Answered step by step

Verified Expert Solution

Question

1 Approved Answer

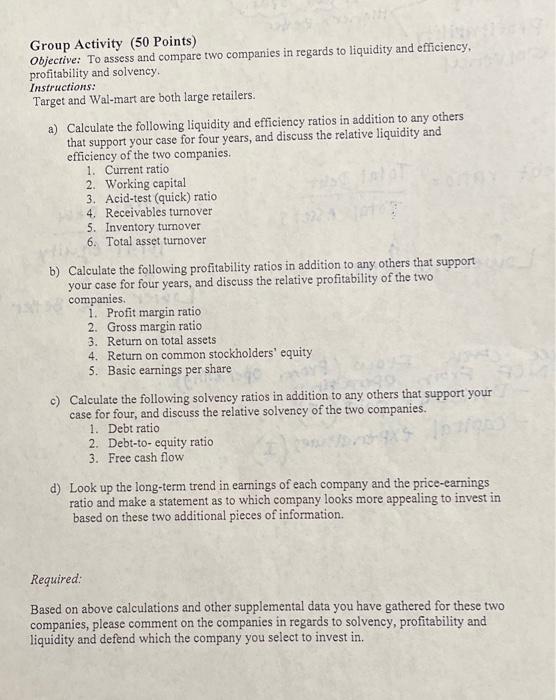

Objective is to assess and compare to companies in regards to liquidity and efficiency, profitability, and solvency. Group Activity (50 Points) Objective: To assess and

Objective is to assess and compare to companies in regards to liquidity and efficiency, profitability, and solvency.

Group Activity (50 Points) Objective: To assess and compare two companies in regards to liquidity and efficiency, profitability and solvency. Instructions: Target and Wal-mart are both large retailers. a) Calculate the following liquidity and efficiency ratios in addition to any others that support your case for four years, and discuss the relative liquidity and efficiency of the two companies. 1. Current ratio 2. Working capital 3. Acid-test (quick) ratio 4. Receivables turnover 5. Inventory turnover 6. Total asset turnover b) Calculate the following profitability ratios in addition to any others that support your case for four years, and discuss the relative profitability of the two companies. 1. Profit margin ratio 2. Gross margin ratio 3. Return on total assets 4. Return on common stockholders' equity 5. Basic earnings per share c) Calculate the following solvency ratios in addition to any others that support your case for four, and discuss the relative solvency of the two companies. 1. Debt ratio 2. Debt-to- equity ratio 3. Free cash flow d) Look up the long-term trend in earnings of each company and the price-earnings ratio and make a statement as to which company looks more appealing to invest in based on these two additional pieces of information. Required: Based on above calculations and other supplemental data you have gathered for these two companies, please comment on the companies in regards to solvency, profitability and liquidity and defend which the company you select to invest in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started