Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oakley Wholesale Hardware and Supplies (OWHS) sells tools, lumber, and other remodeling supplies to commercial contractors. The company controller is compiling cash and other

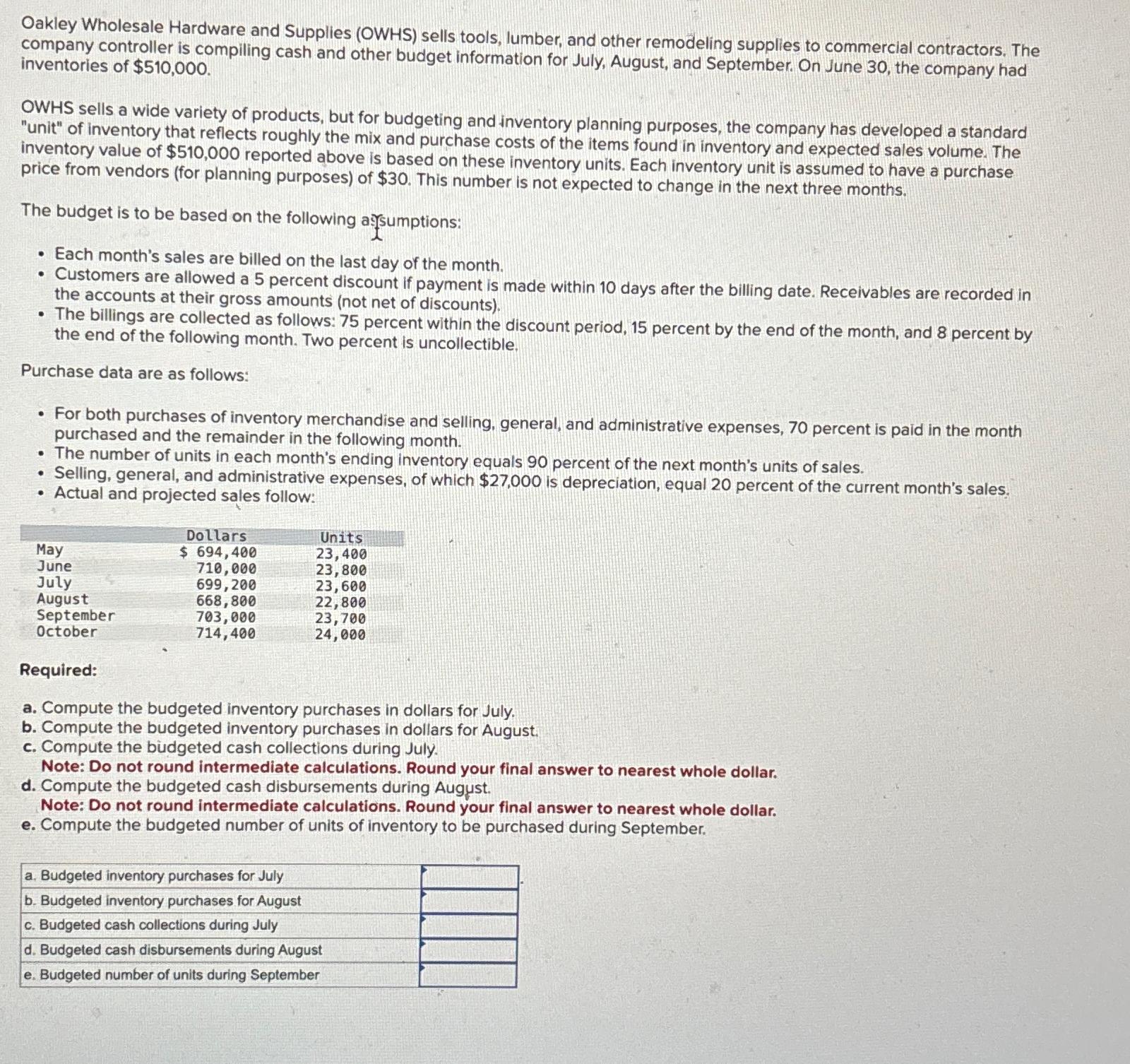

Oakley Wholesale Hardware and Supplies (OWHS) sells tools, lumber, and other remodeling supplies to commercial contractors. The company controller is compiling cash and other budget information for July, August, and September. On June 30, the company had inventories of $510,000. OWHS sells a wide variety of products, but for budgeting and inventory planning purposes, the company has developed a standard "unit" of inventory that reflects roughly the mix and purchase costs of the items found in inventory and expected sales volume. The inventory value of $510,000 reported above is based on these inventory units. Each inventory unit is assumed to have a purchase price from vendors (for planning purposes) of $30. This number is not expected to change in the next three months. The budget is to be based on the following assumptions: Each month's sales are billed on the last day of the month. Customers are allowed a 5 percent discount if payment is made within 10 days after the billing date. Receivables are recorded in the accounts at their gross amounts (not net of discounts). The billings are collected as follows: 75 percent within the discount period, 15 percent by the end of the month, and 8 percent by the end of the following month. Two percent is uncollectible. Purchase data are as follows: For both purchases of inventory merchandise and selling, general, and administrative expenses, 70 percent is paid in the month purchased and the remainder in the following month. The number of units in each month's ending inventory equals 90 percent of the next month's units of sales. . Selling, general, and administrative expenses, of which $27,000 is depreciation, equal 20 percent of the current month's sales. Actual and projected sales follow: Dollars Units May June July $ 694,400 23,400 710,000 23,800 699,200 23,600 August 668,800 22,800 September 703,000 23,700 October 714,400 24,000 Required: a. Compute the budgeted inventory purchases in dollars for July. b. Compute the budgeted inventory purchases in dollars for August. c. Compute the budgeted cash collections during July. Note: Do not round intermediate calculations. Round your final answer to nearest whole dollar. d. Compute the budgeted cash disbursements during August. Note: Do not round intermediate calculations. Round your final answer to nearest whole dollar. e. Compute the budgeted number of units of inventory to be purchased during September. a. Budgeted inventory purchases for July b. Budgeted inventory purchases for August c. Budgeted cash collections during July d. Budgeted cash disbursements during August e. Budgeted number of units during September

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Budgeted inventory purchases for July Budgeted Cost of Goods Sold COGS Units sol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started