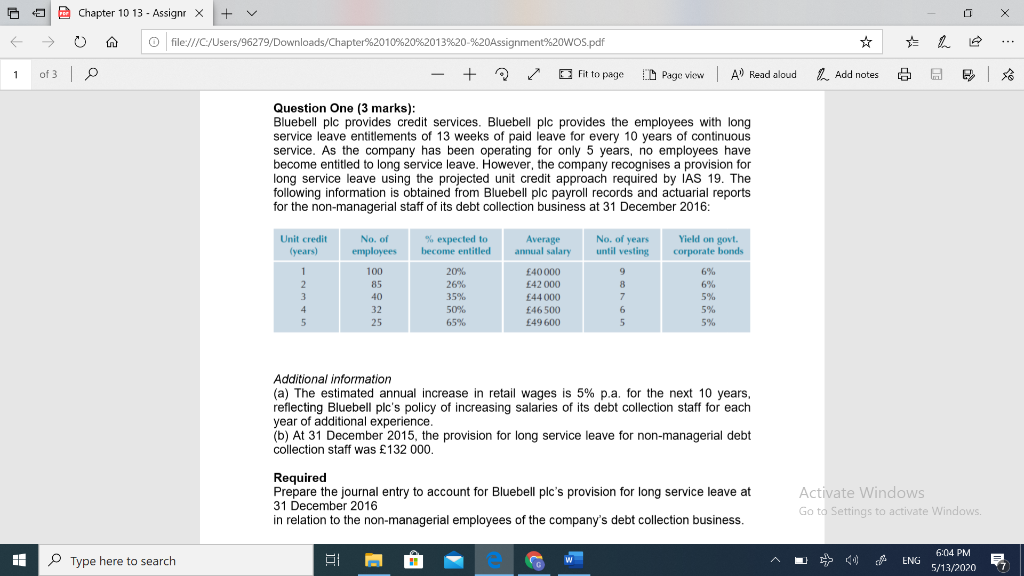

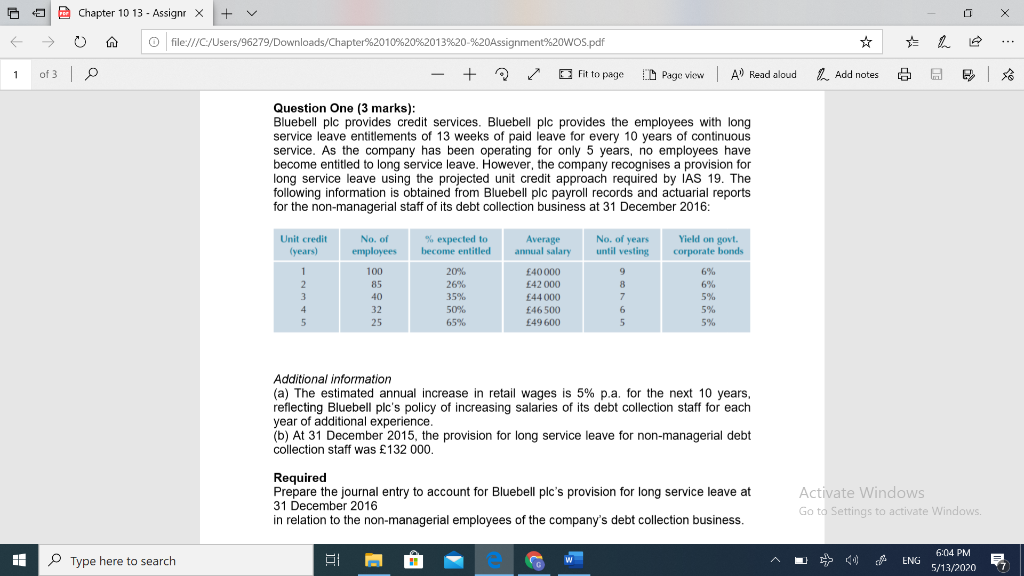

- o X a > Chapter 10 13 - Assignr x + V 0 file:///C:/Users/96279/Downloads/Chapter%2010%20%2013%20-%20Assignment%20WOS.pdf 1 of 3 lo - + Fit to page Page View A Read aloud . Add notes 6 Question One (3 marks): Bluebell plc provides credit services. Bluebell plc provides the employees with long service leave entitlements of 13 weeks of paid leave for every 10 years of continuous service. As the company has been operating for only 5 years, no employees have become entitled to long service leave. However, the company recognises a provision for long service leave using the projected unit credit approach required by IAS 19. The following information is obtained from Bluebell plc payroll records and actuarial reports for the non-managerial staff of its debt collection business at 31 December 2016: Unit credit (years) No. of employees 100 % expected to become entitled Average annual salary No. of years until vesting Yield on govt. corporate bonds 6% 85 20% 26% 35% 50% 65% 40000 42000 44000 46500 49 600 5% 5% Additional information (a) The estimated annual increase in retail wages is 5% p.a. for the next 10 years, reflecting Bluebell plc's policy of increasing salaries of its debt collection staff for each year of additional experience. (b) At 31 December 2015, the provision for long service leave for non-managerial debt collection staff was 132 000. Required Prepare the journal entry to account for Bluebell plc's provision for long service leave at 31 December 2016 in relation to the non-managerial employees of the company's debt collection business Activate Windows Go to Settings to activate Windows. 16 Type here to search - se A u Chapter 10 13 - Assignr x + V 0 file:///C:/Users/96279/Downloads/Chapter%2010%20%2013%20-%20Assignment%20WOS.pdf 1 of 3 lo - + Fit to page Page View A Read aloud . Add notes 6 Question One (3 marks): Bluebell plc provides credit services. Bluebell plc provides the employees with long service leave entitlements of 13 weeks of paid leave for every 10 years of continuous service. As the company has been operating for only 5 years, no employees have become entitled to long service leave. However, the company recognises a provision for long service leave using the projected unit credit approach required by IAS 19. The following information is obtained from Bluebell plc payroll records and actuarial reports for the non-managerial staff of its debt collection business at 31 December 2016: Unit credit (years) No. of employees 100 % expected to become entitled Average annual salary No. of years until vesting Yield on govt. corporate bonds 6% 85 20% 26% 35% 50% 65% 40000 42000 44000 46500 49 600 5% 5% Additional information (a) The estimated annual increase in retail wages is 5% p.a. for the next 10 years, reflecting Bluebell plc's policy of increasing salaries of its debt collection staff for each year of additional experience. (b) At 31 December 2015, the provision for long service leave for non-managerial debt collection staff was 132 000. Required Prepare the journal entry to account for Bluebell plc's provision for long service leave at 31 December 2016 in relation to the non-managerial employees of the company's debt collection business Activate Windows Go to Settings to activate Windows. 16 Type here to search - se A u