Question: Avicenna, a major insurance company, offers five-year life insurance policies to 65-year-olds. If the holder of one of these policies dies before the age

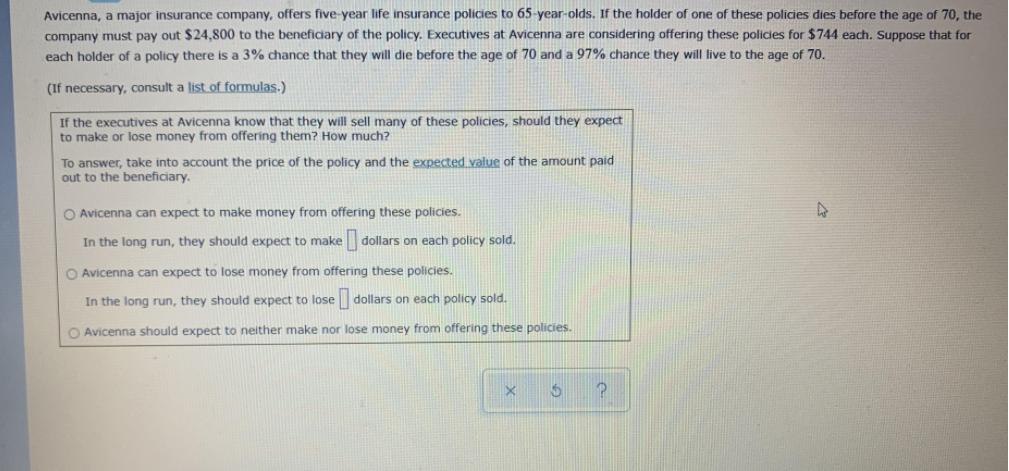

Avicenna, a major insurance company, offers five-year life insurance policies to 65-year-olds. If the holder of one of these policies dies before the age of 70, the company must pay out $24,800 to the beneficiary of the policy. Executives at Avicenna are considering offering these policies for $744 each. Suppose that for each holder of a policy there is a 3% chance that they will die before the age of 70 and a 97% chance they will live to the age of 70. (If necessary, consult a list of formulas.) If the executives at Avicenna know that they will sell many of these policies, should they expect to make or lose money from offering them? How much? To answer, take into account the price of the policy and the expected value of the amount paid out to the beneficiary. O Avicenna can expect to make money from offering these policies. In the long run, they should expect to make dollars on each policy sold. O Avicenna can expect to lose money from offering these policies. In the long run, they should expect to lose dollars on each policy sold. O Avicenna should expect to neither make nor lose money from offering these policies.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts