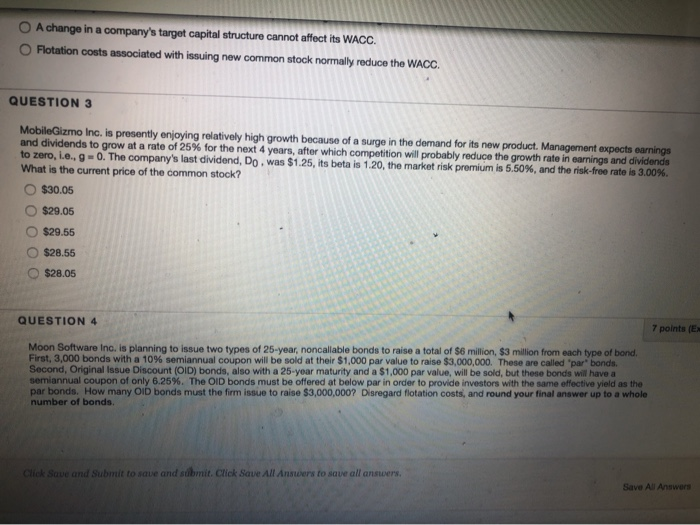

O A change in a company's target capital structure cannot affect its WACC. Flotation costs associated with issuing new common stock normally reduce the WACC. QUESTION 3 Mobile Gizmo Inc. is presently enjoying relatively high growth because of a surge in the demand for its new product Management expects earning and dividends to grow at a rate of 25% for the next 4 years, after which competition will probably reduce the growth rate in earnings and dividenda to zero, L., 9 0. The company's last dividend, Do. was $1.25, its beta is 1.20, the market risk premium is 5.50%, and the risk-free rate is 3.00% What is the current price of the common stock? $30.05 $29.05 $29.56 $28.55 $28.05 7 points (E: QUESTION 4 Moon Software Inc. is planning to issue two types of 25 year, noncallable bonds to raise a total of $6 million $3 million from each type of bond First 3,000 bonds with a 10% semiannual coupon will be sold at their $1,000 par value to raise $3,000,000. These are called "par bonds Second, Original Issue Discount (OID) bonds, also with a 25-year maturity and a $1.000 par value, will be sold, but these bonds will have a semiannual coupon of only 6.25%. The OID bonds must be offered at below par in order to provide investors with the same effective yield as the par bonds. How many OID bonds must the firm issue to raise $3,000,000? Disregard flotation costs, and round your final answer up to a whole number of bonds. Clean and submit to save and submit. Click Save All Answers to save all answers Save As Answers O A change in a company's target capital structure cannot aff Flotation costs associated with issuing new common stock QUESTION 3 MobileGizmo Inc. is presently enjoying relatively high growth beca and dividends to grow at a rate of 25% for the next 4 years, after to zero, i.e., g = 0. The company's last dividend, Do, was $1.25, i What is the current price of the common stock? $30.05 $29.05 $29.55 $28.55 $28.05 QUESTION 4 Moon Software Inc. is planning to issue two types of 25-year, noncalla First, 3,000 bonds with a 10% semiannual coupon will be sold at their Second, Original Issue Discount (OID) bonds, also with a 25-year matu semiannual coupon of only 6.25%. The OID bonds must be offered at par bonds. How many OID bonds must the firm issue to raise $3,000, number of bonds