Question

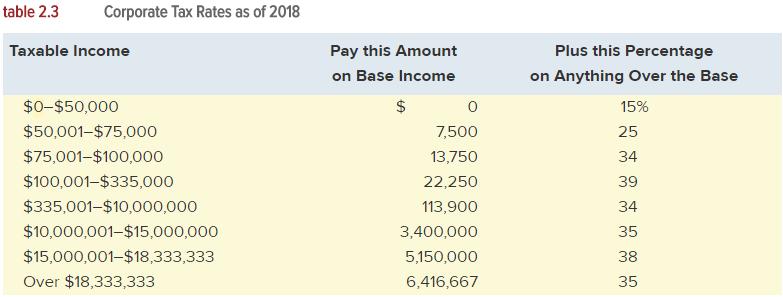

Oakdale Fashions, Inc. had $315,000 in 2018 taxable income. Using the tax schedule in Table 2.3 to calculate the companys 2018 income taxes. What is

Oakdale Fashions, Inc. had $315,000 in 2018 taxable income.

Using the tax schedule in Table 2.3 to calculate the company’s 2018 income taxes.

What is the average tax rate?

What is the marginal tax rate?

table 2.3 Corporate Tax Rates as of 2018 Taxable Income Pay this Amount Plus this Percentage on Base Income on Anything Over the Base $0-$50,000 $ 15% $50,001-$75,000 7,500 25 $75,001-$100,000 13,750 34 $100,001-$335,000 22,250 39 $335,001-$10,000,000 113,900 34 $10,000,001-$15,000,000 3,400,000 35 $15,000,001-$18,333,333 5,150,000 38 Over $18,333,333 6,416,667 35

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Compute income tax liability of Oakdale Fashion Inc as follows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav

13th Edition

8120335643, 136126634, 978-0136126638

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App