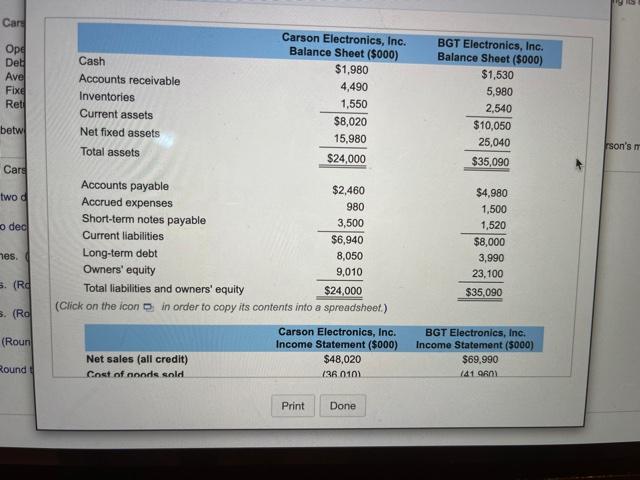

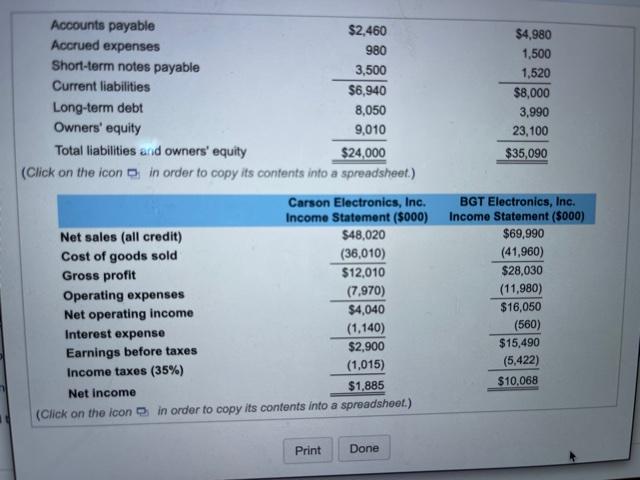

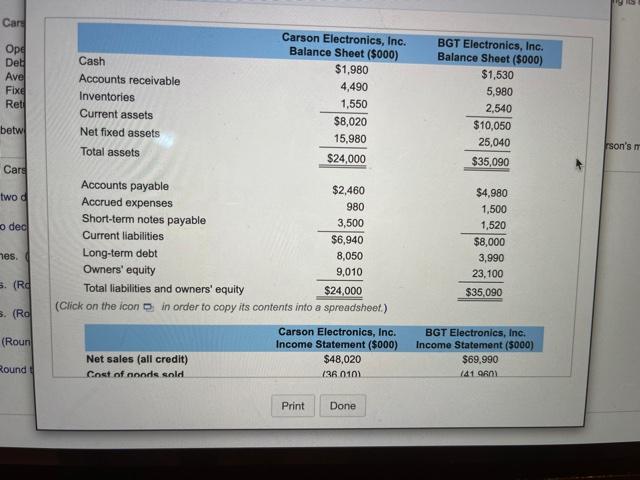

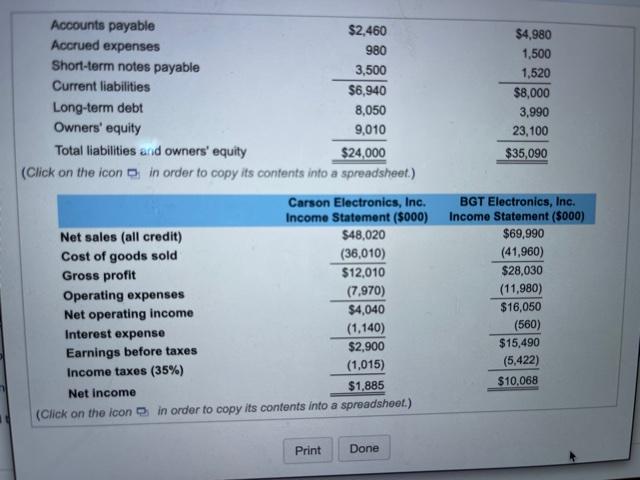

o (Financial statement analysh) Carson Electronice management has long viewed BGT Electronics as an industry leader and then this fm as a model fim for analyzing its own performance. The balance sheets we income struments for the two Toms are found here Calculate the following motos for both Carson and BGT Currento Operating robum on assets Times interesteamed Det ratio Inventory turnover Average collection period Total se bumover Fred turnover Operating profit margin Return on equily b. Analyze the differences you observe between the two firme. Comment on what you view as weaknesses in the performance of Carson compared to BOT that Canon's management might focus on to improves operations a Calculate the following rotice for both Carson and BGT Carson's current tio is Round to two decimal places) DOT's current to Round to two decimal places Carson's times interested is ties. Round to two decimal places BGT times inheresteamed Road to two decimal places) Carson's inventory tumour times. (Round to two decimal places BGT Inventory turnover is times. (Round to two decimal places Caruce's toteutettumover isRound to two decimal places) Click to select your work MacBook Air S RO * 3 & 7 0. 9 3 0 4 6 5 KTET P U T 0 Carl Opd Det Ave Fixe Ret Cash Accounts receivable Inventories Current assets Net fixed assets Total assets Carson Electronics, Inc. Balance Sheet($000) $1,980 4,490 1,550 $8,020 15,980 $24,000 BGT Electronics, Inc. Balance Sheet (5000) $1,530 5,980 2,540 $10,050 25,040 betw rson's $35,090 Cars two d o decl $4.980 1,500 1,520 $8,000 3,990 23,100 $35,090 hes Accounts payable $2,460 Accrued expenses 980 Short-term notes payable 3,500 Current liabilities $6,940 Long-term debt 8,050 Owners' equity 9,010 Total liabilities and owners' equity $24,000 (Click on the icon in order to copy its contents into a spreadsheet.) Carson Electronics, Inc. Income Statement ($000) Net sales (all credit) $48,020 Cost of nonde sold 136 0101 5. (Rd 3. (Rol (Roun BGT Electronics, Inc. Income Statement (5000) $69.990 141 001 Round Print Done $4.980 1,500 1,520 $8,000 3,990 23,100 $35,090 Accounts payable $2,460 Accrued expenses 980 Short-term notes payable 3,500 Current liabilities $6,940 Long-term debt 8,050 Owners' equity 9,010 Total liabilities and owners' equity $24,000 (Click on the icon in order to copy its contents into a spreadsheet.) Carson Electronics, Inc. Income Statement (5000) Net sales (all credit) $48,020 Cost of goods sold (36,010) Gross profit $12,010 Operating expenses (7,970) Net operating income $4,040 Interest expense (1,140) $2,900 Earnings before taxes Income taxes (35%) (1,015) $1.885 Net Income (Click on the icon in order to copy its contents into a spreadsheet.) BGT Electronics, Inc. Income Statement (5000) $69,990 (41,960) $28,030 (11,980) $16,050 (560) $15,490 (5,422) $10.068 Print Done