Question

Assume that the arbitrager can borrow $1,000,000 (833,333 euros (-$1,000,000/1.20) at the current spot exchange rate. One-year interest rate in the U.S. = 4%

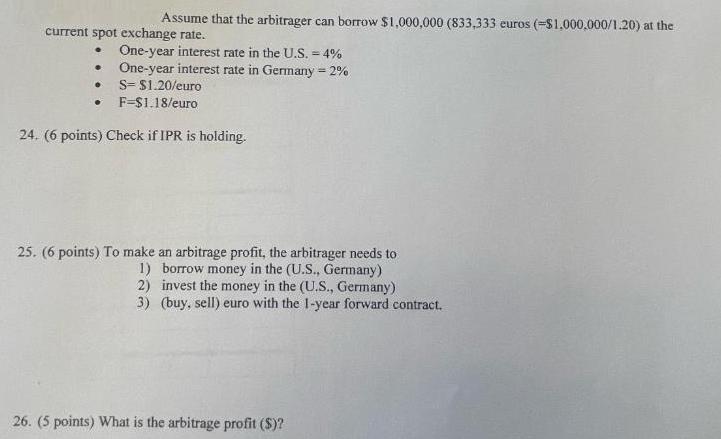

Assume that the arbitrager can borrow $1,000,000 (833,333 euros (-$1,000,000/1.20) at the current spot exchange rate. One-year interest rate in the U.S. = 4% . One-year interest rate in Germany = 2% S= $1.20/euro F=$1.18/euro 24. (6 points) Check if IPR is holding. . 25. (6 points) To make an arbitrage profit, the arbitrager needs to 1) borrow money in the (U.S., Germany) invest the money in the (U.S., Germany) 2) 3) (buy, sell) euro with the 1-year forward contract. 26. (5 points) What is the arbitrage profit ($)?

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

24 Interest rate parity IRP states that the difference between the interest rates in two countries s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Economics

Authors: Robert C. Feenstra, Alan M. Taylor

5th Edition

1319218504, 9781319218508

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App