Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Numerous variations on the basic design of options have been proposed. These nonstandard options are sometimes called as exotic options. One example is a

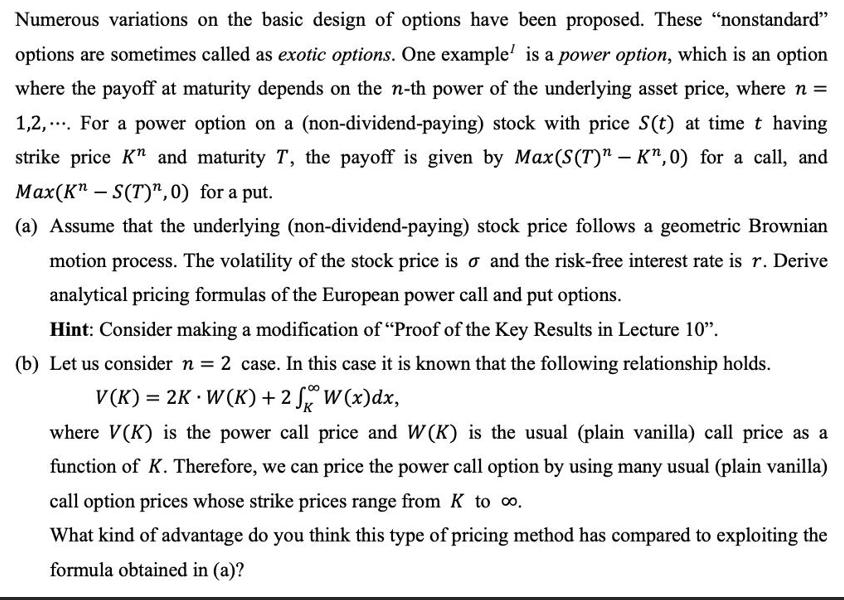

Numerous variations on the basic design of options have been proposed. These "nonstandard" options are sometimes called as exotic options. One example is a power option, which is an option where the payoff at maturity depends on the n-th power of the underlying asset price, where n = 1,2,. For a power option on a (non-dividend-paying) stock with price S(t) at time t having strike price Kn and maturity T, the payoff is given by Max(S(T)" - Kn,0) for a call, and Max(K" S(T)",0) for a put. - (a) Assume that the underlying (non-dividend-paying) stock price follows a geometric Brownian motion process. The volatility of the stock price is and the risk-free interest rate is r. Derive analytical pricing formulas of the European power call and put options. Hint: Consider making a modification of "Proof of the Key Results in Lecture 10". (b) Let us consider n = 2 case. In this case it is known that the following relationship holds. V(K) = 2K W(K) +2 fx W(x)dx, where V(K) is the power call price and W(K) is the usual (plain vanilla) call price as a function of K. Therefore, we can price the power call option by using many usual (plain vanilla) call option prices whose strike prices range from K to o. What kind of advantage do you think this type of pricing method has compared to exploiting the formula obtained in (a)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started