Answered step by step

Verified Expert Solution

Question

1 Approved Answer

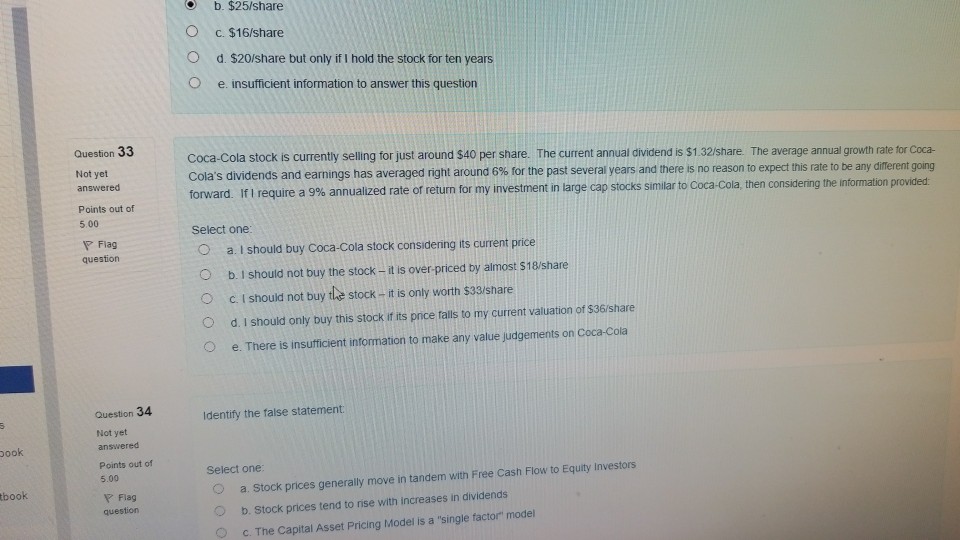

O b. $25/share O c. $16/share O d. $20/share but only if I hold the stock for ten O e insufficient information to answer this

O b. $25/share O c. $16/share O d. $20/share but only if I hold the stock for ten O e insufficient information to answer this question Question 33 Not yet answered Points out of Coca-Cola stock is currently selling for just around $40 per share. The current annual dividend is $1.32/share. The average annual growth rate for Coca- Cola's dividends and earnings has averaged right around 6% for the past several years and there is no reason to expect this rate to be any di erent gong forward. If I req ure a 9% annualized rate or return for my investment in large cap stocks similar to Coca-Cola, then considering the information provided Select one: Flag question 0 a. I should buy Coca-Cola stock considering its current price O b. I should not buy the stock-it is over-priced by almost S18/share C. [ should not buy tle stock-it is only worth $33/share Od. I should only buy this stock if ts pnce tails to my current valuation of $36/share O e. There is insufficient information to make any value judgements on Coca-Cola Question 34 Not yet Identify the false statement ook Points out of 5.00 Select one O a. Stock prices generally move in tandem with Free Cash Flow to Equity Investors O b. Stock prices tend to nse with increases in dividends O c. The Capital Asset Pricing Model is a 'single factor model tbook Flag

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started