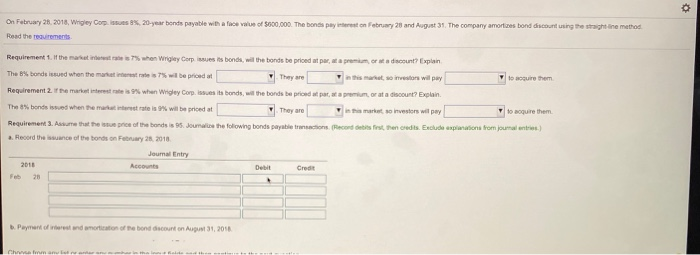

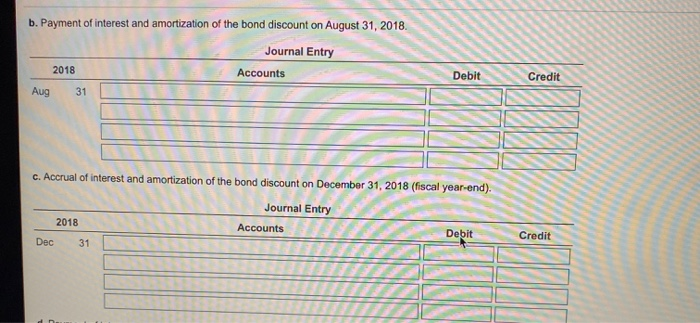

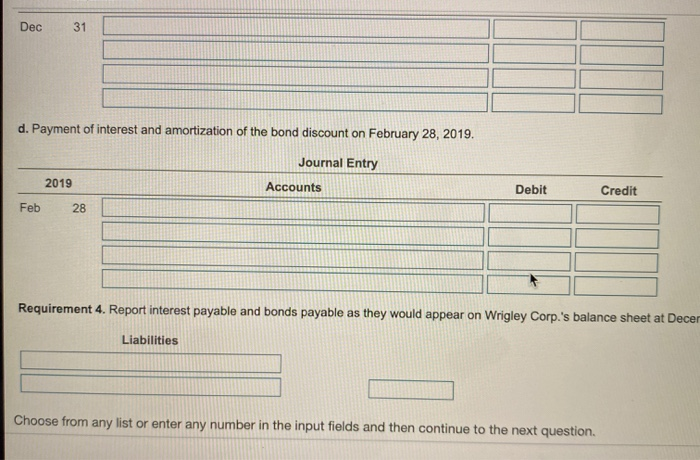

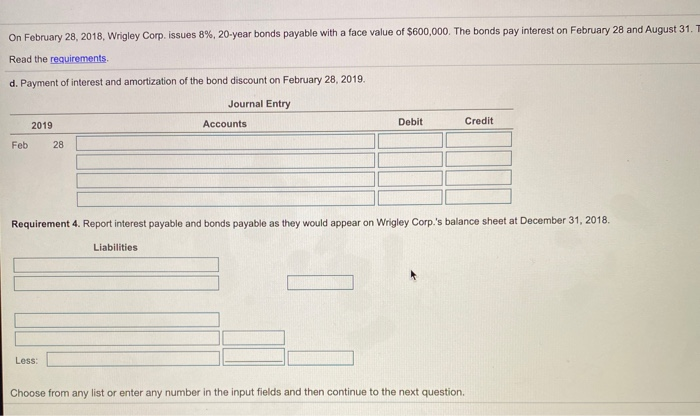

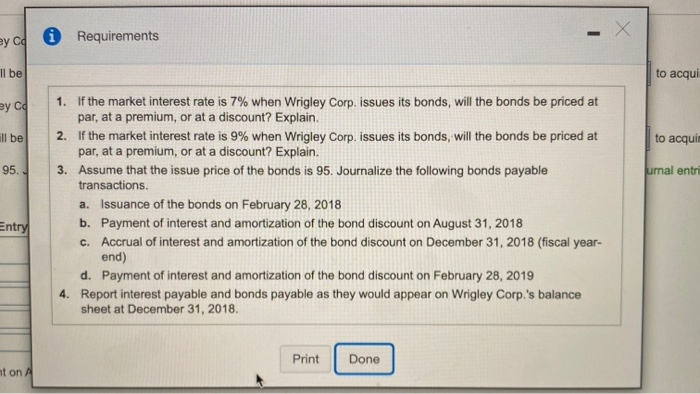

o On February 28, 2018 Wrigley Cops%. 20-year bonds payable with a face value of $600,000. The bond payment on February 28 and August 31. The company amortizes bond discounting the straight line method Read the requirements Requirement 1. if the matter when Wrigley Corp issues its bonds will the bonds be prioed at pa, a premium or a discount? Explain The 8% bonds issued when the market rates will be priced at in this man, so investors will pay Yoguire them Requirement 2. The market interest rate when Wrigley Corp. is its bonds, wil the bonds be priced at para a premium or at a discount? Explain The 3% bonds wed when the market rates will be priced at They are in het so investors will pay to boquire them Requirements. Assume that these price of the bonds is 95. Jounalise the following bonds payable transactions Reconets first, the credits. Exclude explains from ournal Record the sunce of the bonds on February 28, 2018 Joumal Entry 2010 Accounts Debit Credit Feb 28 b. Payment of read more of the bond discount on August 31, 2016 Chat b. Payment of interest and amortization of the bond discount on August 31, 2018 Journal Entry 2018 Accounts Debit Credit Aug 31 c. Accrual of interest and amortization of the bond discount on December 31, 2018 (fiscal year-end). Journal Entry 2018 Accounts Debit Credit Dec 31 Dec 31 d. Payment of interest and amortization of the bond discount on February 28, 2019. Journal Entry 2019 Accounts Debit Credit Feb 28 Requirement 4. Report interest payable and bonds payable as they would appear on Wrigley Corp.'s balance sheet at Decer Liabilities Choose from any list or enter any number in the input fields and then continue to the next question, On February 28, 2018, Wrigley Corp. issues 8%, 20-year bonds payable with a face value of $600,000. The bonds pay interest on February 28 and August 31. Read the requirements d. Payment of interest and amortization of the bond discount on February 28, 2019 Journal Entry Accounts 2019 Debit Credit Feb 28 Requirement 4. Report interest payable and bonds payable as they would appear on Wrigley Corp.'s balance sheet at December 31, 2018 Liabilities Less: Choose from any list or enter any number in the input fields and then continue to the next question. ey co i Requirements Il be to acqui ey co ill be to acquir 95. urnal entri 1. If the market interest rate is 7% when Wrigley Corp. issues its bonds, will the bonds be priced at par, at a premium, or at a discount? Explain. 2. If the market interest rate is 9% when Wrigley Corp. issues its bonds, will the bonds be priced at par, at a premium, or at a discount? Explain. 3. Assume that the issue price of the bonds is 95. Journalize the following bonds payable transactions. a. Issuance of the bonds on February 28, 2018 b. Payment of interest and amortization of the bond discount on August 31, 2018 C. Accrual of interest and amortization of the bond discount on December 31, 2018 (fiscal year- end) d. Payment of interest and amortization of the bond discount on February 28, 2019 4. Report interest payable and bonds payable as they would appear on Wrigley Corp.'s balance sheet at December 31, 2018. Entry Print Done it on A