Question

Objectives: 1. Perform a qualitative analysis on a capital budgeting project. 2. Perform a valuation analysis on an existing business. 3. Perform scenario analysis (that

Objectives:

1. Perform a qualitative analysis on a capital budgeting project. 2. Perform a valuation analysis on an existing business. 3. Perform scenario analysis (that makes business sense!)

Tasks:

1. Discuss the risks and rewards of investing in Chang Dental from Chris Millers perspective using a SWOT analysis. 2. Discuss the base case valuation provided to you. 3. Run scenario analyses on key variables using information from the case. 4. Make your final recommendation on whether or not Chris Miller should buy Chang Dental.

Tips:

Task 1: Use the information given in the case, but dont be afraid to include your own experiences with dentists in your analysis.

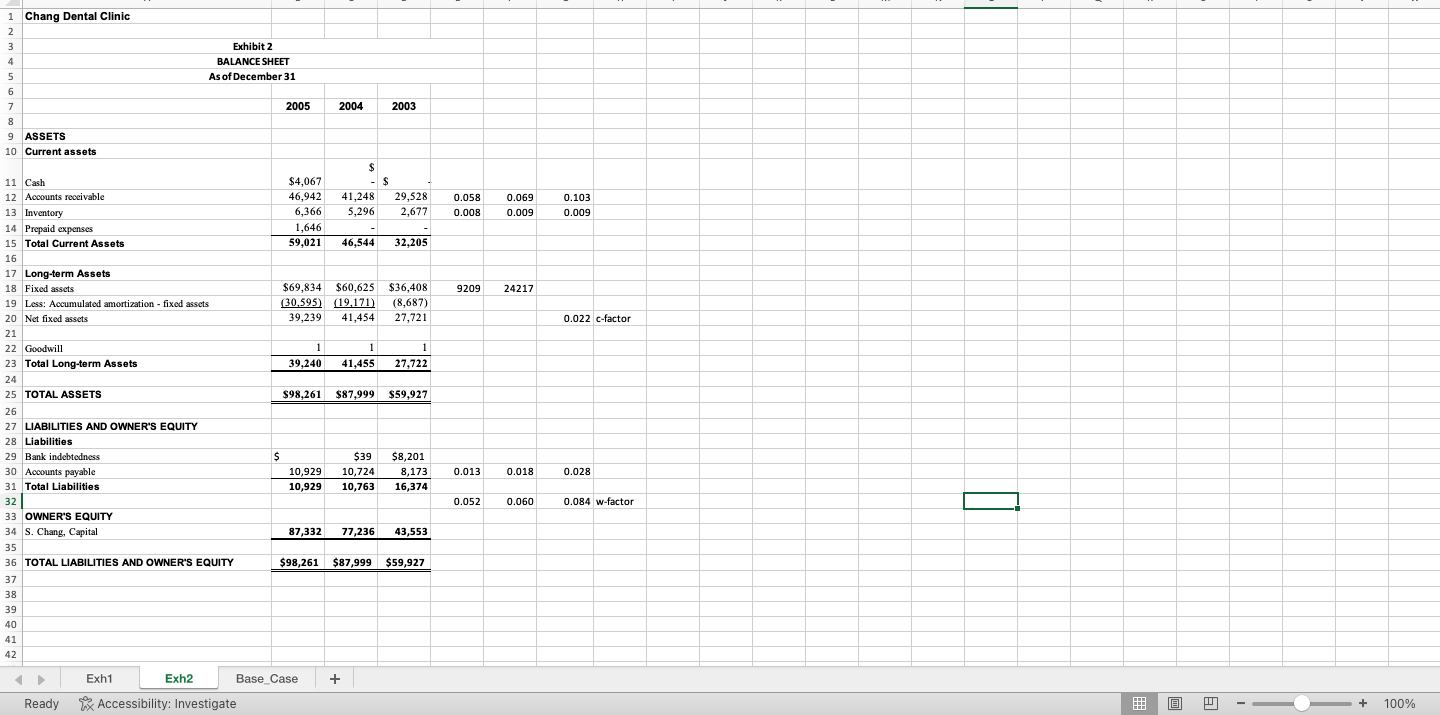

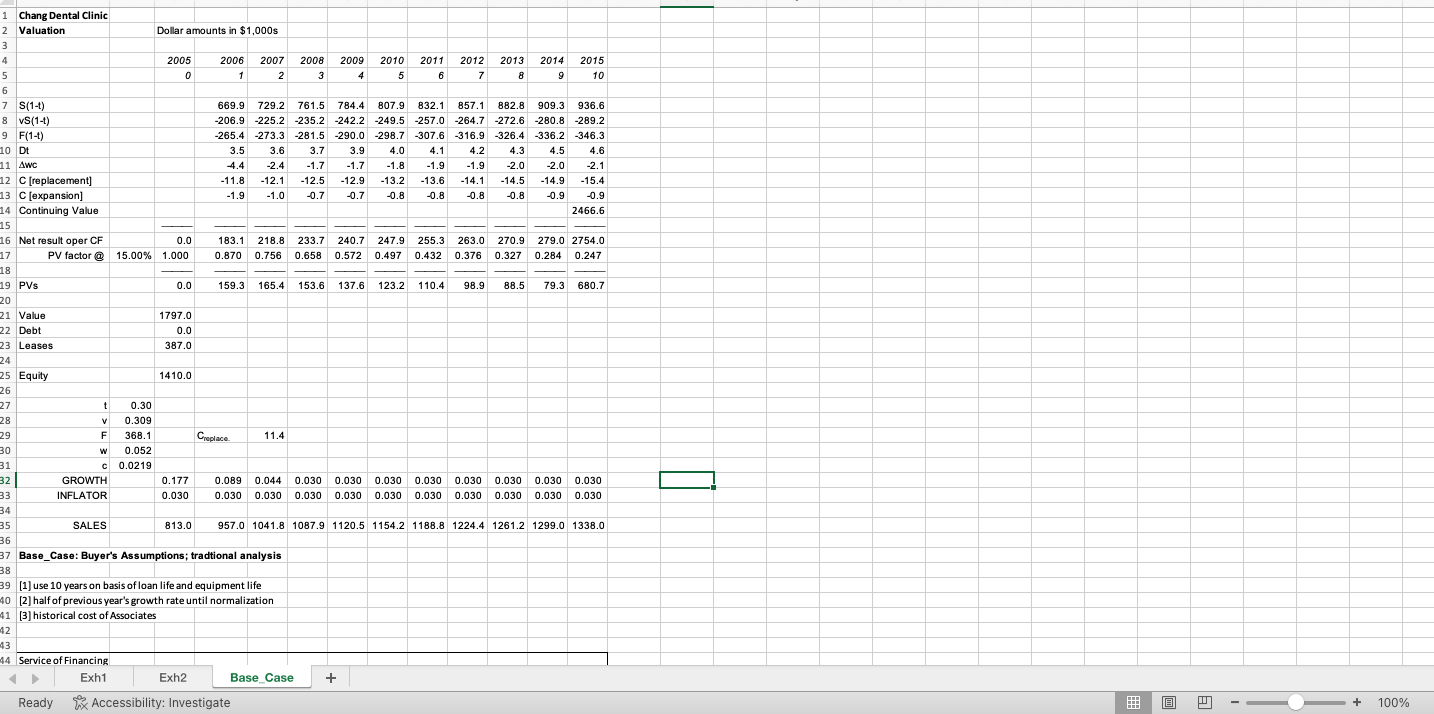

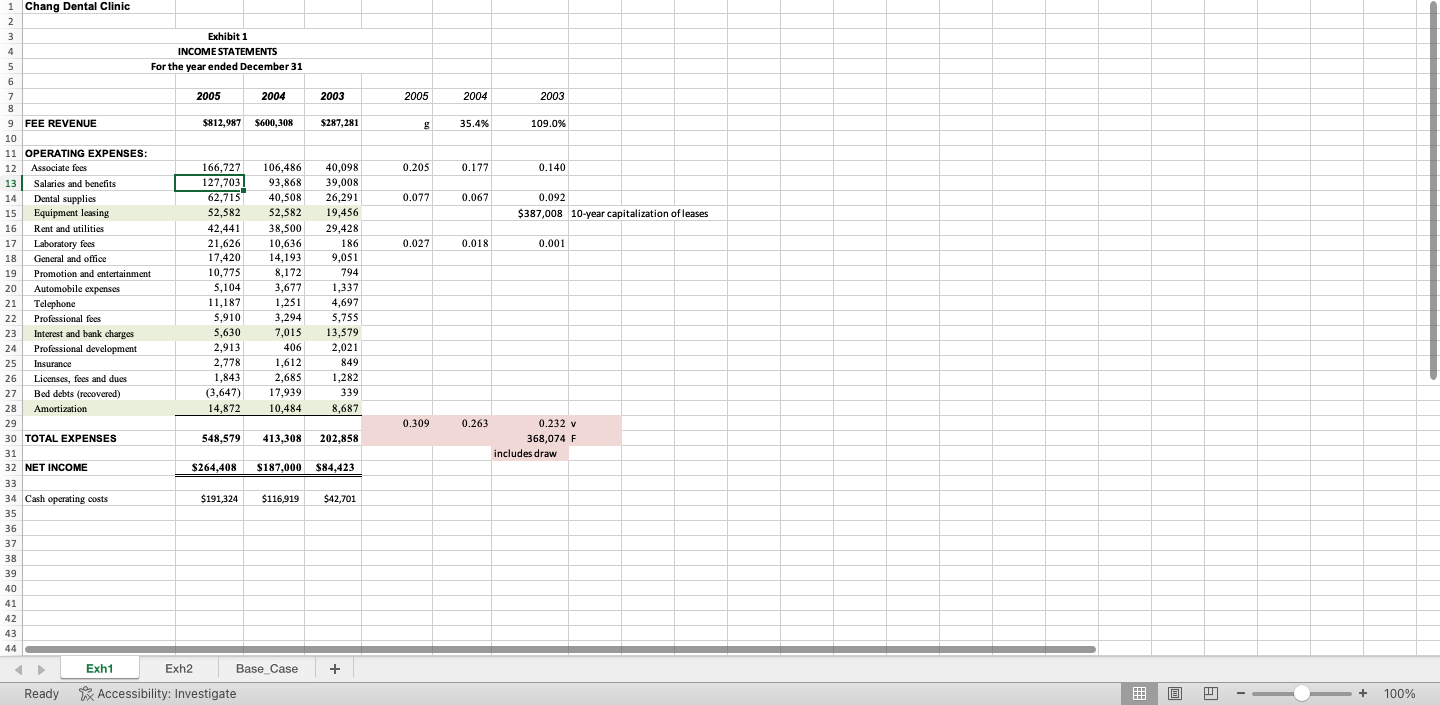

Task 2: Use the Excel file posted. In sheets "Exh1" and "Exh2" are the financial statement data. In sheet "Base_Case" is the completed base case valuation forecast. M7_Project_1_Class.xlsxDownload M7_Project_1_Class.xlsx

Task 3: Use the case as a guide for scenarios. Do not just randomly make scenarios.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started