Answered step by step

Verified Expert Solution

Question

1 Approved Answer

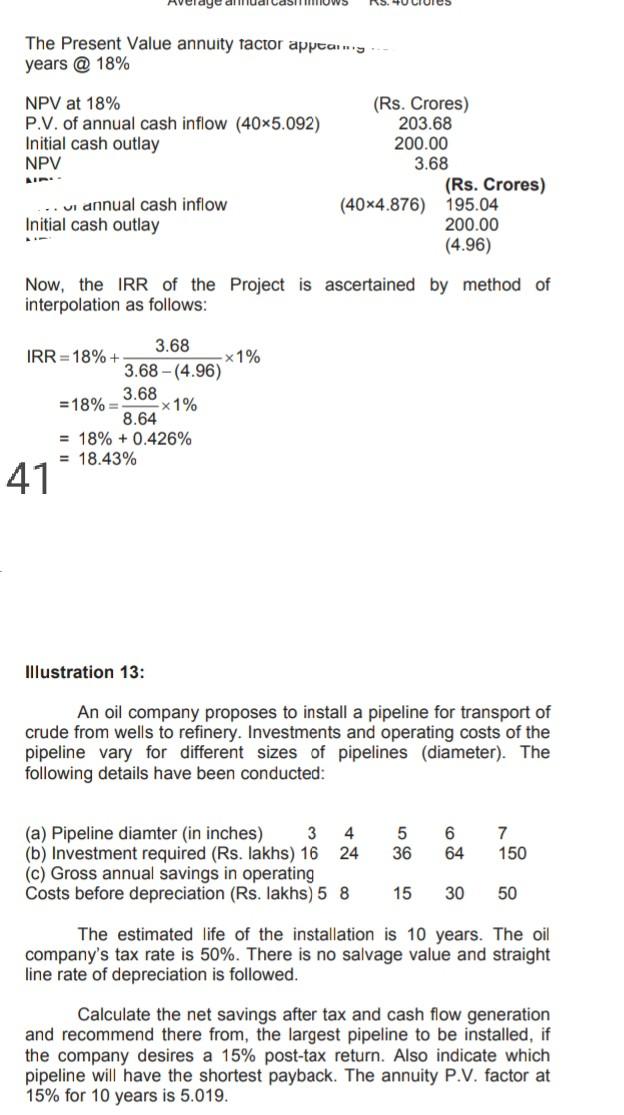

nx HOWE The Present Value annuity factor appeary years @ 18% NPV at 18% P.V. of annual cash inflow (40*5.092) Initial cash outlay NPV (Rs.

nx

HOWE The Present Value annuity factor appeary years @ 18% NPV at 18% P.V. of annual cash inflow (40*5.092) Initial cash outlay NPV (Rs. Crores) 203.68 200.00 3.68 (Rs. Crores) (40x4.876) 195.04 200.00 (4.96) ... vi annual cash inflow Initial cash outlay Now, the IRR of the Project is ascertained by method of interpolation as follows: 3.68 IRR = 18% + X1% 3.68 -(4.96) 3.68 = 18% = x 1% 8.64 = 18% + 0.426% = 18.43% 41 Illustration 13: An oil company proposes to install a pipeline for transport of crude from wells to refinery. Investments and operating costs of the pipeline vary for different sizes of pipelines (diameter). The following details have been conducted: 5 36 6 64 7 150 (a) Pipeline diamter (in inches) 3 4 (b) Investment required (Rs. lakhs) 16 24 (c) Gross annual savings in operating Costs before depreciation (Rs. lakhs) 5 8 15 30 50 The estimated life of the installation is 10 years. The oil company's tax rate is 50%. There is no salvage value and straight line rate of depreciation is followed. Calculate the net savings after tax and cash flow generation and recommend there from, the largest pipeline to be installed, if the company desires a 15% post-tax return. Also indicate which pipeline will have the shortest payback. The annuity P.V. factor at 15% for 10 years is 5.019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started