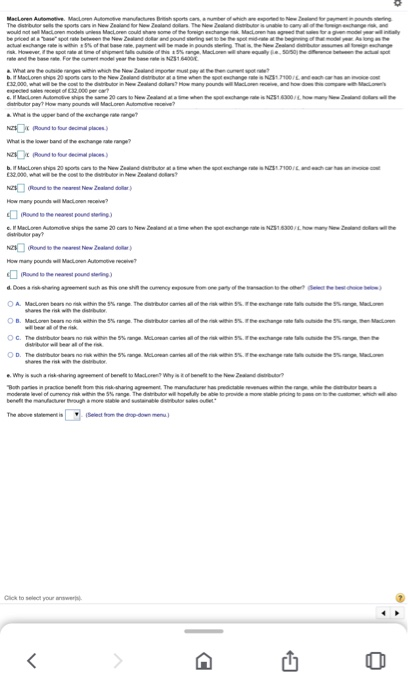

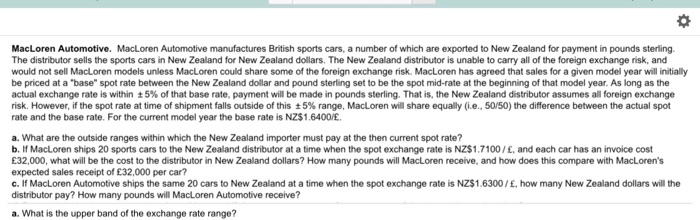

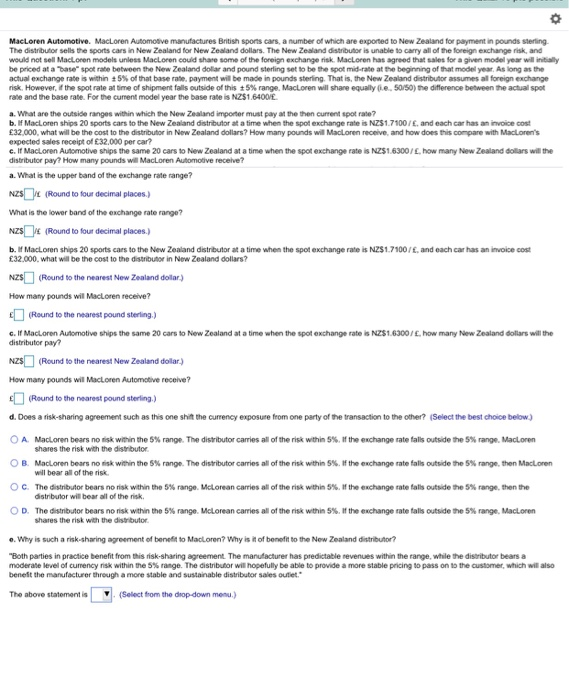

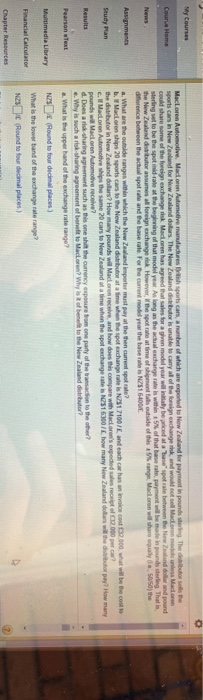

OA Macarena with The burre the exchange rate . OD Therese M age moderne for The door week Gee more MacLoren Automotive. MacLoren Automotive manufactures British sports cars, a number of which are exported to New Zealand for payment in pounds sterling. The distributor sells the sports cars in New Zealand for New Zealand dollars. The New Zealand distributor is unable to carry all of the foreign exchange risk, and would not sell MacLoren models unless MacLoren could share some of the foreign exchange risk. MacLoren has agreed that sales for a given model year will initially be priced at a "base" spot rate between the New Zealand dollar and pound sterling set to be the spot mid-rate at the beginning of that model year. As long as the actual exchange rate is within 5% of that base rate, payment will be made in pounds sterling. That is, the New Zealand distributor assumes all foreign exchange risk. However, if the spot rate at time of shipment falls outside of this t 5% range, MacLoren will share equally (e., 50/50) the difference between the actual spot rate and the base rate. For the current model year the base rate is NZ$1.6400/. a. What are the outside ranges within which the New Zealand importer must pay at the then current spot rate? b. If MacLoren ships 20 sports cars to the New Zealand distributor at a time when the spot exchange rate is NZ$1.7100/, and each car has an invoice cost 32,000, what will be the cost to the distributor in New Zealand dollars? How many pounds will MacLoren receive, and how does this compare with MacLoren's expected sales receipt of 32,000 per car? c. If MacLoren Automotive ships the same 20 cars to New Zealand at a time when the spot exchange rate is NZ$1.6300/, how many New Zealand dollars will the distributor pay? How many pounds will MacLoren Automotive receive? a. What is the upper band of the exchange rate range? Maclaren Automotive. MacLoren Automotive manufactures British sports cars, a number of which are exported to New Zealand for payment in pounds sterling The distributor sells the sports cars in New Zealand for New Zealand dollars. The New Zealand distributor is unable to carry all of the foreign exchange risk, and would not sell MacLoren models unless MacLoron could share some of the foreign exchange risk. MacLoren has agreed that sales for a given model year will initially be priced at a base" spot rate between the New Zealand dollar and pound sterling set to be the spot mid-rate at the beginning of that model year. As long as the actual exchange rate is within 5% of that base rate payment will be made in pounds sterling. That is, the New Zealand distributor assumes al foreign exchange risk. However, the spot rate at time of shipment falls outside of this 5% range, Maclaren will share equallye, 50/50) the difference between the actual spot rate and the base rate. For the current model year the base rate is NZ$1.6400/ a. What are the outside ranges within which the New Zealand importer must pay at the then current spot rate? b. f MacLoren ships 20 sports cars to the New Zealand distributor at a time when the spot exchange rate is NZS 1.7100/, and each car has an invoice cost 32000, what will be the cost to the distributor in New Zealand dollars? How many pounds wil MacLoren receive and how does this compare with MacLoren's expected sales receipt of 32,000 per car? c. If MacLoren Automotive ships the same 20 cars to New Zealand at a time when the spot exchange rate is NZ$1.6300/L. how many New Zealand dollars will the distributor pay? How many pounds will MacLoren Automotive receive? a. What is the upper band of the exchange rate range? NZSL (Round to four decimal places.) What is the lower band of the exchange rate range? NZSL (Round to four decimal places.) and each car has an invoice cost b. MacLoren ships 20 sports cars to the New Zealand distributor at a time when the spot exchange rate is NZ$1.7100/ 32.000, what will be the cost to the distributor in New Zealand dollars? NZS (Round to the nearest New Zealand dollar) How many pounds wil MacLoren receive? (Round to the nearest pound sterling.) c. If MacLoren Automotive ships the same 20 cars to New Zealand at a time when the spot exchange rate is NZ$1.6300/. how many New Zealand dollars will the distributor pay? NZS (Round to the nearest New Zealand dollar) How many pounds wil MacLoren Automotive receive? (Round to the nearest pound sterling) d. Does a risk-sharing agreement such as this one shit the currency exposure from one party of the transaction to the other? (Select the best choice below.) O A. MacLoren bears no risk within the range. The distributor carries all of the risk within 5% of the exchange rate falls outside the 5% range. MacLoren shares the risk with the distributor OB. MacLoren bears no risk within the 5% range. The distributor carries all of the risk within 5%. If the exchange rate falls outside the 5% range, then MacLoren will bear all of the risk OC. The distributor bears no risk within the 5% range. McLorean carries all of the risk within 5%. If the exchange rate falls outside the 5% range, then the distributor will bear all of the risk OD. The distributor bears no risk within the 5% range. McLorean carries all of the risk within 5%. If the exchange rate falls outside the 5% range. MacLoren shares the risk with the distributor o Why is such a risk-sharing agreement of benefit to MacLoren? Why is it of benefit to the New Zealand distributor? "Both parties in practice benefit from this risk-sharing agreement. The manufacturer has predictable revenues within the range, while the distributor bears a moderate level of currency risk within the 5% range. The distributor will hopefully be able to provide a more stable pricing to pass on to the customer, which will also benefit the manufacturer through a more stable and sustainable distributor sales outlet." The above statement is (Select from the drop-down menu.) Macloren Automotive. Macoren Automotive manufactures is sports car, amber of which are exported to New Zealand for payment in pounds sering. The r oses the sports cars in New Zealand for New Zealand Dollars The New Zealand distributors unable to carry all of the foreign exchange risk and would not Maden medewers Mactoren could share some of the foreign exchange in Macaron has agreed that sales for a given model year will initially becedata Tase porabeen the New Zealand door and pound sterling set to be the spolni rate of the beging of that model year. As long as the actual exchange rate is within of that base payment we be made in pod ering that is the New Zealand Abbuforasmes all foron change is However, the spot rate of time of shipments outside of this range, Macieren will share s the difference between the actual spot rate and the banere For the current model year the baseras N/516400/ a. What are the outside ranges within which the New Zealand importer must pay at the then current spot rate? b. I MacLorenships 70 sports cars to the New Zealand is at a time when the spot exchange rate is NZ5171007 and each car has an invoice 2000, what will be the cost to the distributor in New Zealand dollars? How many pounds will Macron receive, and how does this compare with MacLoren's expected sales receipt of per car? c. If Mad oren Automotive ships the same 20 cars to New Zealand at a time when the spot exchange rate is NZ516300 / how many New Zealand dolans with distributor pay How many pounds will MacLoren Automotive receive? d. Does a risk-sharing agreement such as this one shit the currency exposure from one party of the transaction to the other? e. Why is such a risk-sharing agreement of benefit to Machoren? Why is it of benefit to the New Zealand distributor? Assignments Macloren Automotive Macorendomte mandare i sports cars, a number of which are exported to New Zealand for payment in pounds Marting the horsese sports cars in New Zealand for New Zealand dollars. The New Zealand distributor is unable to carry all of the change and would not sell Macron a Mac or could share some of the foreign exchange risk Madaren has agreed that sales for a gen model year will be priced at a basesperate between the New Zealand do and pound sterling to be the spot the beginning of that model year As long as the actual exchange rates within of the best payment be made in pound sterling That is the New Zealand to assumes all foreign exchange risk However, the spot at time of shipment fulls outside of this range. Macoren wil here d es the difference between the colorate and the base rate for the current model year the bas is NZ515400 a. What are the outside ranges within which the New Zealand importer must pay the then current spole? b. Macaronships 20 sports cars to the New Zealand distributor at time when the spot exchange rates N7517100/L and each car has an invoice Oost 2000, what will be the cost the distributor in New Zealand dollars? How many pounds wil Maclaren receive and how does this compare with Mactor's expected sales reco 0 00 per c. MadLoren Automotive ships the same 20 cars to New Zealand at a time when the spot change rate N7516000/ how many New Zealand dollars will the pay? How many pounds will adoren Automotive receive d. Does a ksharing agreement such as this one that the currency exposure from one party of the main to the other e. Why is such ask sharing agreement of bet to Macieren? W ist of benefit to the New Zealand distributor? a. What is the upper hand of the exchange rate range? Study Plan Results Pearson Text Multimedia Library NZS Pound to four decimal places What is the lower band of the exchange rate range? Financial Calculator NZSL (Round to four decimal places) Chapter Resources OA Macarena with The burre the exchange rate . OD Therese M age moderne for The door week Gee more MacLoren Automotive. MacLoren Automotive manufactures British sports cars, a number of which are exported to New Zealand for payment in pounds sterling. The distributor sells the sports cars in New Zealand for New Zealand dollars. The New Zealand distributor is unable to carry all of the foreign exchange risk, and would not sell MacLoren models unless MacLoren could share some of the foreign exchange risk. MacLoren has agreed that sales for a given model year will initially be priced at a "base" spot rate between the New Zealand dollar and pound sterling set to be the spot mid-rate at the beginning of that model year. As long as the actual exchange rate is within 5% of that base rate, payment will be made in pounds sterling. That is, the New Zealand distributor assumes all foreign exchange risk. However, if the spot rate at time of shipment falls outside of this t 5% range, MacLoren will share equally (e., 50/50) the difference between the actual spot rate and the base rate. For the current model year the base rate is NZ$1.6400/. a. What are the outside ranges within which the New Zealand importer must pay at the then current spot rate? b. If MacLoren ships 20 sports cars to the New Zealand distributor at a time when the spot exchange rate is NZ$1.7100/, and each car has an invoice cost 32,000, what will be the cost to the distributor in New Zealand dollars? How many pounds will MacLoren receive, and how does this compare with MacLoren's expected sales receipt of 32,000 per car? c. If MacLoren Automotive ships the same 20 cars to New Zealand at a time when the spot exchange rate is NZ$1.6300/, how many New Zealand dollars will the distributor pay? How many pounds will MacLoren Automotive receive? a. What is the upper band of the exchange rate range? Maclaren Automotive. MacLoren Automotive manufactures British sports cars, a number of which are exported to New Zealand for payment in pounds sterling The distributor sells the sports cars in New Zealand for New Zealand dollars. The New Zealand distributor is unable to carry all of the foreign exchange risk, and would not sell MacLoren models unless MacLoron could share some of the foreign exchange risk. MacLoren has agreed that sales for a given model year will initially be priced at a base" spot rate between the New Zealand dollar and pound sterling set to be the spot mid-rate at the beginning of that model year. As long as the actual exchange rate is within 5% of that base rate payment will be made in pounds sterling. That is, the New Zealand distributor assumes al foreign exchange risk. However, the spot rate at time of shipment falls outside of this 5% range, Maclaren will share equallye, 50/50) the difference between the actual spot rate and the base rate. For the current model year the base rate is NZ$1.6400/ a. What are the outside ranges within which the New Zealand importer must pay at the then current spot rate? b. f MacLoren ships 20 sports cars to the New Zealand distributor at a time when the spot exchange rate is NZS 1.7100/, and each car has an invoice cost 32000, what will be the cost to the distributor in New Zealand dollars? How many pounds wil MacLoren receive and how does this compare with MacLoren's expected sales receipt of 32,000 per car? c. If MacLoren Automotive ships the same 20 cars to New Zealand at a time when the spot exchange rate is NZ$1.6300/L. how many New Zealand dollars will the distributor pay? How many pounds will MacLoren Automotive receive? a. What is the upper band of the exchange rate range? NZSL (Round to four decimal places.) What is the lower band of the exchange rate range? NZSL (Round to four decimal places.) and each car has an invoice cost b. MacLoren ships 20 sports cars to the New Zealand distributor at a time when the spot exchange rate is NZ$1.7100/ 32.000, what will be the cost to the distributor in New Zealand dollars? NZS (Round to the nearest New Zealand dollar) How many pounds wil MacLoren receive? (Round to the nearest pound sterling.) c. If MacLoren Automotive ships the same 20 cars to New Zealand at a time when the spot exchange rate is NZ$1.6300/. how many New Zealand dollars will the distributor pay? NZS (Round to the nearest New Zealand dollar) How many pounds wil MacLoren Automotive receive? (Round to the nearest pound sterling) d. Does a risk-sharing agreement such as this one shit the currency exposure from one party of the transaction to the other? (Select the best choice below.) O A. MacLoren bears no risk within the range. The distributor carries all of the risk within 5% of the exchange rate falls outside the 5% range. MacLoren shares the risk with the distributor OB. MacLoren bears no risk within the 5% range. The distributor carries all of the risk within 5%. If the exchange rate falls outside the 5% range, then MacLoren will bear all of the risk OC. The distributor bears no risk within the 5% range. McLorean carries all of the risk within 5%. If the exchange rate falls outside the 5% range, then the distributor will bear all of the risk OD. The distributor bears no risk within the 5% range. McLorean carries all of the risk within 5%. If the exchange rate falls outside the 5% range. MacLoren shares the risk with the distributor o Why is such a risk-sharing agreement of benefit to MacLoren? Why is it of benefit to the New Zealand distributor? "Both parties in practice benefit from this risk-sharing agreement. The manufacturer has predictable revenues within the range, while the distributor bears a moderate level of currency risk within the 5% range. The distributor will hopefully be able to provide a more stable pricing to pass on to the customer, which will also benefit the manufacturer through a more stable and sustainable distributor sales outlet." The above statement is (Select from the drop-down menu.) Macloren Automotive. Macoren Automotive manufactures is sports car, amber of which are exported to New Zealand for payment in pounds sering. The r oses the sports cars in New Zealand for New Zealand Dollars The New Zealand distributors unable to carry all of the foreign exchange risk and would not Maden medewers Mactoren could share some of the foreign exchange in Macaron has agreed that sales for a given model year will initially becedata Tase porabeen the New Zealand door and pound sterling set to be the spolni rate of the beging of that model year. As long as the actual exchange rate is within of that base payment we be made in pod ering that is the New Zealand Abbuforasmes all foron change is However, the spot rate of time of shipments outside of this range, Macieren will share s the difference between the actual spot rate and the banere For the current model year the baseras N/516400/ a. What are the outside ranges within which the New Zealand importer must pay at the then current spot rate? b. I MacLorenships 70 sports cars to the New Zealand is at a time when the spot exchange rate is NZ5171007 and each car has an invoice 2000, what will be the cost to the distributor in New Zealand dollars? How many pounds will Macron receive, and how does this compare with MacLoren's expected sales receipt of per car? c. If Mad oren Automotive ships the same 20 cars to New Zealand at a time when the spot exchange rate is NZ516300 / how many New Zealand dolans with distributor pay How many pounds will MacLoren Automotive receive? d. Does a risk-sharing agreement such as this one shit the currency exposure from one party of the transaction to the other? e. Why is such a risk-sharing agreement of benefit to Machoren? Why is it of benefit to the New Zealand distributor? Assignments Macloren Automotive Macorendomte mandare i sports cars, a number of which are exported to New Zealand for payment in pounds Marting the horsese sports cars in New Zealand for New Zealand dollars. The New Zealand distributor is unable to carry all of the change and would not sell Macron a Mac or could share some of the foreign exchange risk Madaren has agreed that sales for a gen model year will be priced at a basesperate between the New Zealand do and pound sterling to be the spot the beginning of that model year As long as the actual exchange rates within of the best payment be made in pound sterling That is the New Zealand to assumes all foreign exchange risk However, the spot at time of shipment fulls outside of this range. Macoren wil here d es the difference between the colorate and the base rate for the current model year the bas is NZ515400 a. What are the outside ranges within which the New Zealand importer must pay the then current spole? b. Macaronships 20 sports cars to the New Zealand distributor at time when the spot exchange rates N7517100/L and each car has an invoice Oost 2000, what will be the cost the distributor in New Zealand dollars? How many pounds wil Maclaren receive and how does this compare with Mactor's expected sales reco 0 00 per c. MadLoren Automotive ships the same 20 cars to New Zealand at a time when the spot change rate N7516000/ how many New Zealand dollars will the pay? How many pounds will adoren Automotive receive d. Does a ksharing agreement such as this one that the currency exposure from one party of the main to the other e. Why is such ask sharing agreement of bet to Macieren? W ist of benefit to the New Zealand distributor? a. What is the upper hand of the exchange rate range? Study Plan Results Pearson Text Multimedia Library NZS Pound to four decimal places What is the lower band of the exchange rate range? Financial Calculator NZSL (Round to four decimal places) Chapter Resources