Answered step by step

Verified Expert Solution

Question

1 Approved Answer

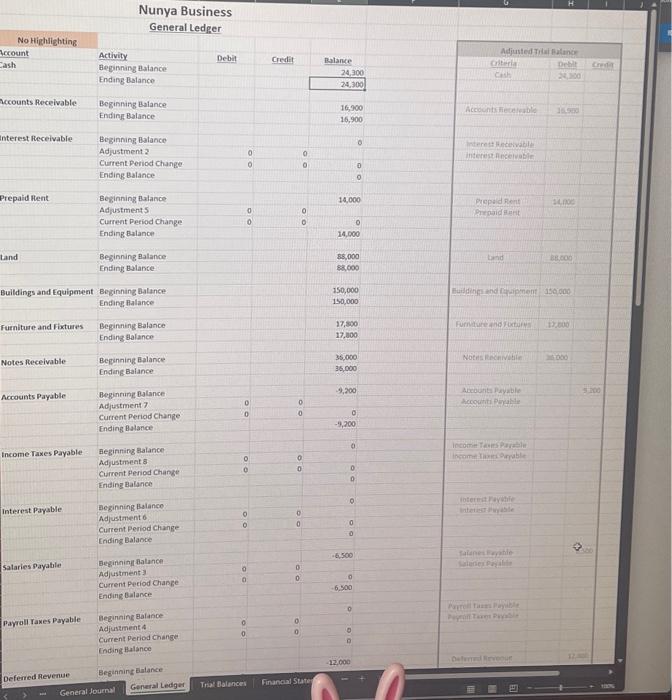

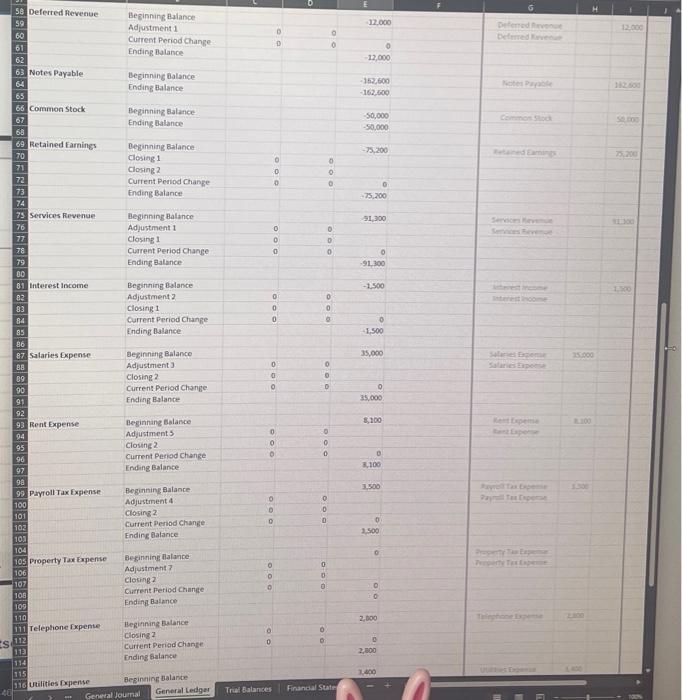

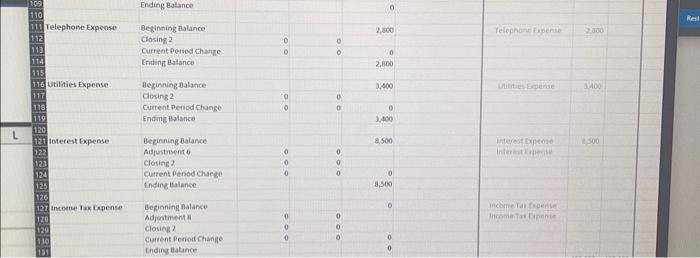

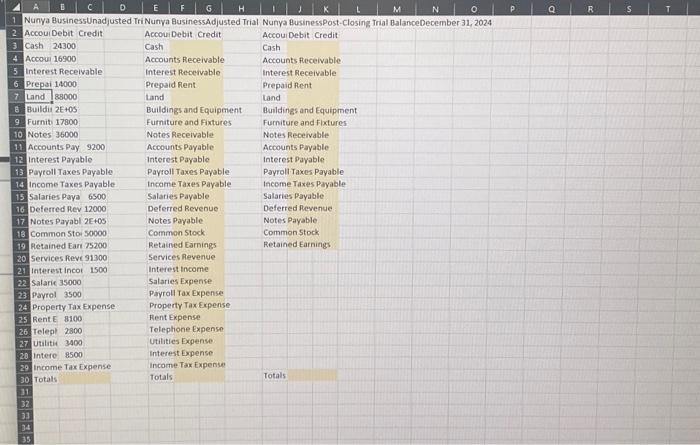

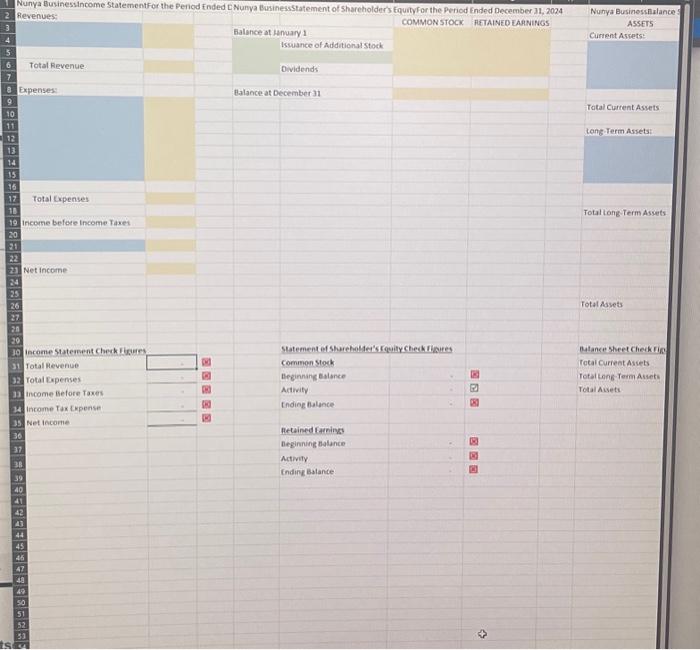

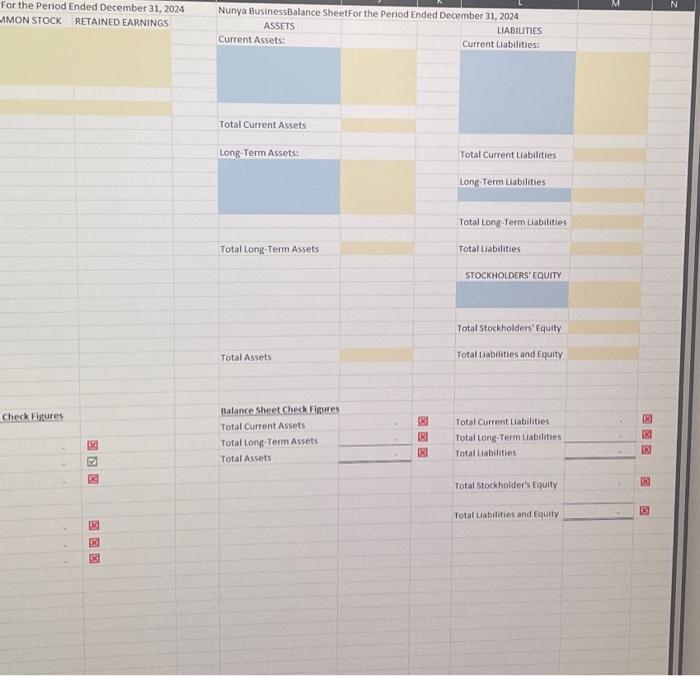

Nunya Business Unadjusted Tri Nunya BusinessAdjusted Trial Nunya BusinessPost-Closing Trial Balance December 31, 2024 Accoui Debit Credit Accoui Debit Credit Accoui Debit Credit Cash Cash

Nunya Business Unadjusted Tri Nunya BusinessAdjusted Trial Nunya BusinessPost-Closing Trial Balance December 31, 2024 Accoui Debit Credit Accoui Debit Credit Accoui Debit Credit Cash Cash 24300 Cash Accoui 16900 Interest Receivable Prepai 14000 Land 88000 Buildin 2E+05 Furnit 17800 Notes 36000 Accounts Pay 9200 Interest Payable Payroll Taxes Payable Income Taxes Payable Salaries Paya 6500 Deferred Rev 12000 Notes Payabl 2E+05 3 Common Sto 50000 9 Retained Eari 75200 Services Reve 91300 1 Interest Inco 1500 2 Salarie 35000 3 Payrol 3500 4 Property Tax Expense 5 Rent E 8100 5 Teleph 2800 7 Utilitie 3400 8 Intere 8500 9 Income Tax Expense 0 Totals 1 Accounts Receivable Interest Receivable Prepaid Rent Land Buildings and Equipment Furniture and Fixtures Notes Receivable Accounts Payable Interest Payable Payroll Taxes Payable Income Taxes Payable Salaries Payable Deferred Revenue Notes Payable Common Stock Retained Earnings Services Revenue Interest Income Salaries Expense Payroll Tax Expense Property Tax Expense Rent Expense Telephone Expense Utilities Expense Interest Expense Income Tax Expense Totals Accounts Receivable Interest Receivable Prepaid Rent Land Buildings and Equipment Furniture and Fixtures Notes Receivable Accounts Payable Interest Payable Payroll Taxes Payable Income Taxes Payable Salaries Payable Deferred Revenue Notes Payable Common Stock Retained Earnings Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started