of Akamai Technologies (AKAM). S-39.25, annual volatility-45%, effective annual interest rate =2.0% (i.e., exp(rc)=1.02), T=2 years, and no cash dividend is expected by option expiration (for analytical simplification). In a "zero-cost collar" contract often used by executives trying to lock in gains or hedge insider holding, Don sells European call options, if called upon, to sell shares at SA (higher). And he can use the proceeds to buy European put options, giving him the right to sell shares at $B (lower). This arrangement covers Don's 100,000 AKAM shares and is exercisable 2 years from now. (a) If Don sets the value of B at 25, calculate the value of put option (p in part (b)) for each share hedged. (b) Calculate f(X) = SN(d) Xe N(d) p using the initial selected exercise price X of 40.84. (c) Calculate f'(X) = -e N(d) using the initial selected exercise price X of 40.84. (d) Based on Xn+1 = Xn ess for the implied exercise price? f(x) f (x) (e) Find the exercise price of A for the call option contained in the zero-cost collar contract. 9 what is our ne

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 10 2 for each subquestion a To calculate the value of the put option p for each share hedged when ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started