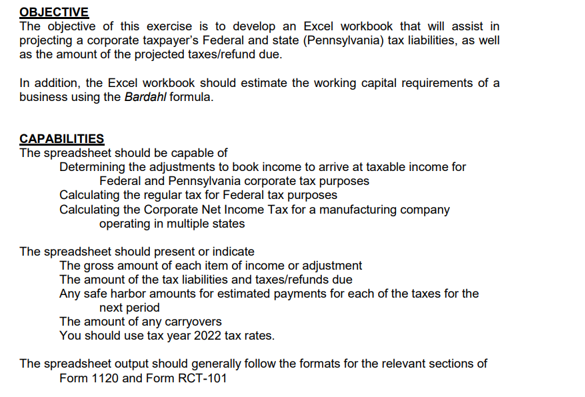

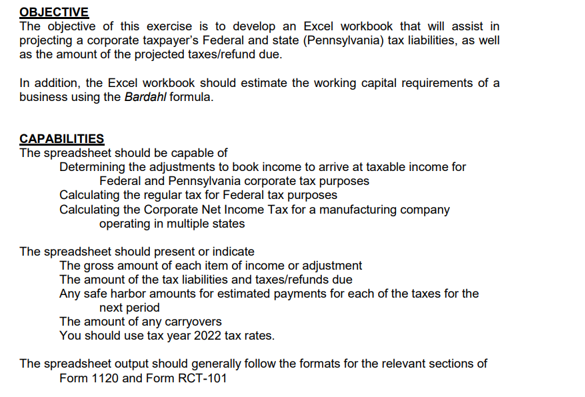

OBJECTIVE The objective of this exercise is to develop an Excel workbook that will assist in projecting a corporate taxpayer's Federal and state (Pennsylvania) tax liabilities, as well as the amount of the projected taxes/refund due. In addition, the Excel workbook should estimate the working capital requirements of a business using the Bardahl formula. CAPABILITIES The spreadsheet should be capable of Determining the adjustments to book income to arrive at taxable income for Federal and Pennsylvania corporate tax purposes Calculating the regular tax for Federal tax purposes Calculating the Corporate Net Income Tax for a manufacturing company operating in multiple states The gross amount of each item of income or adjustment The amount of the tax liabilities and taxes/refunds due Any safe harbor amounts for estimated payments for each of the taxes for the next period The amount of any carryovers You should use tax year 2022 tax rates. The spreadsheet output should generally follow the formats for the relevant sections of Form 1120 and Form RCT-101 The spreadsheet should present or indicate OBJECTIVE The objective of this exercise is to develop an Excel workbook that will assist in projecting a corporate taxpayer's Federal and state (Pennsylvania) tax liabilities, as well as the amount of the projected taxes/refund due. In addition, the Excel workbook should estimate the working capital requirements of a business using the Bardahl formula. CAPABILITIES The spreadsheet should be capable of Determining the adjustments to book income to arrive at taxable income for Federal and Pennsylvania corporate tax purposes Calculating the regular tax for Federal tax purposes Calculating the Corporate Net Income Tax for a manufacturing company operating in multiple states The gross amount of each item of income or adjustment The amount of the tax liabilities and taxes/refunds due Any safe harbor amounts for estimated payments for each of the taxes for the next period The amount of any carryovers You should use tax year 2022 tax rates. The spreadsheet output should generally follow the formats for the relevant sections of Form 1120 and Form RCT-101 The spreadsheet should present or indicate