Question

O: 10/1 - $1,500 rent check cut & mailed to landlord for office 10/3 - $213 Office supplies ordered online using Office Depot credit account

O:

10/1 - $1,500 rent check cut & mailed to landlord for office

10/3 - $213 Office supplies ordered online using Office Depot credit account

10/5 - $5,000 payment received from client/customer for services provided in Oct

10/7 - $2,050 payroll direct deposited to employees

10/15 - $10,000 payment received from client/customer for services provided in Oct

10/22 - $2,050 payroll direct deposited to employees

NOV:

11/2 - $1,500 rent check cut & mailed to landlord for office

11/4 - $6,000 services rendered to client/customer but not yet paid

11/7 - $2,050 payroll direct deposited to employees

11/13 - $45,000 small biz loan obtained (5% APR, 2 years int only, 365 basis)

11/22 - $2,050 payroll direct deposited to employees

11/30 - $3,013 annual business insurance renewed (policy covers Dec - Nov)

DEC:

12/1 - $1,500 rent check cut & mailed to landlord for office

12/7 - $2,050 payroll direct deposited to employees

12/13 - $ interest payment directly debited from bank account for SBL

12/18 - $9,744 cash spent on company holiday party

12/22 - $7,050 payroll direct deposited to employees

12/28 - $5,000 payment received from client/customer for November services

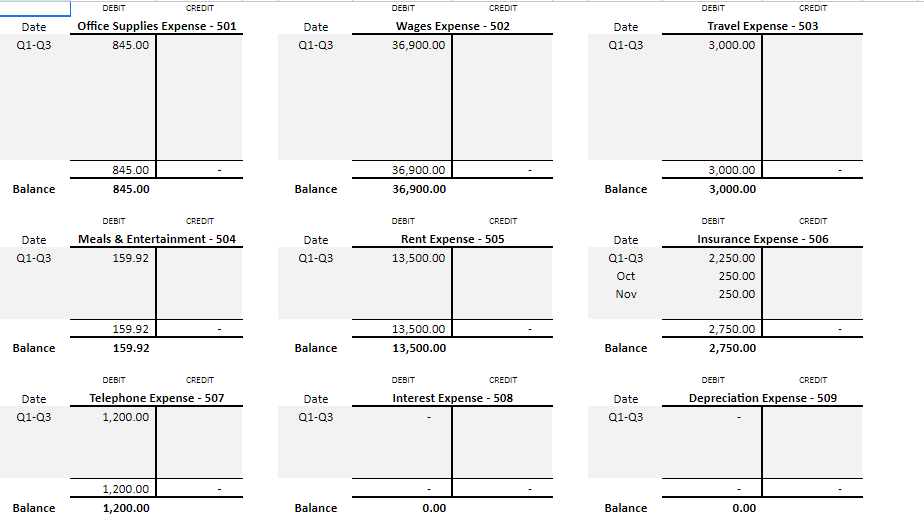

Using this information prepare the T-account for Expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started