Answered step by step

Verified Expert Solution

Question

1 Approved Answer

o Suppose Roasted Pepper restaurant is considering whether to (1) bake bread for its restaurant in-house or (2) buy the bread from a local bakery.

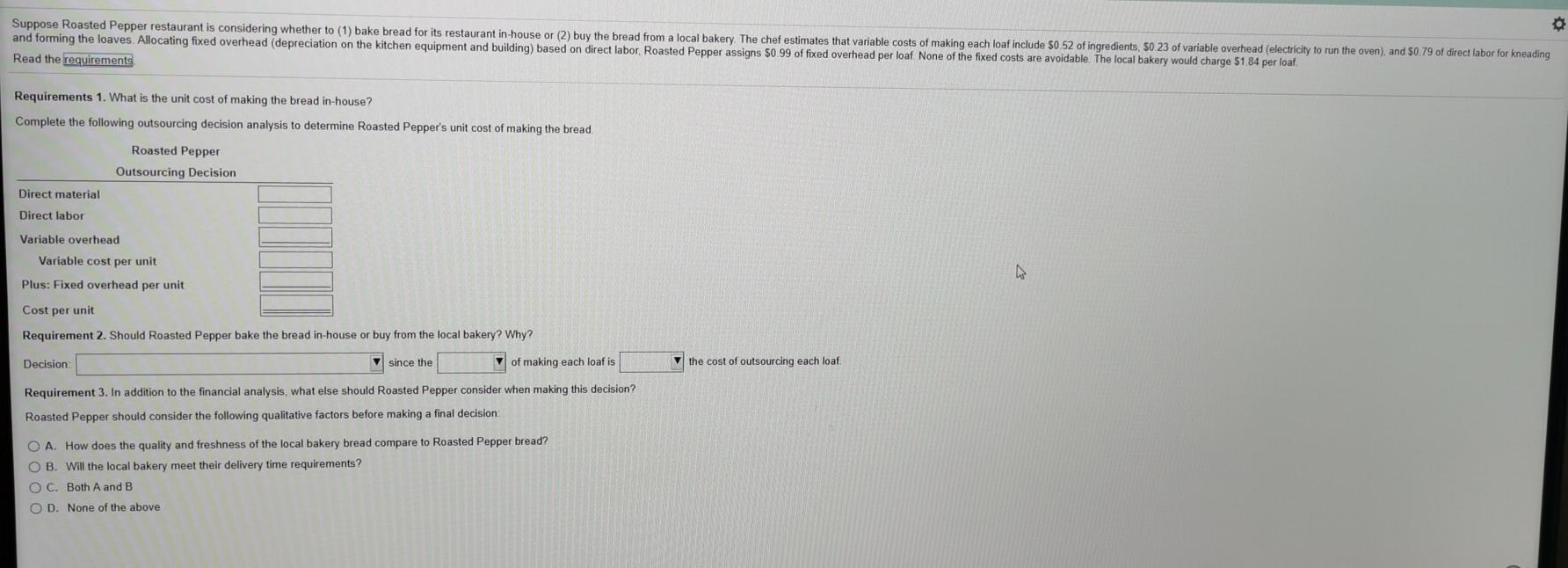

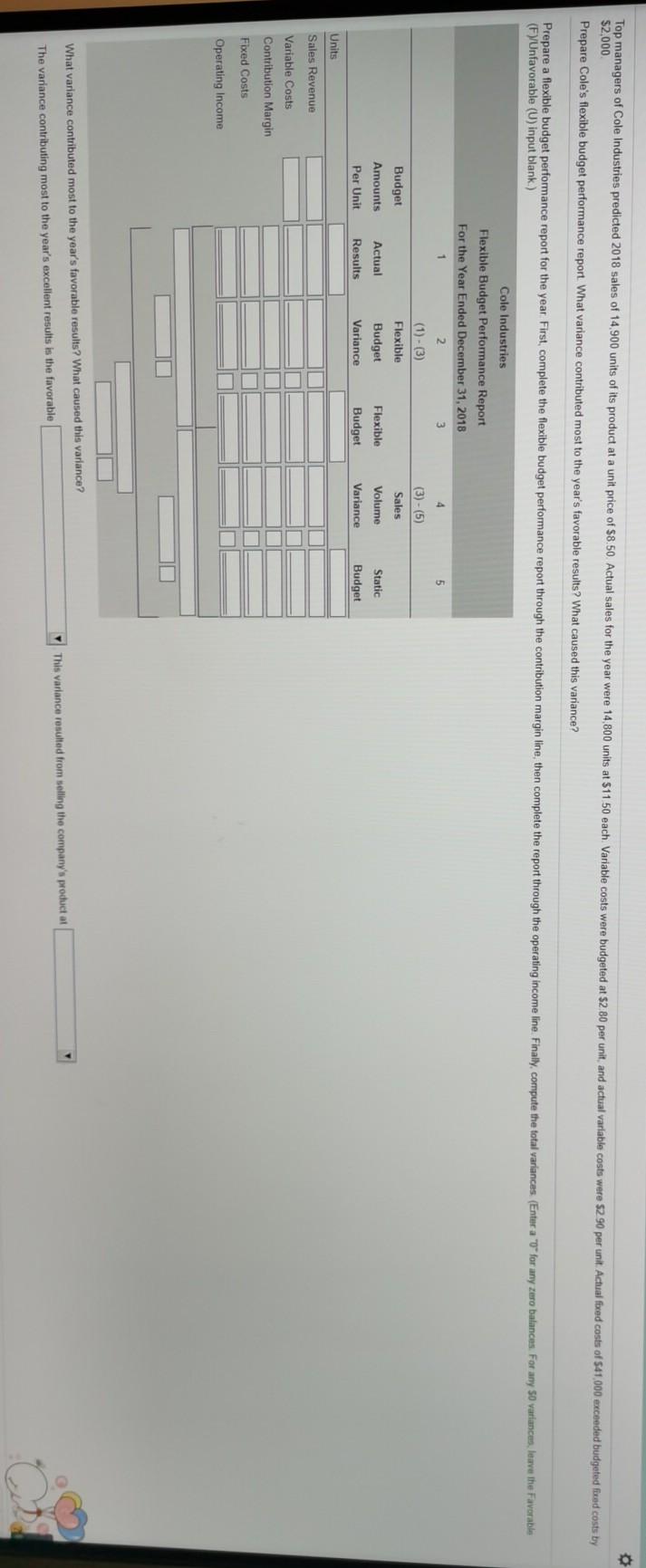

o Suppose Roasted Pepper restaurant is considering whether to (1) bake bread for its restaurant in-house or (2) buy the bread from a local bakery. The chef estimates that variable costs of making each loaf include $0.52 of ingredients, 50 23 of variable overhead (electricity to run the oven), and 50.79 of direct labor for kneading and forming the loaves. Allocating fixed overhead (depreciation on the kitchen equipment and building) based on direct labor, Roasted Pepper assigns $0.99 of fixed overhead per loaf. None of the fixed costs are avoidable. The local bakery would charge 51.84 per loaf Read the requirements Requirements 1. What is the unit cost of making the bread in-house? Complete the following outsourcing decision analysis to determine Roasted Pepper's unit cost of making the bread Roasted Pepper Outsourcing Decision Direct material Direct labor Variable overhead Variable cost per unit Plus: Fixed overhead per unit Cost per unit Requirement 2. Should Roasted Pepper bake the bread in-house or buy from the local bakery? Why? Decision since the of making each loaf is the cost of outsourcing each loaf Requirement 3. In addition to the financial analysis, what else should Roasted Pepper consider when making this decision? Roasted Pepper should consider the following qualitative factors before making a final decision O A. How does the quality and freshness of the local bakery bread compare to Roasted Pepper bread? OB. Will the local bakery meet their delivery time requirements? O C. Both A and B OD. None of the above Top managers of Cole Industries predicted 2018 sales of 14.900 units of its product at a unit price of $8.50 Actual sales for the year were 14,800 units at $1150 each Variable costs were budgeted at 52. 80 per unit and actual variable costs were 52 90 per unit. Actual fred costs of 541,000 exceeded budgeted fixed costs by $2,000 Prepare Cole's flexible budget performance report. What variance contributed most to the year's favorable results? What caused this variance? Prepare a flexible budget performance report for the year First, complete the flexible budget performance report through the contribution margin line, then complete the report through the operating income line. Finally, compute the total variances (Enter a "v" for any zero balances. For any 50 variances, leave the favorable (Fy/Unfavorable (U) input blank.) 4 5 Cole Industries Flexible Budget Performance Report For the Year Ended December 31, 2018 1 2. 3 (1)-(3) Flexible Actual Budget Flexible Results Variance Budget (3) - (5) Sales Budget Amounts Per Unit Volume Static Variance Budget Units Sales Revenue Variable Costs Contribution Margin Fixed Costs ODODD Operating Income What variance contributed most to the year's favorable results? What caused this variance? This variance resulted from selling the company's product at The variance contributing most to the year's excellent results is the favorable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started